THE RISE OF THEY CRYPTOCURRENCY MARKET EMPIRE

The cryptocurrency market is booming and everyone is making bank (unless your portfolio strategy is to invest entirely in the adult crypto sector like bigboobs coin - you are probably doing well)

It’s like the good old days of the roman empire where every night was a feast followed by and orgy and someone was feeding you grapes.

Yet, I can’t help but think of how or when the end game will play out. The “end game” is the term I like to use to describe market period when “the big boys” decide to enter market.

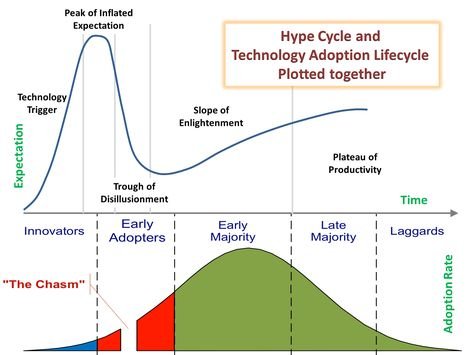

Think of the period as the tail end of the Gartner Hype Cycle and Technology Adoption Life Cycle (TALC).

The only difference is see a similar curve when I think of it in terms of Mergers and Acquisitions (M&A) activity for emerging technologies.

The following are the nicknames I’ve given the stages in the M&A market life-cycle:

1. The Expansion

This is where the cryptocurrency market is now. Everyone is trying to be the first mover and/or positioning themselves for a piece of the market share pie. There are over 1300 cryptocurrencies on coinmarketcap.com, and no one really knows which noodles will stick. Emerging technology markets are like a software development sandbox or science experimentation lab.

But I’ve seen this before. Everyone can’t be a winner. The majority of cryptos will not survive.

A good example is the blockchain gambling/sports betting sector. I did a post three months ago. This is a very crowded sector but people still feel they can enter the market and have a shot at the throne. Just take a look at how many companies are slated to enter the market in this sector here. How many of these companies will ultimately survive? Probably only a handful.

2. The Desolation (if you are less dramatic then use "The Consolidation")

In this stage competition is fierce, cashflow becomes an even bigger challenge, and government regulations set in. Entities have a better sense of their survival probability. To survive, sometimes you must cut your losses while you still have sellable assets, or you seek out a partner in a similar situation to merge. This is the when M&A really heats up.

The majority are in survival mode. There will be blood.

I can think of two examples in recent history where a market consolidation occurred. Everyone wanted a piece of the fantasy sports market revenue pie in the early 2000s. Even Best Buy ran a fantasy sports game in 2009.

Fantasy sports was around decades before that and found exponential growth during the internet’s dot.com boom and online growth. I remember tons of small companies. Heck, I won a basketball championship from a small company that paid for a 10-day cruise for my wife. It’s no longer around, but those size fantasy sports companies all wanted to king of industry. How many big players are there now after the dust settled - Fanduel and Fantasy Kings.

The second example is the growth in the global e-cigarette/vaporizer market where the market growth is now driven largely by the flurry of M&A, patent warfare, and customization of products. The story of Big Tobacco’s e-cigarette bet on the future can be read here

3. The Reckoning

Judgement Day and "the tribe has spoken." There are clear winners from the previous stage and the bloodbath is mostly over. If you are lucky enough to have reached this stage don’t pat yourself on the back just yet. More blood will be shed.

4. The End Game

Congrats, you have reached the “Big Boss” stage. This is where you think you know who the villain is only to find out that a super-villain was waiting for the herd to thin out. “The Big Boys” will deploy a variety of strategies to enter the market by either buying their way in or take heavy losses to steal market share. A lot of entities will outright sell while others will take their chances.

For readers that are not familiar with some of the main reasons for M&A, the following is a little refresher/primer (source)

Synergy: The most used word in M&A is synergy, which is the idea that by combining business activities, performance will increase and costs will decrease. Essentially, a business will attempt to merge with another business that has complementary strengths and weaknesses.

Diversification/Sharpening Business Focus: These two conflicting goals have been used to describe thousands of M&A transactions. A company that merges to diversify may acquire another company in a seemingly unrelated industry in order to reduce the impact of a particular industry's performance on its profitability. Companies seeking to sharpen focus often merge with companies that have deeper market penetration in a key area of operations.

Growth: Mergers can give the acquiring company an opportunity to grow market share without having to really earn it by doing the work themselves - instead, they buy a competitor's business for a price. Usually, these are called horizontal mergers. For example, a beer company may choose to buy out a smaller competing brewery, enabling the smaller company to make more beer and sell more to its brand-loyal customers.

Increase Supply-Chain Pricing Power: By buying out one of its suppliers or one of the distributors, a business can eliminate a level of costs. If a company buys out one of its suppliers, it is able to save on the margins that the supplier was previously adding to its costs; this is known as a vertical merger. If a company buys out a distributor, it may be able to ship its products at a lower cost.

Eliminate Competition: Many M&A deals allow the acquirer to eliminate future competition and gain a larger market share in its product's market. The downside of this is that a large premium is usually required to convince the target company's shareholders to accept the offer. It is not uncommon for the acquiring company's shareholders to sell their shares and push the price lower in response to the company paying too much for the target company.

Acquiring Unique Capabilities (source): Lastly, an M&A strategy might be to acquire a competitor’s patents and/or licenses. It might also mean that the acquiring company wants to make sure a competing patent is buried and never used. On the surface, while this reason makes a lot of sense, acquiring company have to do their due diligence when dealing with unique capabilities as Volkswagen discovered in 1998 when it assumed it automatically had the rights to the Roll-Royce trademark by outbidding BMW to by Rolls Royce and Bentley and their British factory from Vickers PLC for $917 million. Only after a separate deal was made with BMW (after BMW acquired the rights out from under Volkswagen) for did they finally have the rights to manufacture a trademarked Rolls-Royce car. Ouch.

I used to wonder why big industry leaders don’t enter a booming new market sooner. The simple reason is the revenue/profit level isn’t worth their time. It takes billions of dollars to move the needle for Apple. Acquiring a company with 10 million in profit would make most swoon, but for Apple it just doesn’t benefit their overall numbers. In addition, there is a risk betting on what you may think is a winning horse only to find out that another horse becomes the an industry leaders. However, emerging technology markets will eventually show some big results. When that happens the giants will take notice and they will explore a ways to enter the market such as an M&A strategy.

"HIDDEN IN PLAIN SITE" RISK?

If you made it this far here is a virtual fit bump. I’m finally getting to my point.

For the most part, M&A is rare in the cryptocurrency market.

However, I view M&A activity as a positive sign that the market has reached a certain level of maturity and is mainstream acceptance. It’s a little odd (maybe even worrisome) that there isn’t more activity, but then again, the blockchain market has only started to take form and show exponential growth in the year. In other words, we are still in The Expansion stage.

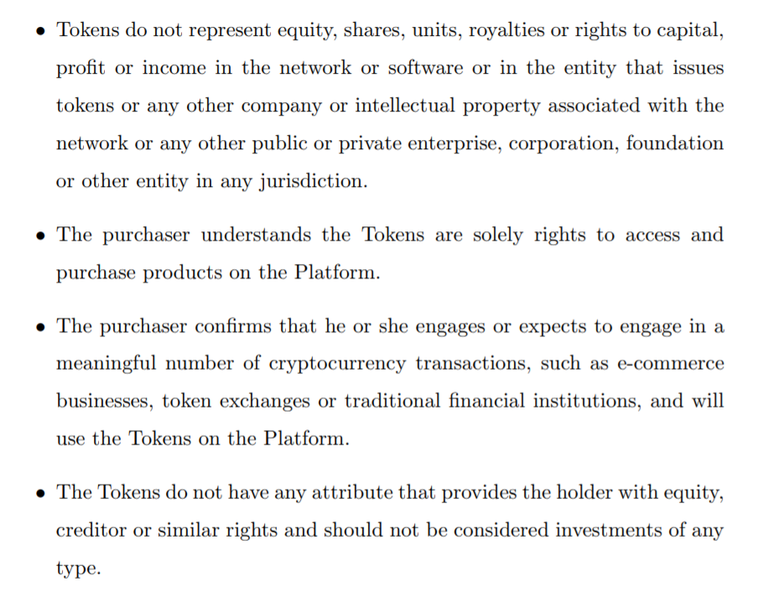

I often wonder if M&A within the crypto market represents a bigtime risk with tokens. If you read the fine print (if there is even fine print to read) it will probably say something like this:

M&A isn’t always about a net positive outcome where everyone wins. The strategy is often used to eliminate the competition. Therefore, I’m not sure what it means where crypto company X acquires crypto company Y. What happens to crypto company Y coins/tokens if crypto company X has no need to support them?

With traditional securities/equities shareholders are rewarded.

I’m not the only one thinking about M&A. Here is an excerpt from an coindesk article writing by venture capitalist Ash Egan:

EXCERPT START

As a venture investor at Converge focused on crypto and blockchain businesses, I am curious how tokens will affect an acquirer's decision-making. Blockchain company buy-outs, even those without their own tokens are not yet a norm, although we've seen small acquisitions – Skry, Mediachain, CryptoWatch, Bitnet and CleverCoin.

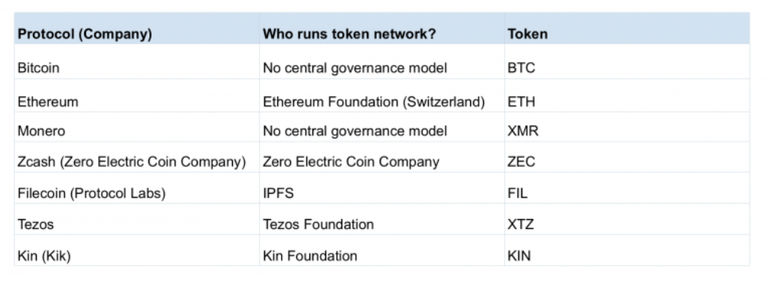

Before retrofitting an M&A framework and jumping into the logistics of how a corporate might purchase company X with blockchain tokens, it's important to know that many of these tokens are governed via a separate entity: i.e. a foundation, often based overseas (exampled below).

Additionally, tokens offer unique properties: some pass the Howey Test (and are considered securities), many are offered via a foundation (not the company), some have immediate utility, while others may not be distributed for months to years following the token sale.

Wary of cryptocurrency FoMO (fear of missing out), corporates are having conversations on how they might acquire a tokenized blockchain company.

Corporates may want to acquire a company for the team, for the large open-source development community, or simply because the corporation finds the build-your-own token process overly cumbersome.

But, while interest is there, corporate M&A teams do not have a status quo to rely on.

Here are five possible viewpoints:

- Company has value, tokens are irrelevant

- Company has value, tokens seem interesting

- Company does not have value, tokens are important to our go-forward

- We don’t know which has value, but we want to own it all

- This is going to be a regulatory, compliance nightmare — let’s sit this one out.

"We want the company, we don't care about the tokens."

The company owns the patents, the team is superb, but the M&A team does not understand why tokens are necessary for the business or how the tokens merit a high price.

As diligence, the M&A team will try to acquire the company, and ignore the tokens. Just in case, this team will check token sale documents to find out corporate structure of tokens (i.e. was it the C-corp or foundation which issued the tokens?), details on how the team is compensated and token distribution plans. If acquiring tokens is absolutely necessary, the number of tokens issued will likely have a material impact on the exit potential.

If the token market cap is high, and many of these tokens have already been issued, it will be a stretch to see a deal proposed, let alone done.

The team is great, the technology is great, the protocol makes sense and the team taps into its valuable network of users.

In this instance, there may be an existing relationship between a company and corporation exploring an acquisition. Because most of the activity happening in blockchain is experimental, or the product isn't as far as long as market cap, I think we won't see any corporate pay full equity price plus total outstanding price per token.

The structure of tokens were issued will significantly impact the acquisition price.

This company got very lucky in being first to market, but the team is just not up to snuff – maybe there are even signs of fraudulent or malicious activity.

If the market position, developer community and technology are superb, corporates may take an active approach of buying tokens in the wild or even the outstanding tokens.

This is going to be the last strategy an M&A team wants to present to its C-suite.

This is the FoMO scenario.

Whatever the reason might be (i.e. a corporation is under pressure from its shareholders and board to develop a blockchain strategy, executives realize they have no one internally who understands blockchain), price sensitivity becomes an afterthought, and the M&A team makes a bid to buy a blockchain token C-corp, alongside outstanding tokens, at current price per token.

Depending on the token acquisition strategy, this scenario could cost billions for the corporation. Biggest question for corporate is what happens to tokens in the wild? And will those token holders remain loyal? Or flock to a competitive blockchain system?

An existing company (say, gambling company Betfair) may shell out $100 million (not $1 billion) for something with regulatory advantages. Companies are clueless about peer-to-peer betting services – let alone blockchain.

Today's sole corporate strategy for token and C-corp M&A.

The M&A team and C-suite find the landscape difficult to follow, and are worried about losing millions on token volatility, or even how they would go about acquiring token network. Because pricing and acquisitions will be so complex, many corporates will sit on the sidelines and let their competitors dictate price, or may make their own play at the 11th hour.

In this vein, corporates may (Scenario 6) explore potential acquisitions, and ultimately release their own blockchain token, similar to what Kik is doing through Kin Interactive.

Corporates, especially public companies, will drift to Scenario 5 for the next few years, or decide that tokens have immense value and issue their own.

For all of the entrepreneurs thinking of issuing tokens, it's important to understand the downside risk maybe even more so than the benefits of bringing in extra capital. Take the long term view. Ultimately, how would you articulate the value of tokens to your potential buyer?

Other areas corporate M&A teams will analyze, not include above: Who powers the network? Miners?

EXCERPT FINISH

I'm not sure what all this means which is a large part of the reason why I'm writing a post on this topic.

If M&A are not an option because of decentralization, and M&A is a healthy part of an emerging technology growth, then what does that mean for the market when companies are looking to survive longer through M&A? What does it mean when the big players can't enter the market and accelerate market maturity? Will the market landscape be messier for a long time?

What happens when a company decides to fold with assets? The token holders have no rights to those assets.

In sum, i'm a little worried about what things will look like in say 3-5 years when crypto companies are looking for ways to survive. This topic needs more discussion and i'm sure I haven't raised all the questions that I should have asked.

Again, not everyone can be a winner. It's just not possible.

Proceed with caution and watch the M&A activity level along with what the big players are doing to enter the market (along with how crypto companies are existing the market).

These posts have greater value when you comment. Please share your thoughts with the Steemit community.

Traversing the Cryptosphere,

Kryptonaut

Hey dropping off an extra vote for using @echowhale services

Very well written and researched post! Some valuable info in there. Thank you.

This was a great read, interesting times ahead for Crypto world. We are still at early stages. I did read some experts mentioning that out of 1300 coins currently trading close to 95% are bound to fail at some point.

In terms of M&A ... I have seen instances where developers working on a crypto project decide to join hands with another one and move onto that platform

One example would be http://bitcoindark.com/ where the developers of BTCD decide to join hands with Komodo ( KMD) and moved to KMD platform and are working on that now

80% of BTCD supply got swapped for KMD coins at the rate of 1 BTCD = 50 KMD

So Merger of sorts is happening right now in Crypto world even with coins/tokens

Thanks for pointing out the KMD example. Do you have any conjectures what both parties have to gain?

Wow! Great post @kryptonaut ! Really epic reading !

You're raising some interesting points here and I think many others would get a lot of benefit from understanding some of the principles you're talking about, so I've upvoted, resteemed and followed.

Centralisation is on everyone's mind after the Bitcoin/Bitcoin Cash weekend of madness where people thought the two were going to flip. I know there's much more to your post than this, but it certainly has helped me expand my thinking beyond just some conspiracy theory that miners were just trying to make a few quid.

Thanks for sharing!

This post has received gratitude of 1.11 % from @appreciator thanks to: @kryptonaut.

Very well written and researched post!

Thanks for the kind words!

You got a 3.00% upvote from @upme courtesy of @kryptonaut!

@echowhale just wanted to swim by and drop off your up vote. I hope you know content like this is with out a doubt amazing.

Send @echowhale between 0.20 - 1.00 steem/sbd and receive an up vote worth more than what you sent.

Disclaimer The only content we here at @echowhale up vote is content that is original and follows the steemit community guidelines and rules.

Ps: You will also be receiving an upvote from the owners accounts .

Super informative and eye-opening! Thanks!

Thanks for reading!

@kryptonaut I just wanted to swim by and drop off your up vote and I wanted to say Thank you for using @echowhale

Send 0.20 - 1.00 sbd/steem and receive an up vote of greater value.

Disclaimer: In order to receive an up vote for your post submissions, you must submit original content and/or content that falls under the steemit community guidelines.

This post was resteemed by @steemvote and received a 46.41% Upvote

thank you i voted and follow u

Thanks for the upvote and follow!

This post has received a 0.70 % upvote from @sneaky-ninja thanks to: @kryptonaut.

This post has received a 37.50 % upvote from @msp-bidbot thanks to: @kryptonaut.

Delegate SP to this public bot and get paid daily: 50SP, 100SP, 250SP,500SP, 1000SP,5000SP Don't delegate so much that you have less than 50SP left on your account.

USE THE BANKSTERS CASH TO BUY CRYPTOS -

https://steemit.com/crypto/@davemanchester/getting-into-altcrypto-as-they-all-rise

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.coindesk.com/ico-ma-token-exits-get-messy/

Congrats this post was randomly resteemed & upvoted by @superbot - the Best Resteem bot on Planet !

Good Luck!

Follow for 10 minutes ,

Send 0.100 Steem/Steem Dollar and the URL in the memo that you want resteemed and upvoted.

So don't waste any time ! Get More Followers and gain more Visibility With Superbot .

viewed, voted, commented, and re-steemed ...

anyone follows me i'll follow back within a few days

if you have complaints please check the blog or i can link you the why ... a resteem is a resteem, atm to 117 people, thats 117 chances to have it re-resteemed,

if you consider this spam, then by all means, the mute button is on the top right side, feel free to do so and you'll never have to read me again :)

otherwise, good luck ... be wary of whales and stalkers, content dictators and bedroom nurrd fascists ... extortion bots and hatebots ...

STOP SPAM!