Over the weekend we bid farewell to a rather interesting character. Though his past is hardly clean there’s a lot we can learn from Ikea’s founder Ingvar Kamprad.

His personal affiliation with the Nazi party and use of political prison laborers between 1960 and 1990 will discount him from going down in history as a true idealist but what he built, and helped others to build, despite many setbacks is truly inspirational.

At one point, he was the richest man in the world. Yet still, he would haggle frugally with fruit vendors in the marketplace. He would very rarely splurge on luxuries, flew only economy, wore second-hand clothes, and drove a beat-up old Volvo.

What inspires me most is the humility of the man and the humility he inspired in others. Like the products he sold, everything had to appear plain and simple, even if they were incredibly complex under the surface.

eToro, Senior Market Analyst@MatiGreenspan

Today’s Highlights

Dollar Bites Back

Major Hack Resolved

Clear Skies for Bitcoin

Please note: All data, figures & graphs are valid as of January 29th. All trading carries risk. Only risk capital you’re prepared to lose.

Traditional Markets

Looks like President Trump’s little Swiss Business trip is bearing some fruits today and we can see the US Dollar finally finding some much needed support.

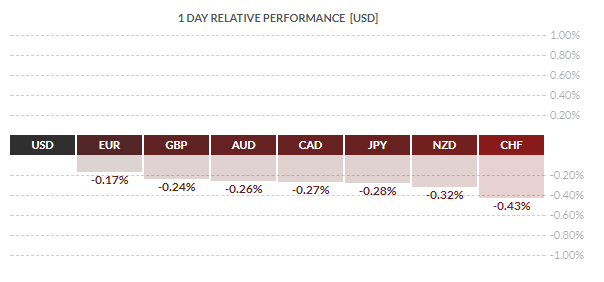

Here we can see that Dollar strength is prevalent in the currency markets today…

This move is uncorrelated with any sort of flight to safety or appetite for risk. Rather, over the last few weeks, we’ve seen Dollar weakness as the main theme and now she’s biting back.

Also, despite apparent calm in Asian and European markets this morning the China50 Index is having a very bad time, down 2.85%.

Here again, this move seems to be uncorrelated with other markets or with the current trends. The analysts are calling this a simple strategic move as investors are “taking profits” after a massive run up.

The Dollar strength this morning is having an impact on commodity prices but it’s still unclear whether this is a just a minor pullback or the start of a new micro-trend.

)

)

Coincheck Hack

The hack on Friday is one of the biggest hacks to hit the crypto industry to date with more than $530 Million worth of NEM stolen.

This event does seem to have affected the cryptos quite a bit and things quickly fell towards the bottom of their respective price ranges. However, as we didn’t see any new lows in the market the damage does seem to have been contained.

Let’s take a look at Dash for a good example of what happened here. This chart shows the massive range from the highs of late December to the lows of mid-January.

The yellow circle was the immediate reaction to the Coincheck hack. As we can see, the blue triangle formation has not been damaged but rather the price simply came down to meet the lower level of support. Had the bottom blue line been broken, or had we seen new lows in the market things could have been very different.

The announcement from Coincheck on Sunday that they will be repaying investors has given great confidence to the market. After all, though things may get lost or stolen the entire industry is thriving.

Furthermore, this has given a greater push for regulators to be more hands on and help the respective companies to ramp up their security measures.

Bitcoin Under the Surface

At least while the FOMO is out of the markets, bitcoin miners have had a chance to clear the backlog of transactions that were piling up.

At peak FOMO of December 20th, the bitcoin blockchain saw a record of 4.8 transactions per second. This increased attention was certainly causing some strain on the network. Now that there’s less traffic on the main chain, the transaction rate is down to 2.6 per second.

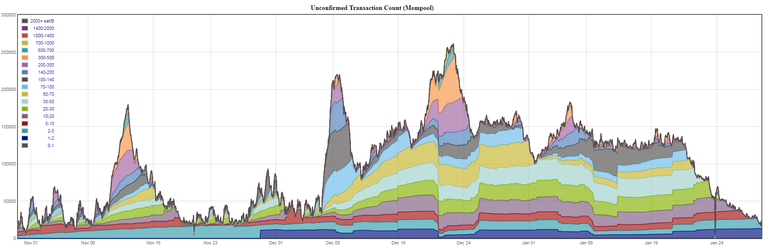

Here we can see that the total number of unconfirmed transactions in Bitcoin’s mempool was above 100k for most of the period from December 8th to January 21st. Finally, today we can observe a slightly more normal level.

Over the weekend we bid farewell to a rather interesting character. Though his past is hardly clean there’s a lot we can learn from Ikea’s founder Ingvar Kamprad.

// -- Discuss and ask questions in our community on Workplace.

His personal affiliation with the Nazi party and use of political prison laborers between 1960 and 1990 will discount him from going down in history as a true idealist but what he built, and helped others to build, despite many setbacks is truly inspirational.

At one point, he was the richest man in the world. Yet still, he would haggle frugally with fruit vendors in the marketplace. He would very rarely splurge on luxuries, flew only economy, wore second-hand clothes, and drove a beat-up old Volvo.

What inspires me most is the humility of the man and the humility he inspired in others. Like the products he sold, everything had to appear plain and simple, even if they were incredibly complex under the surface.

// -- Become a yearly Platinum Member and save 69 USD and get access to our secret group on Workplace. Click here to change your current membership -- //

eToro, Senior Market Analyst

@MatiGreenspan

Today’s Highlights

Dollar Bites Back

Major Hack Resolved

Clear Skies for Bitcoin

Please note: All data, figures & graphs are valid as of January 29th. All trading carries risk. Only risk capital you’re prepared to lose.

Traditional Markets

Looks like President Trump’s little Swiss Business trip is bearing some fruits today and we can see the US Dollar finally finding some much needed support.

Here we can see that Dollar strength is prevalent in the currency markets today…

This move is uncorrelated with any sort of flight to safety or appetite for risk. Rather, over the last few weeks, we’ve seen Dollar weakness as the main theme and now she’s biting back.

Also, despite apparent calm in Asian and European markets this morning the China50 Index is having a very bad time, down 2.85%.

Here again, this move seems to be uncorrelated with other markets or with the current trends. The analysts are calling this a simple strategic move as investors are “taking profits” after a massive run up.

The Dollar strength this morning is having an impact on commodity prices but it’s still unclear whether this is a just a minor pullback or the start of a new micro-trend.

Coincheck Hack

The hack on Friday is one of the biggest hacks to hit the crypto industry to date with more than $530 Million worth of NEM stolen.

This event does seem to have affected the cryptos quite a bit and things quickly fell towards the bottom of their respective price ranges. However, as we didn’t see any new lows in the market the damage does seem to have been contained.

Let’s take a look at Dash for a good example of what happened here. This chart shows the massive range from the highs of late December to the lows of mid-January.

The yellow circle was the immediate reaction to the Coincheck hack. As we can see, the blue triangle formation has not been damaged but rather the price simply came down to meet the lower level of support. Had the bottom blue line been broken, or had we seen new lows in the market things could have been very different.

The announcement from Coincheck on Sunday that they will be repaying investors has given great confidence to the market. After all, though things may get lost or stolen the entire industry is thriving.

Furthermore, this has given a greater push for regulators to be more hands on and help the respective companies to ramp up their security measures.

Bitcoin Under the Surface

At least while the FOMO is out of the markets, bitcoin miners have had a chance to clear the backlog of transactions that were piling up.

At peak FOMO of December 20th, the bitcoin blockchain saw a record of 4.8 transactions per second. This increased attention was certainly causing some strain on the network. Now that there’s less traffic on the main chain, the transaction rate is down to 2.6 per second.

Here we can see that the total number of unconfirmed transactions in Bitcoin’s mempool was above 100k for most of the period from December 8th to January 21st. Finally, today we can observe a slightly more normal level.

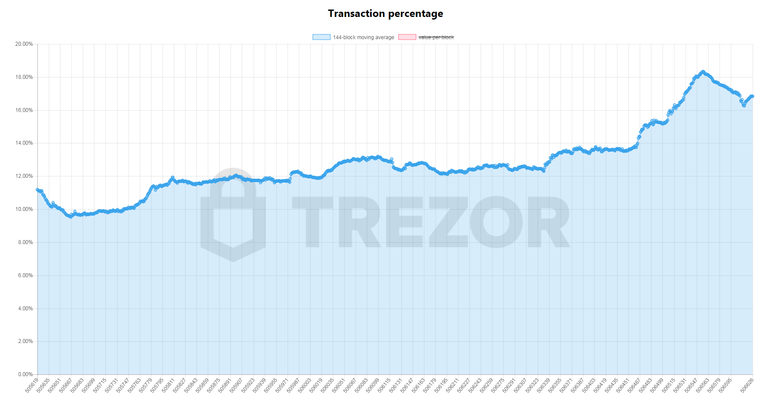

In addition, the adoption of the SegWit solution is also up, reaching as high as 18% of bitcoin transactions.

Inline image 6

The issue is, that it’s unclear whether this increase in Segwit represents more people using this solution or fewer people using non-segwited bitcoin. Either way, it’s good to see the confirmation times coming down. Unfortunately, it’s not clear if Bitcoin can really survive another FOMO surge without some serious work done in preparation.

This content is provided for information and educational purposes only and should not be considered to be investment advice or recommendation.

The outlook presented is a personal opinion of the analyst and does not represent an official position of eToro.

Past performance is not an indication of future results. All trading involves risk; only risk capital you are prepared to lose.

Cryptocurrencies can widely fluctuate in prices and are not appropriate for all investors. Trading cryptocurrencies is not supervised by any EU regulatory framework.

Congratulations @kryptopatryczek! You received a personal award!

Click here to view your Board

Congratulations @kryptopatryczek! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!