Still, things could go awry.

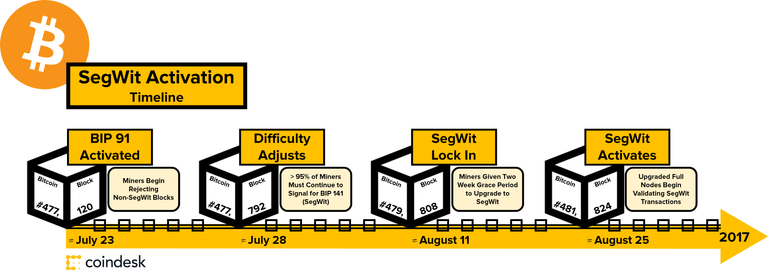

For example, it's possible that bitcoin's miners could stop signaling support for SegWit ahead of the BIP 141 "lock in" deadline (although they'd risk having their blocks rejected by the network, losing the rewards).

While all nodes appear to be signaling correctly, it's hard to know exactly who is running the software – this means that miners could fail to reject a block that wasn't signaling for SegWit, continue adding new blocks on top of that block, and ultimately, produce an alternative chain.

Adding to the argument is that miner support for the idea has notably wavered in the past, with some asserting it's largely the threat that users could push through a change that could lead to a split that has kept miners in check.

ADVERTISEMENT

Litecoin's attempts at integrating SegWit adds context to this theory.

As much as 75% of litecoin's mining hashrate, for instance, was signaling for SegWit in April, meaning it reached the necessary threshold to lock in SegWit. But miner support dropped off soon after. This sparked protocol creator Charlie Lee and other litecoin users to threaten to code an alternative user-activated soft fork (UASF) proposal.

Shortly thereafter, a roundtable was held that united major miners, at which time they agreed to signal support for SegWit.

Should similar psychology come into play here, the idea is that (after averting a UASF on bitcoin on August 1), miner support for SegWit may wane, though the economic stakes here are arguably higher.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://steemit.com/steemit/@beekeyyy/bitcoin-more-capacity-2017725t135757472z

wow