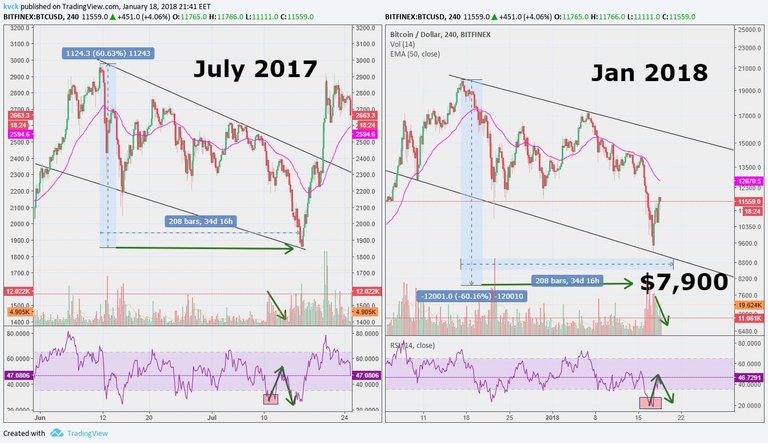

When I compare the price movements in July 2017 and January 2018, there are significant similarities.

First of all, last June/July term the price of Bitcoin decreased by around 60% in around a month. This price fall combined with falling volume (as expected) and double-dip RSI. Moreover, the price trend fluctuated down narrowing wedge.

When I look at what is going on today and compare it with July 2017, the conditions I mentioned (the falling volume, RSI dip, the falling wedge) are quite similar with today.

The only missing part of this puzzle is the next move of Bitcoin. If the next move will be the same with July 2017 then we will see a downward price trend and a fall to $7,900.

The other scenario is that Bitcoin will break the falling wedge around $14,300 and goes above. But the news flow (South Korean Government's decisions, ECB's recent announcement, France and Germany will propose cryptocurrency regulation, etc.) is still affecting the market sentiment. In my opinion, there is still no story for an uptrend.

My Twitter: https://twitter.com/P_roxima/

My Tradingview: https://www.tradingview.com/u/kvck/

Let wait and see.

If you like the content, please upvote, follow and, share!

My BTC Address: 19vHuWQnAfP31LBBHq8eCewjCk4ctfBjow

IMPORTANT: The information above is not financial advise. Please do your own research and invest wisely.

Nice