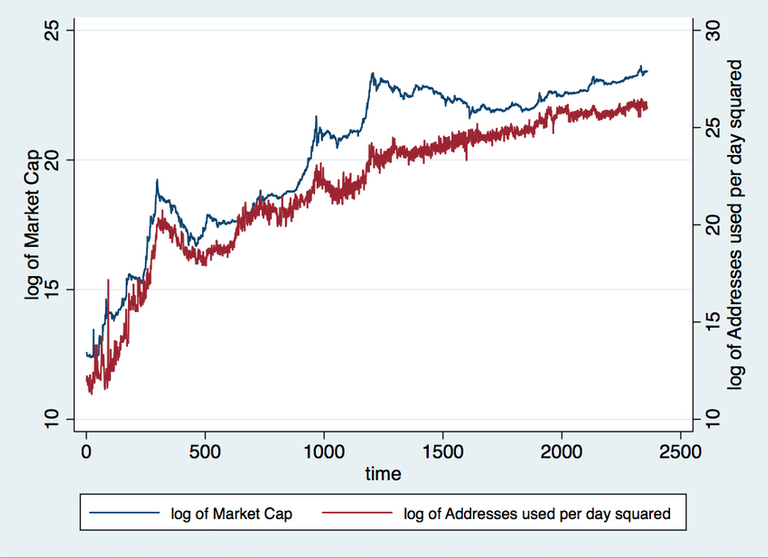

good thoughts! There is an intrinsic value for networks! Its the value people get from interacting (transaction or communication doesn't matter is both communication/interaction) on the network. With n users the network value grows as n² or better: n log n (Metcalfe's network law). It is scientifically validated for:

- Facebook und Tencent: Zhang et al. 2015

- Bitcoin, Ethereum, Dash Alabi 2017

- Bitcoin: Peterson 2018, Civitarese 2018

...of course there are many values reflected in the price. Speculative perceived value is also a value...

but when the price exceeds the network-value, then a bubble is indicated.

There is also research in bubbles, because they are by far no financial asset phenomenon. They are universal. In systems dynamics, it is called finite-time-singularities. This is when a dynamical system matures towards a point of instability, where a small external shock can cause the pop. (pregnant women, earthquake, avalanches, epileptic attacks ...) Super-exponential profiles can be observed in many catastrophes.

But your completly right it was no open market bubble (like dot com). Simply because the market is not acsessable for institutions. They simply are not able nor allowed to buy.

Right, the 2017 spike was very different from the likes of the dot com bubble, which was to a great extent inflated by Wall St and other pirates.