Crypto News, Analysis, Forecasts, ICOs and Events for the week ending 10/19/2018

Crypto News & Analysis

International Business Machines (IBM) has scheduled a demonstration of their own version of a blockchain based, global transfer, rapid payment platform. They have named it 'The Blockchain World Wire'(BWW). Unlike Ripple's xRapid platform, IBM's system can handle cross border transactions with any cryptocurrency as a medium of exchange. Whereas it has been reported that the xRapid system is only able to handle cross-border payments using the XRP crypto.

Capitalism doesn't work without competition. IBM's BWW system will ensure that the price for the service remains competitive. IBM's presence will also cause the cross-border payment and transfer systems to improve their technology. The competition is extremely healthy for the evolution of both platforms.

IBM plans to demonstrate the BWW platform during the Sibos 2018 convention. The convention is being held in Sydney, Australia from October 22 - 25th. IBM holds more patents involving blockchain technology than any other company in America. They currently hold 89 blockchain patents second to Alibaba which holds 90 patents. They also have managed to forge several lucrative relationships with leading food companies and retailers. Some of the companies on the list include, Nestlé, Tyson Foods, Golden State Foods, Wal-Mart Stores Inc., McCormick and Co., and Berkshire Hathaway’s, McLane Co..

IBM's leadership role in blockchain solutions is clearly demonstrated. They proudly boast that their clientele consists of 97% of the world's largest banks. They push their chest out farther and claim their mainframe processes 90% of all major credit card transactions. They then put their nose in the air when they claim they run 60% of all the world's transactional systems. The addition of the BWW system fits right into this configuration.

The Payment system will be powered by the Stellar Lumens (XLM) platform. The XLM cryptocurrency has gained nearly 9% in value over the last 7 days. The last sale at the time of this writing took place at $0.236 per crypto coin.

Forex News & Analysis

The United States Dollar lost ground against Bitcoin this week. The USD started the week pairing with Bitcoin at an exchange rate of $6135/ 1 Bitcoin. The pair ended the week exchanging at a rate of $6396 / 1 Bitcoin. The USD lost a 4.25 % advantage over Bitcoin by the end of the week. Bitcoin continued to demonstrate stability this week. Bitcoin continues to hold steady maintaining a level above its lower resistance level of $6200.

The USD index (.DXY) compares the USD to 6 globally dominant currencies. The USD lost ground when compared to its global counterparts towards the end of the week. The .DXY index recorded a value of 95.06 at the beginning of the week. The Index closed at 95.64 recording a 0.579% gain in value by the end of the week. The dollar lost some momentum on the last trading day of the week. Many analysts believe the loss in momentum is due to the European Euro gaining value. The Euro's gains may be a result of eased tensions of economic conflict between Italy and the European Union. This is not the first time economic woes have entered the relationship. Fears revolved around the idea that the Italian economy, the 3rd largest within the Union, is to big to fail. And a major bailout may have to be initiated. The GBP lost marginal value against the USD. After the news that Brexit was 90% done. The GPB ended the week Exchanging at $1.3069 with the USD, losing 0.01% from the previous trading day. While the Australian Dollar (AUD) lost marginal value compared with the Japanese Yen by the close of the week. The AUD ended the week weaker compared to the JPY exchanging with the JPY at ¥80.12 / 1 AUD a 0.01% decrease in value from the previous trading day.

Crypto Futures News & Analysis

The Securities and Exchange Commission (SEC) has launched a fintech hub. The purpose of this portal is to give SEC the ability to engage with companies involved with blockchain technology, artificial intelligence, and other digital investment instruments. The Finhub is the name the SEC has given it's new division. The Finhub's fearless leader will be Valerie A. Szczepanik, senior advisor for digital assets and innovations. She is also an associate director in the SEC’s Division of Corporate Finance. She will be assisted by representatives from other divisions and offices of the SEC who have expertise and experience in fintech.

The 21st Money Team has long held the position that the SEC was dragging its feet in regulating cryptos. The reason for the snail's pace was because it needed to create the infrastructure to handle digital investment instruments. This was a necessary step towards moving the crypto market forward, and it has finally come to the United States. The Finhub Portal will enable users to easily engage with the SEC. Applicants are now able to easily ask specific questions of the agency. The Finhub portal also allows users to request and schedule meetings with the relevant SEC staff member.

It's important to remember, that it was because of the SEC's lack of resources, manpower, and oversight that provoked and enabled the 2008 financial crisis. You can be assured that everyone that sits behind a desk in that agency is not going to be a part of another financial disaster. The wait has been annoying for potential investors in crypto products. It's unlike the US to lag behind in new technology and investment opportunities. But this time around the SEC is going to take its time and make sure they get it right.

The 21st Money team is confident the SEC will use the next few months to get the bugs out of the Finhub portal. Hopefully crypto investors can look forward to 2019 and the new investing opportunities it will bring. The regulatory body for cryptocurrencies and other digital investment instruments is in place in the US. 5G internet speeds have become available. Digitized data has been created with enormous monetary value. There are exciting times ahead for cryptos.

Crypto Stocks & Analysis

The crypto merchant bank Galaxy Digital (GLXY) began trading on the Toronto Venture Exchange (TSXV) August 1. Galaxy Digital is another first of its kind institution born from blockchain technology. One of the things that make this stock interesting are the people at the helm of the ship. Mike Novogratz and former Goldman Sachs Executive Director Richard Kim as Chief Operating Officer.

(GLXY.V) TSXV Currency in CAD

Chart Courtesy of Yahoo Finance

The stock had a rocky start on its debut day to the public, opening at CAD $2.75. This value is 45% lower than the IPO price of $5. The triumph of this new and innovative company being listed together with their new approach to banking may be what catapults this stock to a place where investors rejoice. Putting the early jitters aside the stock has tremendous potential according to the captain and his chief. Novogratz recently commented that he believes that the cryptocurrency markets could soon be in recovery. “............ Part of this is the anticipation of an ETF that will hopefully get approved.”

This week's Biggest Winners in Cryptocurrencies

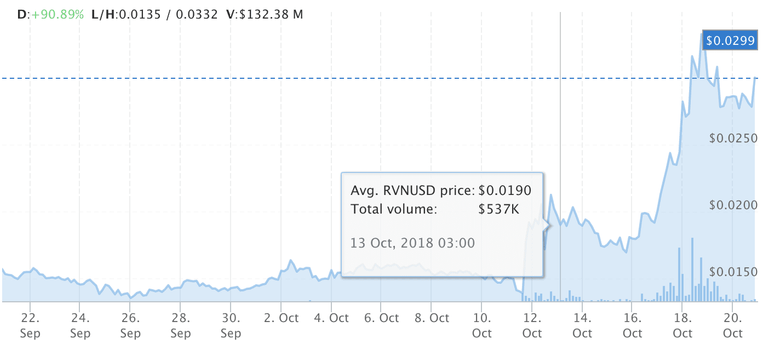

- +48.95% Ravencoin (RVN) Started the week at $0.0190 Ended the week at $0.0283

- +48.90% Request Network (REQ) Started the week at $0.0454 Ended the week at $0.0676

- +47.16% Veritaseum (VERI) Started the week at $17.24 Ended the week at $25.37

- +44.31% Salt Lending (SALT) Started the week at $0.562 Ended the Week at $0.811

- +38.99% DMarket (DMT) Started the week at $0.318 Ended the week at $0.442

- +36.81% GoCoin (GO) Started the week at $0.0326 Ended the week at $0.0446

- +36.31% POA Network (POA) Started the week at $0.0785 Ended the week at $0.107

- +35.80% Basic Attention Token (BAT) Started the week at $0.176 Ended the week at $0.239

- +27.52% EthLend (LEND) Started the week at $0.0149 Ended the week at $0.0190

- +27.28% Aeternity (AE) Started the week at $1.107 Ended the week at $1.409

- +26.77% Cindicator (CND) Started the week at $0.0198 Ended the week at $0.0251

- +26.32% Ambrosus (AMB) Started the week at $0.152 Ended the week at $0.192

- +25.44% Quantstamp (QSP) Started the week at $0.0338 Ended the week at $0.0424

- +24.55% Ethos (ETHOS) Started the week at $0.330 Ended the week at $0.411

- +18.99% Bitcoin Interest (BCI) Started the week at $1.00 Ended the week at $1.190

Crypto Chart of the Week

Ravencoin (RVN)

Chart Courtesy of Coinlib

Ravencoin (RVN) ranks 93rd on the list of cryptos ordered according to their market capitalization. Ravencoin's current market cap is $62,610,000. Ravencoin describe themselves as a use case specific blockchain designed to carry statements of truth about who owns what asset. "Ravencoin aims to implement a blockchain which is optimized specifically for the use case of transferring assets such as tokens from one holder to another" - Medium

$3,160,000 worth of Raven changed hands October 19th at an average price of $0.0307.

Heard Through the Grapevine

Upcoming Events

October 20 - BLOCK 9 Conference 2018 Richmond Virginia USA

October 22 - Web3 Summit Funkhaus Berlin, Germany

October 22 - 24 - East-West Crypto Bridge Frankfurt Germany

October 22 - 25 - Sibos 2018 Sydney, Australia

October 23 - Blockchain & Bitcoin Conference Malta Mellieha, Malta

October 23 -24 - 2018 Korea Blockchain EXPO Seoul, Korea

October 23 - 25 - CoinAgenda Global Las Vegas, Nevada USA

October 24 - World Investment Forum Geneva, Switzerland

October 25 -26 - STABLE CONF 2018 London, England

October 29 - 30 - IoT Blockchain Summit Atlanta, Georgia USA

October 30 - November 2 - Devcon IV in Prague Prague, Czech Republic

October 31 - November 2 - World Crypto Con Las Vegas, Nevada USA

November 1 - 2 - Malta Blockchain Summit St. Julian, Malta

November 8 - 9 - STABLE CONF 2018 Budapest, Hungary

November 28 - 29 - Blockchain Expo North America 2018 Santa Clara, California

November 29 - 30 - Monaco International Blockchain Forum Monaco

March 19 - 21, 2019 - Money20/20 Asia Singapore

Upcoming ICOs

Kuende (KUE) Sale Starts October 19 Sale Ends November 2 / The social network that rewards real life interaction and enhances your wellbeing

beepnow (BPN) Sale Starts October 20 Sale Ends December 29 / A skill-sharing platform that connects “job seeker” and “job offerer” together, and allows you to execute everything, from offering a job to payment, from your smartphone

Blockpit (TAX) Sale Starts October 20 Sale Ends November 20 / A Tax Reporting and Portfolio Monitor

Vanywhere (VANY) Sale Starts October 20 Sale Ends November 10 / A live skill-sharing platform that instantly connects people seeking and offering skills, so they can get personalized results tailored just to them

Dein Anteil (DAT) Sale Starts October 21 Sale Ends January 20, 2019 / The first ecosystem of tokenized real estate and rent

Exosis (EXO) Sale Starts October 21 Sale Ends November 19 / A Masternode coin with Timetravel 10 Algo

Fiii (Fiii) Sale Starts October 21 Sale Ends December 31 / The Only mobile instant cryptocurrency payment terminal in the world to be compatible with up to 1500 cryptocurrencies

Aircraft (AIRT) Sale Starts October 22 Sale Ends December 1 / Aiming to make the use of the cryptocurrency in the tourism field affordable, as well as providing a higher level of security and quality of services in travel

BR11 (BR11) Sale Starts October 22 Sale Ends November 21 / A Security Token legally backed by equity in 11 high-growth revenue generating startups

Carmel (CARMEL) Sale Starts October 22 Sale Ends December 31 / Learn How To Build A Better Future For All Of Us

Crypto Circle X (CCX) Sale Starts October 22 Sale Ends November 26 / Powered by a superior technological algorithm that is capable of high performance trading with over 10 million transactions per second, A.I. bot, auto-trading, professional charts with technical analysis, trading alerts, and much more, in a user friendly and responsive interface or in our specially designed mobile app

EZ Exchange (EZX) Sale Starts October 22 Sale Ends December 17 / Puting traders first, ensuring that users never deal with substandard security or a poor user experience when trading cryptocurrency

Spotcoin (SPOT) Sale Starts October 22 Sale Ends October 27 / Developing a complete digital asset management toolkit

Coingrid (CGT) Sale Starts October 23 Sale Ends December 23 / Aiming to make investing in cryptocurrency as easy as sending an email

RealtyReturns (RRT) Sale Starts October 23 Sale Ends November 23 / A decentralized compliance protocol creating an industry standard for how asset-backed tokens are issued and traded on the blockchain

Coingrid (CGT) Sale Starts October 23 Sale Ends December 23 / Aiming to make investing in cryptocurrency as easy as sending an email

ASSPACE (ASP) Sale Starts October 25, 2018 Sale Ends January 1, 2019 / Intended to be the one and only cryptocurrency for driving processing and stimulating user activities in a private decentralized social network with 18+ content

EveryCoin (EYC) Sale Starts October 25 Sale Ends December 25 / A new financial platform that combines stable coin (TabiPay) with fluid value coin (EveryCoin) to solve the problems of blockchain speed and high variability of cryptocurrency

GEMERA (GEMA) Sale Starts October 25 Sale Ends December 12 / A crypto-token backed by Colombian emeralds which provide a blockchain based platform where the tokens can be redeemed for physical emeralds

Skillchain (SKI) Sale Starts October 25 Sale Ends November 24 / Certified Skills on Blockchain

Vena Network (VENA) Sale Starts October 25 Sale Ends November 5 / An open protocol for tokenized asset financing and exchange, in which everyone can process P2P cryptocurrency collateral lending and OTC trading anytime and anywhere, enabling free exchange between cryptocurrency and fiat currency

XERA (XERA) Sale Starts October 25 Sale Ends December 23 / Transforming the way cryptocurrencies are traded, offering traders and investors a seamlessly integrated solution for their cryptocurrency investing

Click here for 21st Money’s complete list of upcoming and ongoing ICOs

Posted from my blog with SteemPress : https://heartlandnewsfeed.com/2018/10/20/the-21st-money-weekly-newsletter-10-19/

let's power it up