Whenever Bitcoin experiences a run in price, the bubble callers come out of the woodwork. You'll have to forgive them, as they've been "right"a few times. (Note: definition of "right" open to interpretation)

However, their accuracy can be mostly credited to (literal) "dumb" luck, as neither Bitcoin, nor tulips themselves, actually bear any resemblance to what we know as "Dutch Tulip Mania."

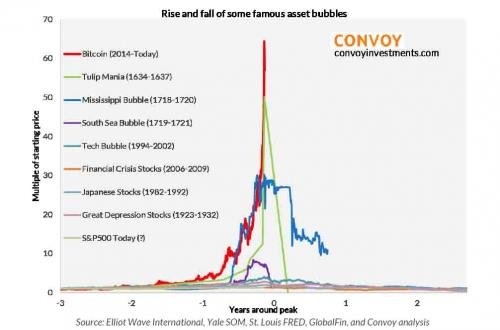

Perhaps you've seen this chart:

For those unaware, perhaps the most famous bubble in history is the "Dutch Tulip Mania". The mainstream knowledge has it that such a furious bidding war broke out for tulips in Amsterdam in the late 1600s that it made most modern stock market bubbles look like a bunny hill. Supposedly, the truly insane delusion of crowds bid a single rare tulip bulb to a price in excess of a luxurious Dutch estate, and men were thrown in jail for the accidental destruction of a flower.

Of course, none of that is true in any way. Here are 3 generally unknown reasons why Tulip "fever" was bullshit.

Demand for tulips was already at a cyclical high. The "Thirty Years War" (1618-1648) had taken a vast toll on the Dutch people. Wikipedia notes that the war "ranks with the worst famines and plagues as the greatest medical catastrophe in modern European history" with "population loss in central European states "ranging up to 50%". In other words, there was already high demand for Tulips and every reason to assume that would continue for the foreseeable future

The top of the bubble, or the point that everyone makes their "Tulips went up XXX%" calculations from, is a lie. The "trade" marking the top of the bubble, the one everyone uses to calculate the total bubble percentage? Never happened. A careful perusal of existing Dutch records show that not even ONE SINGLE bankruptcy was recorded or attributed to the "bursting of the Tulip Bubble".

Most Tulip contracts had an opt-out clause. This means that, effectively, you could pay money to speculate with limited downside. Consider this example: You are watching the tulip market rapidly appreciate. A market maker allows you to buy the option to receive delivery of $100 in Tulips at today's value in 1-month, for $100, with a delightful catch – for a mere $1, you can reject delivery in one-month and destroy the contract. Sound like limited downside and extreme upside? Well, that's exactly what it is, and this is why so many tulip contracts traded.

In other words, tulips were not a bubble. They were a (mostly) rational response by market actors to unusual demand outside normal statistical variance.

So the next time that you hear someone call Bitcoin a Tulip, go ahead and tell them you're fine with that. Bitcoin being a rational trade with vastly outsized risk relative to the upside is a good thing for all of us.

Then walk away, because they won't get it, unless they, too, were bored enough to write a paper on Tulips when studying for their PhD in economics.

If you have any additions or errata for this post, please let me know! I will see that they are voted to the top of the comments, and will make the appropriate edits (if possible).

We also have a Radio Station! (click me)

...and a 5000+ active user Discord Chat Server! (click me)

Sources: My Economics Thesis, Wikipedia, Smithsonian Magazine

Copyright: FirstCoinCompany.com, Bouq.com

Very Interesting. I suspect central bank funny money might be the actual bubble.

The US$ is probably the largest bubble that this world has ever known. It's distorting everything else to the point where nothing makes sense.

Excellent and relevant discussion, certainly the given topic is hot subject, let me add a little color to an already beautiful piece.... I like to see economics as both social and mathematical, the social part we have done a good job over the years of building different school of thought from Keynesian to Austrian but the mathematical part still mystify us... I believe that where Bitcoin and blockchain technology allows us to understand whats working from whats not... As long as the participant behave by consensus the given price of Bitcoin supports the given economics of the day, it cannot be compared to the mania of the Dutch Tulips where participant acted in their own self-interest often eroding the given market economics, such mania always pops when self-interest cannot find market support...

Good to have you back Lex! More arguments for the the non-believers who still trust in having all their savings in a bank account!

Thanks Jon! I've had this post idea sitting, unfinished, for 5 months. Time to finally get it out there.

By technical point of view, limited supply of 21 million in bitcoin, exponential growth seems reasonable. But trading it as if it's in a bubble makes you to be more wary of your capital. I truly believe in the technology of bitcoin and blockchain, but throught out history every new groundbreaking tech will always underwent bubble of some sort to achieve massive adoption. So it's always wise to trade with moderation and not greed. And suprisingly I posted about the same topic too ahaha.

Great points! I'm not sure if BTC would surprise me more at $1000 or $100,000. It's anyone's guess at this point.

Take-off? Media-attention? New Paradigm?

I think we are at Greed stage, Arrival of CME and CBOE to the scene takes us from 300 billion market cap to the now almost 600 million cap in almost a month! Delusional stage will soon set in, dot com bubble burst at 9.6 trillion. We are now approaching 1 trillion.. Becareful guys. Everyone hope bitcoin will only go higher, but no what goes up must come down. So only invest the money you're willing to lose. Save some money aside to buy when the bubble burst. You might be the crypto Warren Buffet.

Ripple would appear to be clearly confirming your observations:

2 Ripple $82,453,945,458 $2.13 $6,622,780,000 38,739,144,847 XRP *

I like this Lexi... this is a ninja chop to the back of the neck of the bears... Since I started with cryptos I get at least one msg or phone call a month of somebody trying to warn me that I'm going to loose my ass and that I should read about the Tulip Mania to know what I'm walking towards...

So this is like a ninja chop that is going to be in my batman utility belt...

Hey, it could certainly still crash hard! It's done it before.

But, the tulip analogy is really overdone. I don't like seeing it at "reputable" financial websites.

Wasn't the demand for Tulips due to the greatest world power at the time, the Ottoman Sultanate, designating the Tulip as the imperial flower? The so-called Tulip era of Suleiman's court gave rise to the French nobility attempting to emulate the Ottomans, which later spread to the nouveau riche copying their betters.

The Tulip mania as a process continues to be instructive, as the traded commodity became tulip bulb, not even the flower itself. The folly of the mania is not the bubble itself, but the fascinating phenomena of men mortgaging futures, or rather potentials (i.e. bulbs), for the present. In essence, the Tulip futures market, as well as any commodity trading scheme, is a transfer of wealth from the future to the present.

It is interesting that the fleeting preference of one Ottoman Turk, a perceived sworn enemy to Christians, would so influence Christendom nearly a century after his death.

I wasn't aware of this being one of the larger factors in this bubble, though I have heard reference to it.

The story is what most people buy into, stupid FACTS get in the way.

Darn those Dutch Calvinists!

https://www.smithsonianmag.com/history/there-never-was-real-tulip-fever-180964915/

I'm Dutch and i can asure you, we HODL tulips!!! :D

Thank you for this critical modern update.

I think of bitcoin more as a hibiscus

Is that because having large amounts of it will get you "Lei'd"?

I read that the Tulip Mania ended primarily due to plague. Folks got too scaredto come out their houses and transact any exchange.

I can't prove that is correct or not correct. What does your research show?

This was definitely a factor, but it's difficult to determine how much it affected what was already a likely-collapsing price bubble. There were a number of rather grave epidemics recorded during this era.

Thank you for the additional information and details about the tulip mania. A lot of comparison of Bitcoin, or crypto currencies generally, are being made to tulip mania, Ponzi scheme and/or pyramid scheme. Good to get the message out what actually occurred and why these are neither good nor correct comparisons.

The top of almost every "mania" is overstated for effect. It makes for a great story.

If I have to be honest, I just don't know what's going to happen with bitcoin. I just know that all bubbles usually are guilt of banks... and with cryptocurrencies we don't have a bank....

Ah, yes, but banks can still print up money in order to meddle in our markets!

This is so true!

I clearly remember Jamie Dimon and Peter Schiff's statements when even the 5k target was in utopialand

Ah, yes, well we all know what geniuses they both are.

The next Bitcoin halving will probably result in the biggest bullrun we have ever seen here in crypto. Bitcoin is already deflationary, the demand is already bigger(!) than the amount of coins mined in period X.

We may be seeing that now, although Bitcoin might be getting left out this time.

Thanks for analysis and informative post.loved your all the overview about the bitcoin bubble burst, a word which is confusing lots of crypto traders these days but you did a great job by clearing the doubt by throwing it out of mind.

I would love to see more from you.First of all, Nice to see you again after long time @lexiconical

Thank you for noticing! I've been very, very busy.

Thanks for clearing that up. I heard so many negative things about the tulip bubble. Not it makes more sense.

It really was not all it was cracked up to be. Quite literally speaking.

Honestly, we will not know if it is a bubble until after it pops. Predictions until then are mostly a coin toss.

You got that right.

Great article and analysis but my favourite part was your last paragraph "Then walk away, ...." 😂

It's not really worth your time to continue the discussion, if your best point isn't good enough.

Bubble and S-curves look awfully similar until they hit their peak.

https://steemit.com/cryptocurrency/@xsid/bubble-or-s-curve

True story!

Thank you for saying so beautifully to us in history. History has really talked about Bitcoin. Now I am sure that your history is completely complete.

Bitcoin didn't even exist in history. What are you talking about?

Nice lex! More arguments for unbelievers who rely on having all their savings in a bank account!

@lexiconical this is indeed deep research. I never knew about the game of tulip. Thanks for sharing about bitcoin and tulips

They are only related in the bubble comparison.

upvoted and followedHey friend @lexiconical ,,,,it's always great to see your report and always have investors to take the right decision for your post you really done a great work..

I appreciate your support.

extraordinary and lovely photo...thanks for sharing. The chart is looking like the consolidation is coming to an end. Could be a good time to pick some up. Good luck!

i followed you ...

upvoted and resteem

"The chart is looking like the consolidation is coming to an end."

That's a 3+ year old chart. I take it you didn't look too closely?

Very instructive story. I finally understood why tulips were so expensive to sell. And also, I see the differences between tulip mania and bitcoin mania. Good luck to you and good.

"I finally understood why tulips were so expensive to sell"

Oh really? Why was that?

It's simple, people have BELIEVED in the fact that they really stood so much.

STEEM WitnessYou got a 2.77% upvote from @upme requested by: @nikez452. Send at least 1.5 SBD to @upme with a post link in the memo field to receive upvote next round. To support our activity, please vote for my master @suggeelson, as a

Hey @lexiconical, great insight. I am brand new to the whole cryptocurrency market. I only own just over 1 ETH, but I really want to get a firm handle on this new tech because it is the future. Do you think bitcoin is the end game though? Or will some other better form of crypto take over? Like, remember when Nokia was the king of cell phones and it was never going to be surpassed. Well.... you get the point. This is an honest inquiry, as I really just don’t know much about this stuff yet.. visit me @greenroom. I’m here for fun and games but also to get real knowledge on this stuff and all things steem!

"Do you think bitcoin is the end game though? Or will some other better form of crypto take over?"

No, I don't think BTC will be the "endgame", although it could take its place as digital gold (see my article on BTC coexisting with BCH).

There are many cryptos both eager and able to take the crown from BTC (look at BCH, Monero) and Eth (EOS, LISK?)

You got a 11.89% upvote from @postpromoter courtesy of @lexiconical!

You got a 16.73% upvote from @allaz courtesy of @lexiconical!

i sent you a memo regarding ur service, please respond

You should check with them directly via the comments of their most recent post.

12.56% @pushup from @lexiconical

Thank you @lexiconical for promoting this post together with https://steemit.com/budget/@jerrybanfield/introducing-steem-budget-proposals

For more information, click here!!!!

Send minimum 0.050 SBD to bid for votes.

The Minnowhelper team is still looking for investors (Minimum 10 SP), if you are interested in this, read the conditions of how to invest click here!!!

ROI Calculator for Investors click here!!!This post has received a 10.37 % upvote from

This post has received a 0.72 % upvote from @buildawhale thanks to: @lexiconical. Send at least 1 SBD to @buildawhale with a post link in the memo field for a portion of the next vote.

Steem WitnessTo support our daily curation initiative, please vote on my owner, @themarkymark, as a

This post has received a 7.46 % upvote, thanks to: @lexiconical.

This post has received a 4.17 % upvote from @upmyvote thanks to: @lexiconical. Send at least 1 SBD to @upmyvote with a post link in the memo field to promote a post! Sorry, we can't upvote comments.

This post has received gratitude of 2.16 % from @appreciator thanks to: @lexiconical.

the @boomerang whitepaper.This post has received a 7.29 % upvote from @boomerang thanks to: @lexiconical@boomerang distributes 100% of the SBD and up to 80% of the Curation Rewards to STEEM POWER Delegators. If you want to bid for votes or want to delegate SP please read

Sneaky Ninja Attack! You have been defended with a 7.45% vote... I was summoned by @lexiconical! I have done their bidding and now I will vanish...Whoosh

This post has received a 6.29 % upvote from @aksdwi thanks to: @lexiconical.

The difference between tulips and Bitcoins is that tulips have intrinsic value. You can't smell a Bitcoin.

I assume you have the same objections about all other forms of money, scrip, currrency?

Can you smell a stock share? Can you repossess assets if they go bannkrupt?

Actually, I'm a fan of community currencies and floating currencies.

If a business that goes bankrupt has assets that can be liquidated, then you can get something back. I should point out that I'm not a fan of stock market speculation.

This post has received a 17.96% upvote from @lovejuice thanks to @lexiconical. They love you, so does Aggroed. Please be sure to vote for Witnesses at https://steemit.com/~witnesses.

50SP, 100SP, 250SP, 500SP, 1000SP, 5000SP Don't delegate so much that you have less than 50SP left on your account.This post has received a 27.97% upvote from @msp-bidbot thanks to: @lexiconical. Delegate SP to this public bot and get paid daily:

You got a 19.90% upvote from @upmewhale courtesy of @lexiconical!

"On the height of the mania one top tulip cost around 30k Gulden"

This is precisely the misinformation I literally wrote this article to dispel:

"The "trade" marking the top of the bubble, the one everyone uses to calculate the total bubble percentage? Never happened."

Your market cap numbers explain why this number was always such patent nonsense.

My whole point here is that the entire Tulip situation was over-stated.

Wikipedia is not an acceptable sole-source when specifically discussing matters accused of being incorrectly hyped up in history. It will have exactly the same faults. You need more primary sources. Preferably, not Dutch Calvinists.

"there was an offer"

You can't price markets by offers. Offers are not a trade. Hell, you shouldn't even price them by a single trade.

"“There weren’t that many people involved and the economic repercussions were pretty minor,” Goldgar says."

...

"So if tulipmania wasn’t actually a calamity, why was it made out to be one? We have tetchy Christian moralists to blame for that. With great wealth comes great social anxiety, or as historian Simon Schama writes in The Embarrassment of Riches: An Interpretation of Dutch Culture in the Golden Age, “The prodigious quality of their success went to their heads, but it also made them a bit queasy.” All the outlandish stories of economic ruin, of an innocent sailor thrown in prison for eating a tulip bulb, of chimney sweeps wading into the market in hopes of striking it rich—those come from propaganda pamphlets published by Dutch Calvinists worried that the tulip-propelled consumerism boom would lead to societal decay. Their insistence that such great wealth was ungodly has even stayed with us to this day."

https://www.smithsonianmag.com/history/there-never-was-real-tulip-fever-180964915/

Ah, well, you may have a point there. I mostly just use them for the minerals section of the Natural History Museum. Perhaps they are a biased source as well.