Several years ago, hardly anyone knew what Bitcoin was. The word “coin” probably clued in that Bitcoin was some currency — but other than that, it was pretty much unknown. Flash forward to the year 2017, and now Bitcoin is almost a household word. Nearly 80% of Americans have heard of Bitcoin, although a far smaller portion of Americans have any intention of using it, let alone understand what it is.

The rise of cryptocurrencies like Bitcoin pose legitimate questions about their origins. Who started this whole cryptocurrency concept, and why did they do it? The answers can also pave the way for future coins — and help developers determine the next step in cryptocurrency evolution.

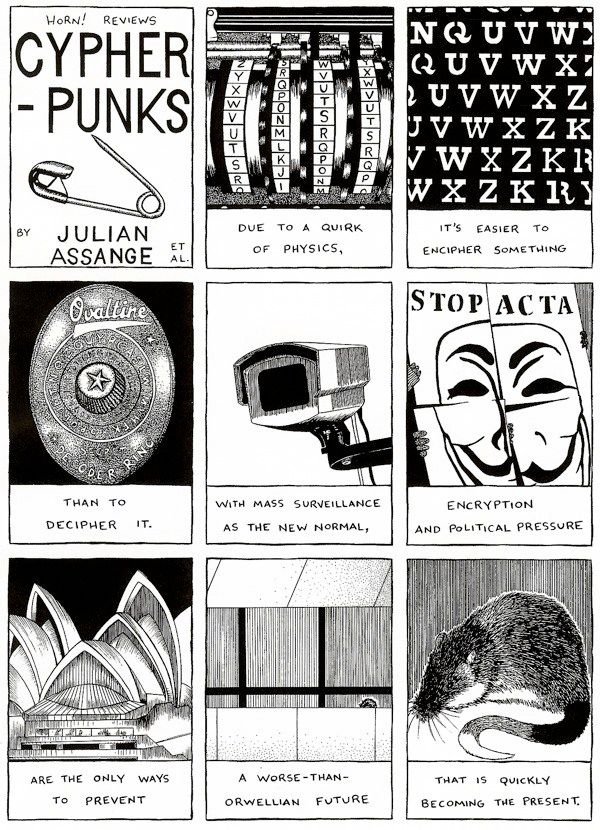

The CypherPunks and their Role in Digital Coin Development

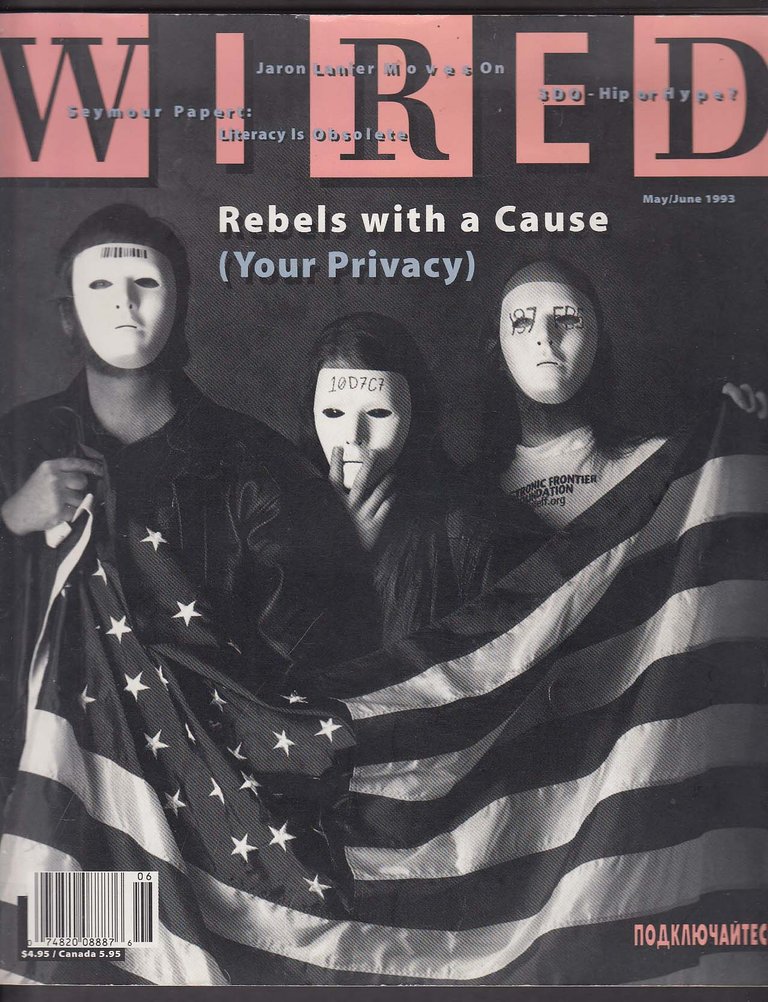

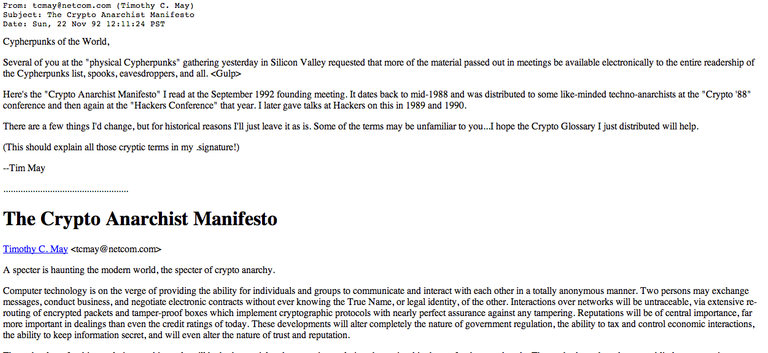

The original CypherPunks met in 1992 in San Francisco, CA. In many ways, their meeting was a product of the founder of the movement, David Chaum. In 1985 (ironically one year after the events of Orwell’s 1984 were set), Chaum published the paper “Security Without Identification: Transaction Systems to Make Big Brother Obsolete.” The article discussed the concepts of anonymous digital cash and pseudo-reputation protocols — thought by many to be the grandfather of cryptocurrencies and blockchain technology.

The CypherPunk meeting in 1992 led to the creation of the CypherPunk Manifesto, published by Eric Hughes on March 9, 1993. In this manifesto, Hughes lamented the current systems where governments, corporations, and other “large, faceless organizations” grant individuals privacy out of their benevolent leadership. The paper noted the irony of authorities “letting” individuals are private and free — at this point, freedom and privacy aren’t inalienable rights, they are just gifts from a stronger, ruling entity.

The essence of Hughes’ response is summed up with the words, “We must defend our privacy if we expect to have any. We must come together and create systems which allow anonymous transactions to take place… The technologies of the past did not allow for strong privacy, but electronic technologies do.”

The electronic technologies Hughes refers to is computer coding and software development. The CypherPunks were working on software that would defend privacy and anonymity, all at the exclusion of government control and regulation. What’s more, the project was to be a communal one. Per Hughes, “People must come and together deploy these systems for the common good. Privacy only extends so far as the cooperation of one’s fellows in society.”

With this historical background, it’s no surprise that cryptocurrencies have risen in popularity in recent years. A considerable part of their appeal is their commitment to the principals of David Chaum and the CypherPunks — anonymous, decentralized cryptography-based currencies that are entirely free from government interference and manipulation. In fact, Bitcoin’s 2008 whitepaper cites “hashcash” and “b-money” as crucial influences — both inventions of the late 90s CypherPunks Adam Back and Wei Dai, respectively.

The ascension of Bitcoin has given rise to other digital coins, and to date, there are over one thousand coins in circulation. Cryptocurrencies are a dream for privacy and freedom lovers because they restore transacting power back to whom it belongs — individuals who have a right to control their own money. Cryptocurrency advocates understand the concerns of the original CypherPunks — privacy and freedom are inherent rights, not gifts to be bestowed by powerful ruling entities.

But… Cryptocurrencies Aren’t Where They Should Be

The goal of the Cypherpunk movement, as Hughes notes, is for it to be accepted by the broader community. The case is no different for cryptocurrencies — the more decentralized users, the better. Unfortunately, the majority of individuals and businesses have yet to get on board.

This is because of cryptocurrencies, for all of their advantages, still have some pretty big turn-offs. Some of the more popular reasons why cryptocurrencies aren’t more widely used include digital coin volatility and slow transaction time.

Sensing these concerns, some blockchain startups are creating cryptocurrency payment platforms that address outstanding concerns. The platforms’ native tokens can be hedged by purchasing low-cost put option contracts that protect against downside price movements. These hedging services help mitigate cryptocurrency volatility. Because cryptocurrency stability will be significantly increased, individuals and businesses alike will have incentives to begin conducting business in cryptocurrencies.

Additionally, some payment platforms can process as many as ten thousand transactions per second. This blows standard cryptocurrency transactions times out of the water and is in line with other payment methods like PayPal and Visa. By increasing the number of transactions per second, cryptocurrencies will become much more competitive regarding actual transaction output. Businesses won’t have to fear a payment backlog, and individuals will have the peace of mind that comes with their payment accounts being settled quickly.

These platforms are doing something unusual for blockchain technology and cryptocurrencies — they are creating payment platforms and tokens that function similarly to fiat currencies, but have eliminated the disadvantages of fiat currencies by utilizing blockchain technology. These cryptocurrencies are still decentralized, completely auditable, and free from centralized regulation.

The use of blockchains ensures that users are in control of their money, not governments, corporations, or other significant, faceless organizations. This adjustment will encourage mass acceptance of cryptocurrencies not only as investment vehicles but as payment mediums as well. The CypherPunks will be proud.

very nice article. instant follow! keep up the good work!