You are probably not very thrilled about the development of Bitcoin or other cryptocurrencies prices since december. As of writing, Bitcoin sits at $6,500, lowest it's been since early november. Overall crypto market cap has lost over 50% of its value. Let's look at the main reasons: negative news & sentiment + panic selling and loss of "quick money" status from the general public.

Negative news & change in sentiment

First, let's take a quick round of some top (but mostly negative) news around Bitcoin and cryptocurrencies and how that sits with the price drop.

South Korea

- initially many news outlets were shouting about South Korea planning to ban cryptocurrencies (which isn't true)

- there were news about South Korean authorities raiding some exchanges

- further development leading to more strict rules for user registration on exchanges (to buy cryptocurrencies) - you now need a real bank account and name. This stopped the hype which was much stronger in South Korea compared to anywhere else - everyone was buying bitcoin without really knowing why (FOMO - fear of missing out very likely)

- today, exchanges of cryptocurrencies work fine, there is no ban, but you do need a real bank account and name

Another hack

- another massive hack leading to loss of around $533 million on crypto exchange Coincheck.com. Although they have -

announced that their customers will be compensated, but the marketing damage to cryptocurrencies is done anyway.

Bitfinex & USD Tether conspiracy (theory)

- the biggest crypto exchange Bitfinex is also apparently the owner / creator of most of USDT - a coin that is linked to USD and, according to Bitfinex and Tether, is backed by real dollars. Therefore every 1 USDT = 1 USD that they should have somewhere. So far, they haven't proven whether they have the needed amount of dollars to cover all USDT in circulation or not.

- there's much more to read about, many conspiracy theories (or truth, no one knows, many opinions floating around) which also isn't helping with the trustworthiness of cryptocurrencies or the technology overall

Facebook clamping down on crypto ads

- in a move aimed at making ads on FB safer for everyone, FB has announced a ban on some types of crypto or ICO ads

- overall, this is good news - it will remove the junk and scammy ICO's, but in the short-term, this further damages the crypto technology good will.

Lloyds, JPMorgan or Bank of America blocking cryptocurrency purchases using their credit cards

- whether it's from fears of a competing technology, fears that credit card owners won't be able to sustain the losses or good intentions of protecting their customers from entering unknown financial markets, this doesn't help the situation either way.

I'm sure if you search around, you'll find more bad news. January 2018 is full of regulation, speculation, scammy ICOs. This means that the world is catching up on cryptocurrencies. Regulatory agencies, politicians and banks are no longer ignoring crypto as something only nerds talk about. It's being taken seriously and that means also that it needs to be regulated. This was expected, so don't act surprised!

Loss of interest of general public & loss of "get rich quick" tag

What wasn't expected is the reaction of the market - people who bought bitcoin or other cryptocurrencies. The negative news resulted in panic selling - smaller price drops made some people think "Oh shit, I need to sell to lock my profits!", which led to further price drops and more "Oh shit!" moments.

If that wasn't enough, there's also a loss of interest (which is generally positive, but as it came so suddenly and fast, it's really pushing the prices down further). Why positive? Because people, who only bought bitcoin or other coins as a get rich quick idea are now probably too scared to buy more. This means that there's less speculative buying and more real world usage (transactions) and long term buying.

Because this happened pretty much within one month, it certainly led to more panic selling. The euphoria is over - it went as fast as it came. The technology is still as good or better as before, but your grandma probably doesn't want to buy Bitcoin anymore because she heard on the news she can make a few hundred bucks.

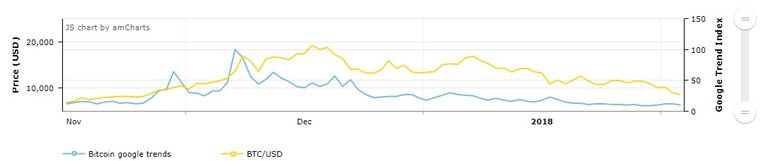

Just have a look at Google Trends in searches for bitcoin or other cryptocurrencies - and how it correlates with the price drop: (source cryptocurrent.co)

Blue line = Google search trends = people searching for Bitcoin on Google.

Yellow line = Bitcoin price in USD

You can see more of this on our Hype monitoring page.

We can see that the surge in interest also led to a surge in BTC price. This likely echoed into other cryptocurrencies too. Today, the interest (general public or people who don't know much about cryptotechnology, but heard it's making big bucks on the news) is falling. Likely because news headlines during the last 2 months did not shout stuff like "Bitcoin surges to new heights again" or "Another 18 year old bitcoin millionaire found", as it did in october and november, when the price has risen rapidly.

It's pretty simple:

- headlines changed from positive to negative, from making money to warning about potential downfalls

- people hop onto any bandwagon that promises a quick buck. But as soon as there's some uncertainity, they jump off - which is what we see happening right now.

- the euphoria is probably over, reality has kicked in. This is good news.

What is the real question we should ask?

Did the technology change in any negative way?

Answer is: NO. Exactly the opposite - it improved:

- the lighting network has launched and is growing every day (much faster Bitcoin transactions and lower fees)

- Bitcoin network is getting less backed up and transactions are getting lower (everything is processed faster for lower fees)

- other technologies like IOTA or Ripple are charging ahead with new projects, use cases, big companies on board

Generally, the technology itself is improving and developers are introducing new ideas and fixes. The bad news is mainly external - regulation, politics, panic selling or just standard loss of interest from general public.

We saw this before... drop leading to an even bigger increase

If nothing else, then think about this - we saw such drops (as end of Jan, early Feb 2018) before - 50% drop in Bitcoin price which then led to a 50% or higher increase a few months later - all during early stages of 2015, 2016 or 2017. It's safe to say that it's a regular cycle - price shoots up, then corrects a bit, then shoots up even higher.

- December 2014 - January 2015: BTC went from $350 to $185 (47% drop), then back up to $290 (+56% increase) within a few months

- December 2015 - January 2016: BTC went from $450 to $350 (22% drop), then back to $465 (32% increase) within a few months

- January 2017 - BTC went from $1102 down to $764 in a few days (30% drop), then up to $1259 within a few months (60% increase)

- What about now? January 2018 - BTC went down from $19,000 to $6500 in about a month (65% drop) .... wait until April for a ... 70%? 80%? 100%? increase?

What should we, as investors do?

This isn't investing advice, just my humble opinion, but it might help you make your own mind up - best I think we can do is hold. Today is the worst time to sell because you will either not get much out of your investment or you will end up with a loss.

Over long term (later in 2018), the development will stabilise which will bring new demand in and push the price higher:

- some regulation will be in play (which is good, it will make things safer for everyone)

- negative headlines will not be so prominent (news outlets will get bored with click baiting on the same topic all the time)

- further progress and improvements in the technology (security, wallets, exchanges)

Based on the analysis of price drops and increases every dec/january, you might do quite well if you continue to hold, or if you're liquid (have some cash on the side), buy some more now. The analysis shows that it's likely to go up by more than it went down recently.