With the cryptocurrency craze in full swing, it's important to invest responsibly and to do your own research. Many people think cryptocurrency is their personal get rich quick scheme; their ticket to fortune. This euphoric rookie assumption is a scammer's best friend.

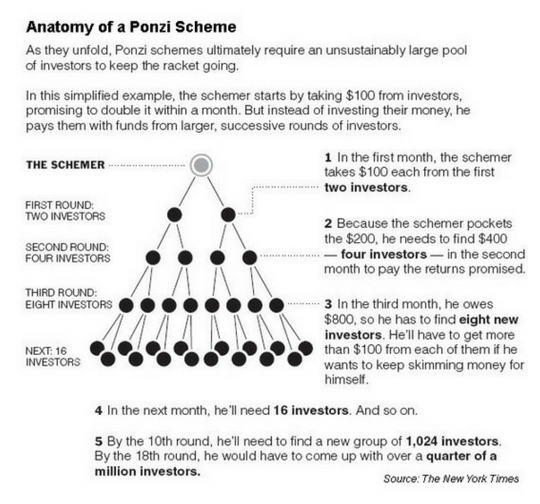

Troves of new, anxious users flock to High-Yield Investment Programs (HYIPs) that they believe will allow them to maximize their gains while minimizing their time frame. What they don't realize is that more times than not, these programs are simply Ponzi schemes.

Yes, you may see small payouts from your investment at first, but as time goes on and new-user registrations dwindle eventually those small payouts will cease entirely. This leaves most users in the red, with their original investment "stuck" in the scheme and having accrued less than that amount from the minimal payouts. I emphasize the word "stuck" because it isn't really stuck, rather it's completely gone. What happened to it you ask? It was provided to the "investors" a level above you in the form of their "profits."

Now the 100 Bitcoin question: How do I identify and avoid a ponzi scheme?

- First things first, a legitimate Investment Program will have no problem providing at least some sort of plan on how they invest. If the website does not disclose their investment plan and the company refuses to provide any sort of plan when contacted just walk away now.

- Do they emphasize Referrals/Affiliates? Sites often urge users to invite as many people as they can in order to keep the scheme going. In exchange for the referrals the site provides "commisions" from the referrals' investments. What these "commissions" really are is a portion of their actual investment. The rest of the amount is divided and distributed to the chain above you (your referrers) in the form of returns from their original investment. When registration slows down, funds run out, then your original investment gets "stuck" forever.

- Check the website's ownership details using a tool like Whois. Look for discrepancies in address, age of site, intentionally hiding company details, etc.

- Are they registered in the same location as they state on their website?

- Do they hide some of their details, notably Administrator Name & Email, using a service like Whoisguard?

- Is the site relatively new?

- Lastly, if you're still on the fence do a cursory google search for reviews on the site and check reputable sites, such as netbusinessrating.com and onlineincomeresources.com to see if they have reviewed and classified the site yet.

But I could still potentially make money, right?

Now, all of this is not to say that you cannot profit off of ponzi schemes. If you are lucky enough to get in at the very beginning you may luck out and potentially recoup your original investment, plus some added profit (at the expense of others, indirectly). However, you have to be lucky enough to guess when it'll stop paying and cashout your original investment prior to that. Being able to calculate that accurately is nearly impossible, it's just one big gamble dependent upon many factors (site foot traffic, amount of investors, how successful testominies and advertising campaigns are, etc). The fact is that they are very risky investments that almost always end badly. The odds of a newcomer looking to get rich quick successfully gauging when the ponzi scheme will collapse are slim-to-none and even if they do it's more than like completely luck.

But, if you're dead-set on trying to take advantage of these programs there are sites that can aid you in your quest. The first one that comes to mind is allhyipmonitors.com. This site provides information from handfuls of sites that test hyips daily and report whether or not they're still paying or not, how long the site has been around, and the last date of confirmed payments. This sort of knowledge is useful when trying to gauge if a ponzi scheme is still successfully operating or if it's about to flop. In my experience I've only seen these sort of sites last about a month before payments stop. The closer to the launch date the more chance you have of getting your return on investment (ROI) and possibly making some profit. However, this is a double-edged sword since you have to also gauge whether the site will pay at all. After all, new scam sites pop up daily and have zero intentions of paying out anything. That's why investing in these HYIPs is very risky and not recommended to anyone, but especially not recommended for newcomers.

Let's apply these tips to an actual site: btchash.io

Browsing their About Us page, the only blurb they provide regarding their program is the following

BtcHash investment program is a super-flexible project for those who like to quickly get tangible results and prefers full control over their finances at any time of the day or night.

Wow! Look at that Affiliate Program!

Looking at the website's registration details using Whois.com we see the following

REGISTRANT CONTACT

Name:WhoisGuard Protected

Organization:WhoisGuard, Inc.

Street:P.O. Box 0823-03411

City:Panama

State:Panama

Country:PA

Phone:+507.8365503

Fax:+51.17057182

Email:[email protected]ADMINISTRATOR CONTACT

Name:WhoisGuard Protected

Organization:WhoisGuard, Inc.

Street:P.O. Box 0823-03411

City:Panama

State:Panama

Country:PA

Phone:+507.8365503

Fax:+51.17057182

Email:[email protected]- Wait a minute, why do the Whois details say the site is registered in Panama while the company claims to operate out of London, UK (See their website footer)? And addressed to a PO Box for that matter?

- And why is the site registrant hiding their contact information via WhoisProtect?

According to btchash's allhyipmonitors profile the site popped up in the beginning of October 2017 and the last confirmed payouts were on November 23, 2017.

Verdict: In October, if you were to come upon this new site you could check out the details outlined here and surmise that it was a ponzi scheme and would not last long.

I hope I have been able to help you understand the risks involved in get-rich-quick schemes, both in the crypto- and real-world alike, and how to avoid potential substantial loss. I'll leave you with one more gem of wisdom

Never invest more than you are willing to lose.

Until next time,

CaffeinatedMike