Dear Steemians,

In the next few pictures i will show you proof of my passive income

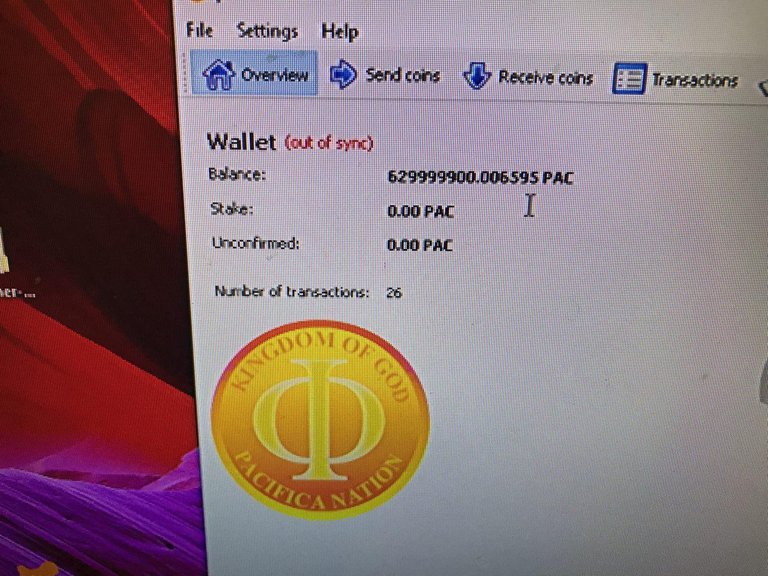

1 : The amount of PAC / PACCOIN in my wallet

2 : the amount of PAC minted 20.5 + 26.4 millions for a total of 46.9 mil paccoins

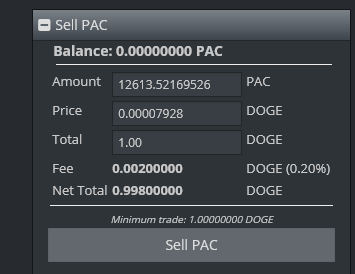

3 : the price DOGE-BTC . Is 43 sats for every doge

4 : the conversion rate are 12613 PAC to 1 DOGE

So this single wallet gives me 3718 DOGE for this month , which is 3718 x 0.00000043 = 0.0015989 BTC

which is about 7.40 usd, so if you look below the whole collection gives me about 50-100 usd monthly

At last the main subject of Understanding Cryptos and how to turn it into a Passive Income stream series. POS coins , or commonly know as Proof of Stake that offer staking rewards. Compared to mining and setting up of masternodes, staking POS coins has a big advantage: It is much simpler! It is so simple that I can explain it in a single statement : To stake POS coins you just need them in a wallet that is unlocked for staking and let the computer run 24/7.

You don’t need to be a nerd or geek to do it. Please take note to always encrypt your wallet for security. Or risk losing your coins!

Personally I use an old laptop that runs 24/7 with wallets of 8 different coins. Laptops use much less electricity than towers and the CPU and RAM of an older or very cheap laptop ( i7 , age 8 years) is enough to keep several staking wallets plus a DAS masternode.It is recommended to optimize your energy settings.Try to limit the energy consumption, especially by determining when the screen is switched of. Please take note that the laptop should not go into hibernation if you want to stake 24/7. If you are an expert on Windows settings, you are welcome to share your knowledge in the comments.

What are the basic advantages of POS coins?

The main advantage is that you get stakes (coins) while your coins are still liquid and not locked up (in term deposits or masternode) . You can make use of these coins at any point without penalty. Not having the coins on an exchange is another plus point. Apart from eliminating security concerns of leaving coins in exchanges, it has another advantage which is preventing you from overtrading. If you are staking and getting small or even big regular returns you are unlikely to get impatient with a coin and sell it for small profits only. Thus it increases the chances for you to just hold and stake till the coin moons. So the gist is buy, stake, hold, sell when it moons and buy back on the dip. Try not to ever sell all the coins. Just sell only 70-80% of the minted coins. That way your holding is always getting bigger. On the flip side, the cons of staking coins in a wallet may mean missing out on quick strong pumps on exchanges. This is not so much of a concern for well established and strong projects, but especially so for smaller, unknown coins that often see quick random pumps.

A very important factor to consider for POS coins is the ROI or APR . Why is this so? First reason is it just tells you how much your annual interests is if you stake, and secondly they tell you something about the inflation of the ecosystem for each coin.

To be continued ….

Appendix A

It took me many hours to do all the research for this article and even more hours to write it. I’d really appreciate upvotes or resteems , if the provided information was kind of useful for you.

Here are some of my addresses:

CBX 5To9Qkf8642rp4xhNC4WLnFr9draQZiBpM

ETH 0xdF15E9399B9F325D161c38F7f2aFd72C11a19500

BTC 17mMPpySrRFECZRCJGSitcTGmoPL6egFLw

NEO ARaEQe3iMLHLqspx8hRaqMYcq4pbeNkR4B

This post recieved an upvote from minnowpond. If you would like to recieve upvotes from minnowpond on all your posts, simply FOLLOW @minnowpond

Loving it , hope to learn more can't wait for the part