Stocks are surging higher on Tuesday, the first trading day of 2018, as investors kick off the new year just as they left the old one: With smooth, consistent buying strength.

There is no particular catalyst for the move higher, although seasonality points to first-business-day-of-the-month portfolio inflows and a tendency for the beginning of January to be strong. Can the momentum continue?

The folks at the Almanac Trader note that January has had a volatile reputation since 2000, with 10 of the past 18 years featuring nasty declines starting with the 5.1% pullback that kicked off the dot-com collapse. January 2009 featured an 8.6% loss that was the worst January on record going back to 1930.

If the bulls are going to buck the trend, these seven stocks need to keep pushing higher:

Stocks to Buy: Alphabet (GOOG)

Alphabet Inc (NASDAQ:GOOG, NASDAQ:GOOGL) shares are on the move, reversing a multi-week downtrend off of the high of near $1,080 set back in the middle of December. Shares are up 15% from the lows seen in September.

The company will next report results Feb. 1 after the close. Analysts are looking for earnings of $9.96 per share on revenues of $31.60 billion. When the company last reported on Oct. 26, earnings of $9.57 beat estimates by $1.17 on a 23.7% rise in revenues.

Stocks to Buy: Facebook (FB)

Facebook Inc (NASDAQ:FB) shares are pushing back up towards their late November highs, rising off of the low of $170 set in early December.

Overall, the stock is up more than 20% from the lows seen back in early July thanks to steady user growth, the success of Instagram with younger audiences and the ongoing shift to higher margin video ads.

The company will next report results on Jan. 31 after the close. Analysts are looking for earnings of $1.93 per share on revenues of $12.5 billion. When the company last reported on Nov. 1, earnings of $1.59 beat estimates by 31 cents on a 47.3% rise in revenues.

Stocks to Buy: Disney (DIS)

Walt Disney Co (NYSE:DIS) shares are surging more than 3% higher on Tuesday, encouraged by an upgrade from analysts at Macquarie.

Star Wars: The Last Jedi has officially become the highest grossing movie of 2017 bolstering sentiment after some internet-driven blowback against the plot line and Luke Skywalker’s role. Nerds.

The company will next report results on Feb. 6 after the close. Analysts are looking for earnings of $1.60 per share on revenues of $15.5 billion. When the company last reported on Nov. 9, earnings of $1.07 per share missed estimates by five cents on a 2.8% decline in revenues.

Stocks to Buy: General Electric (GE)

General Electric Company (NYSE:GE) is a stock that Wall Street has seemingly left for dead after suffering more than a 43% decline from its summer 2016 highs.

This on frustration with the company’s direction, lack of confidence in its new management, and an underwhelming corporate restructuring plan that didn’t do enough, apparently, to trim weak performing areas like transportation.

A possible relief rally could be underway now, however, with shares pushing up and off of a three-month consolidation range near $17.50.

The company will next report results on Jan. 24 before the bell. Analysts are looking for earnings of 30 cents per share on revenues of $33.6 billion. When the company last reported on Oct. 20, earnings of 29 cents missed estimates by 20 cents on an 11.5% rise in revenues.

Stocks to Buy: Schlumberger (SLB)

Schlumberger Limited. (NYSE:SLB) shares are pushing further away from its 200-day moving average, breaking above a seven-month trading range to return to levels not seen since May.

The bulls are being encouraged by the steady rise in energy prices with crude oil rising above the $60-a-barrel threshold today.

The company will next report results on Jan. 19. Analysts are looking for earnings of 45 cents per share on revenues of $8.1 billion. When the company last reported on Oct. 20, earnings of 42 cents per share matched estimates on a 12.6% rise in revenues.

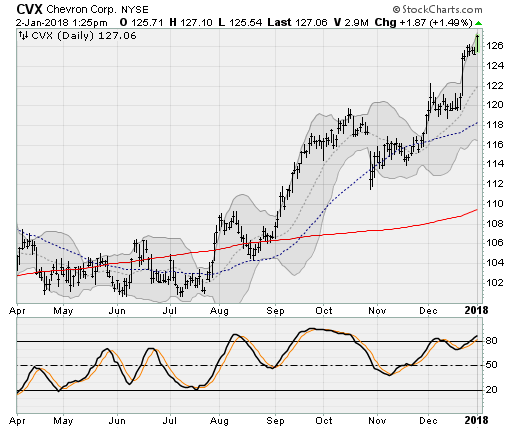

Stocks to Buy: Chevron (CVX)

Chevron Corporation (NYSE:CVX) shares are pushing to new highs, up nearly 30% from their summertime 2017 lows to push well beyond the previous highs hit in the summer of 2014 before the Saudis started their energy price way in the first place.

Analysts are Cowen recently raised their price target on optimism surrounding the company’s free cash flow and Permian basin performance.

The company will next report results on Jan. 26 before the bell. Analysts are looking for earnings of $1.30 per share on revenues of $38.6 billion. When the company last reported on Oct. 27, earnings of $1.03 beat estimates by six cents on a 20.1% rise in revenues.

Stocks to Buy: Netflix (NFLX)

Netflix, Inc. (NASDAQ:NFLX) shares are surging nearly 5% higher on Tuesday, closing in on its previous high near $205 set back in October. Analysts at Loop Capital recently upgraded their price target and named the company one of their best trading ideas of the year.

The company will next report results on Jan. 22 after the close. Analysts are looking for earnings of 42 cents per share on revenues of $3.3 billion. When the company last reported on Oct. 16, earnings of 29 cents per share missed estimates by three cents on a 30.3% rise in revenues.

More on: https://investorplace.com/2018/01/7-stocks-leading-the-new-years-charge/#.Wk4CE9-nGUk

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://finance.yahoo.com/news/7-stocks-leading-charge-200157253.html