40% of bitcoins are controlled by 1000 people , says Aaron Brown, former managing director and head of financial markets research at AQR Capital Management.

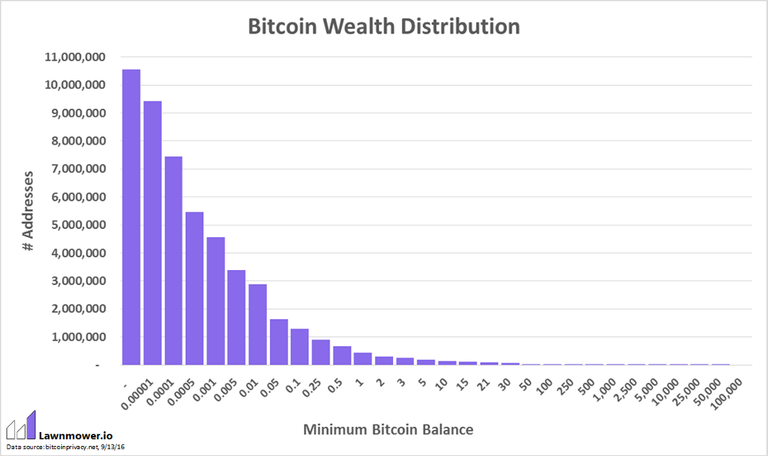

Only 4% of address own 95%of bitcoin.

In this bar graph we can observe the distribution of bitcoin among different address.

Usually there are two categories of investors

- Individual investors

- Whales

Individual investors are like you and me who invest a fraction of our income.

Whales can be rich people or companies who invest hundred and billions of dollars when bitcoin was not well know by majority of the population.

In month of December 2017 bitcoin reached its all time high of 20,000 USD and fell below 7,500 USD by January 2018.

By the end of February 2018 bitcoin was back at 10,000 USD ending the speculation of bubble.

Whales are known to cause such price manipulation.

If whales or a group of whales sell 10% of their holdings ,price of bitcoin will fall by 50%.

In such a scenario individual investors panic and sell.

Eventually the price of bitcoin dips to new lows which gives an opportunity for whales to acquire more bitcoins at cheaper rate with the profit earned from their previous sale.

If you like the post don't forget to upvote ,resteem and follow.

I would love to know your opinion in the comment section.

Thanks for reading.