NewsBuzz.

A committee formed under Niti Aayog is working on a paper to highlight the prospective use of blockchain technology

BENGALURU: Over 80% of blockchain developers in India will be forced to move abroad or work only on foreign projects if the government does not adopt a robust regulatory framework soon, according to a survey of over 100 developers.

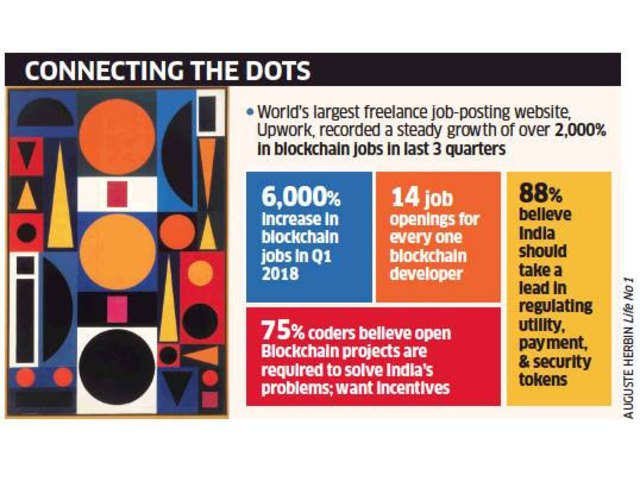

The research, conducted by blockchain community, Incrypt, over a period of six months focuses on how the current regulatory climate is affecting core development activity and blockchain entrepreneurship in India. The survey has found that delay in putting together a framework for blockchain is causing India to lose out on jobs, drag in capital infusion, lack of innovation for local problems, talent flight, and setback in global positioning.

“Blockchain projects are creating new job categories, leading to hiring more fullstack, front-end and back-end engineers globally,” said Nitin Sharma, founder of Incrypt. “At a time when IT services industry is losing jobs, India needs to move fast in putting in place appropriate regulations to manage risks and attract global investment in blockchain.”

The government’s lack of initiative has already forced many blockchain developers and startups shift their domicile to nations like Singapore, Dubai, Estonia and Switzerland that offer tax incentives and e-residency for startups, the report said.

The Reserve Bank of India (RBI) on April 6 notified banks to stop offering services to exchanges and crypto-related businesses in India. This has taken a toll on blockchain entrepreneurs, developers, and exchanges in India. A committee formed under Niti Aayog is working on a paper to highlight the prospective use of blockchain technology.

According to the Incrypt paper, the notion that bitcoin or any crypto asset is not necessary to derive value of blockchain technology adversely affects the innovation ecosystem. For instance, globally, there are thousands of open source and freelance job opportunities to support large public blockchain projects like Ethereum, Stellar, Neo, EOS, etc. There are also hundreds of emerging Initial Coin Offering (ICO) projects that need technical, marketing or advisory talent.

Many of these projects come with tokenbased incentives. Which means, payments for working on these projects are often in cryptocurrencies.

“An Indian developer may be able to receive tokens but if there is no legal way to convert it into Indian rupees, a majority of prospective professionals may be deterred by the possibility that these incentives may be worthless in India or whether the government will consider their work noncompliant in any way,” the report said.

These tokens often come with a vesting schedule for employees. The government’s ‘Blockchain, not bitcoin’ approach is costing the Indian developer who is forced to go underground and deal in cash or other channels that may essentially be illegal activities.

In addition, tokens are also required in the testing and user validation phase of product development.

“The absence of users with such access or capabilities in India is already severely hurting the viability and ease of dozens of such projects in India,” Sharma said. “Existing regulators must realise that this will set India back by several years as far as core protocol or distributed app development is concerned.”

This has also caused a set back on the skilling front, as highlighted by hiring-solutions provider Belong Technologies. Only 5,000 (0.25%) of the 2 million software developers in India currently have the right blockchain skills.

On the capital front, the report stated that India is trailing behind in terms of VC funding for blockchain startups, with a minuscule $5.3 million raised in the last two years, as opposed to over $2 billion invested in blockchain equity deals globally. The Bengaluru-based blockchain community also suggests that regulating fundraising through ICOs will significantly improve access to capital for early stage ventures.

The report notes that public blockchains are needed to unlock the internet of value. Incrypt said potential innovations of adopting public blockchains spans across micro grids, financial inclusion, asset quality and liquidity, heath records, and data marketplaces.

Sort: Trending