Venezuela’s oil-backed cryptocurrency, the petro, is a step closer to reality following the release of the official whitepaper. The eagerly anticipated document outlines the token model and crowdsale mechanism that will be used to launch the ethereum-based project in February. Having been officially signed off by president Nicolás Maduro, the whitepaper is finally available for scrutiny and it doesn’t disappoint.![kripto.png]

( )

)

The $5 Billion ICO

Bigger than Filecoin. Bigger than Tezos. Bigger than Telegram, EOS, and all the rest. In fact, the value of the petro token sale, if it hits its cap, will almost equal the total revenue generated in 2017 from initial coin offerings. With the price of one PTR provisionally fixed at $60, to correspond with a barrel of oil, Venezuela’s tokens are more expensive than even the $50 Bitconnect X is seeking in its current ICO. In fairness to the South American nation, its cryptocurrency is not a Ponzi scheme. Its creators promise:

In many respects, the petro whitepaper is unremarkable. 22 pages, neatly formatted and capably written, save for the odd typo, mark it out as a cut above the average cryptocurrency whitepaper. There’s a lot of talk of blockchain in there, but mercifully no mention of “disruptive technology” or a “new paradigm”. If it were the work of just another startup launching just another cryptocurrency, it would scarcely attract a second glance.

But as the first government-issued cryptocurrency, albeit from a country with pariah status in American eyes, Venezuela’s effort was bound to provoke scrutiny and fascination. While there are no major curveballs in the document, there’s something inescapably strange about reading a national government’s whitepaper which references Coinmarketcap and where talk of pre-sales and token emissions is bandied about. There’s no roadmap, but every other whitepaper staple is present and accounted for.

Highlights from the Petro Whitepaper

The petro whitepaper is worth reading in full, if only to take in the magnitude and bizarreness of it all. Here are a few highlights:

– There is a section which charts the % gains and daily volatility of bitcoin, ripple, and ethereum in 2017.

– 100 million PTR will be created and, like bitcoin, each petro will be divisible into 100 million parts. (Given that the token is designed to hold relative stability against the price of a barrel of oil, eight decimal places seems like overkill.)

– Just as bitcoin’s smallest unit is a satoshi, the petro’s is called a mene (0.00000001). A footnote explains that “mene” is the word for petroleum in wayúu, the second most spoken language in Venezuela.

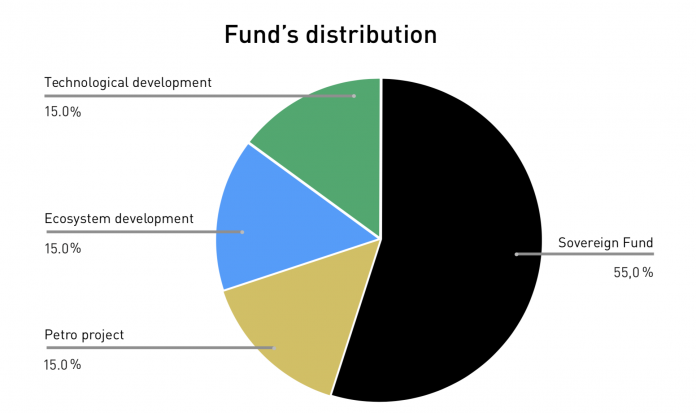

– 38.4% of the tokens will be made available in a pre-sale starting February 20 and 44% will be made available in a public sale starting one month later. The remaining 17.6% will be retained by the Venezuelan Superintendency of Currency and Related Activities.

– Various levels of discount will be available in the pre- and public sales.

– No new tokens will be issued after the public sale, though the government may introduce a Proof of Stake model.

– “The Bolivarian Republic of Venezuela guarantees that it will accept Petro’s [sic] as a form of payment of national taxes, fees, contributions and public services, taking as a reference the price of the barrel of the Venezuelan basket of the previous day with a percentage discount.”

– As an ERC20 token, it is likely that the petro will be tradable on DEXes such as Etherdelta and may also be listed by major non-U.S. exchanges.

– Should the token sale reach its hard cap, $4.944 billion will be raised. If contributions are all in ethereum, that would account for almost 5% of ETH’s total circulating supply.

– If all of the ether collected were to go to a single contract address, it would hold more than twice as much ETH as the next largest wallet, owned by Poloniex. It would also give Venezuela the power to crash the ethereum market by dumping millions of ETH.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://news.bitcoin.com/venezuela-releases-petro-whitepaper-ahead-5-billion-ico/