Bitcoin continued it's recovery last week while it gained 5.23%. Since the start of this month, it surged more than 30% and currently sits at $8909. Many analists and "experts" are getting bullish again. They even share their bullish price targets back in public! But are these bold claims justified?

| Who | BTC Price | Date |

|---|---|---|

| Pantera Capital | $20000 | By the end op 2018 |

| Tom Lee | $25000 | By the end of 2018 |

| Anthony Pompliano | $50000 | By the end of 2018 |

| Alistair Milne | $35000-$60000 | 2020 |

| John Pfeffer | $75000 | By the end of 2018 |

| Kay Van-Petersen | $100000 | By the end of 2018 |

| Tim Draper | $250000 | 2022 |

| Brian Kelly | $250000 | 2022 |

| John Mcafee | $1000000 | 31 Dec 2020 |

I have stated previously that the majority must be wrong because they are the fuel that moves markets. And I think that this is the case again. The majority is, at the moment (!), wrong again. Despite the current bullish momentum, I'm very sceptical that we have seen the low back in February. But I have to admit that we are near a crucial turning point. In my opinion, the odds between bulls and bears are at this point 50/50.

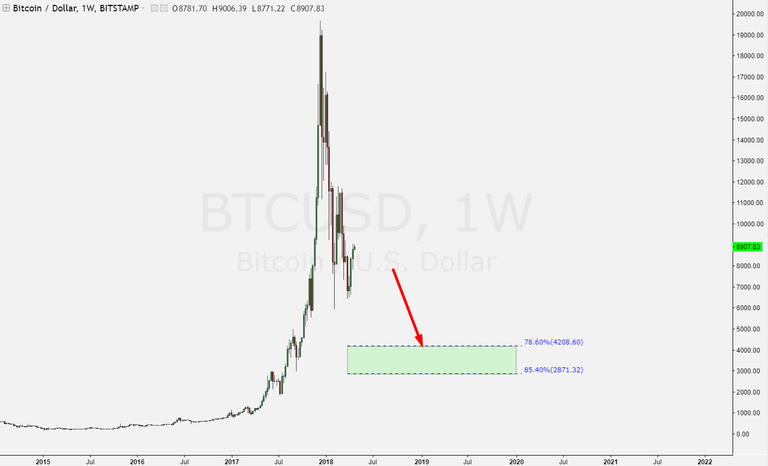

Long term analysis.

The road towards 20k was, according to me, a big first wave so this current decline is obviously the second wave. Typically for a second wave is that it usually declines between 78.6% or 85.4% from wave one. We haven't completed this yet so I expect that we will do this in the near future.

Volume

We bounced without a clear burst in volume. That isn't bullish at all and another reason why I'm sceptical about this move.

Check this article:

Crypto trading tumbles as investment scramble unwinds

Average daily traded volumes across cryptocurrency exchanges fell to $9.1 billion in March and to $7.4 billion in the first half of April, compared to almost $17 billion in December, according to data compiled by crypto analysis website CryptoCompare.

I'm actually not surprised by those statistics because I can't see a jump in the Twitter follower count. Average Joe isn't interested in bitcoin. That's another warning sign for this current rally.

Short term analysis

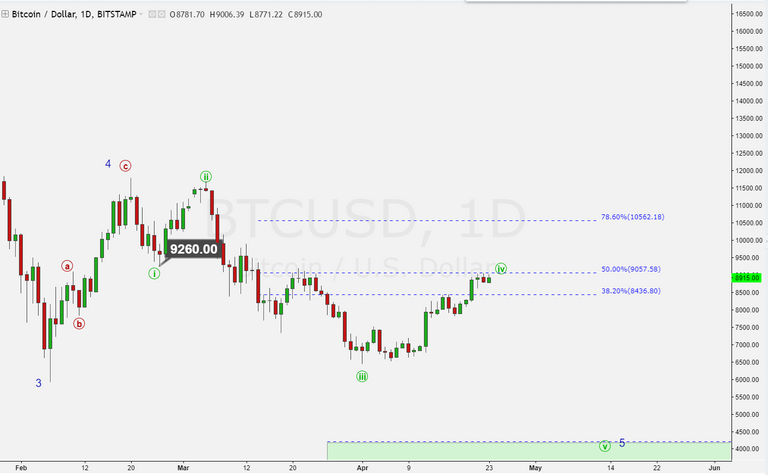

We are in the last wave (wave 5) from wave C.

Here's a better view with the sub counts.

The picture above is very important. You can see that I think that we are currently in a fourth wave. Such wave can only extend 50% from wave 3. $9057.58 is thus my max target. A close above it will result in a bullish scenario. Yep, that's that 50/50 chance. But there is a catch...

I can see divergence on the hourly timeframes and that isn't a good sign. A little new high above 9036 with a lower high on the RSI would be very bearish.

Conclusion

I think it's time to become bearish again.

agree with you bro btc ready to comes down