![[MICA研討會]_20180809.jpg](https://images.hive.blog/768x0/https://cdn.steemitimages.com/DQmUXygkdJZdWY49Eyc6sebuKzZ5QS4dncCxn5yByJGmmQ2/[MICA%E7%A0%94%E8%A8%8E%E6%9C%83]_20180809.jpg)

Bitcoin dominance grows. Altcoins are dying.

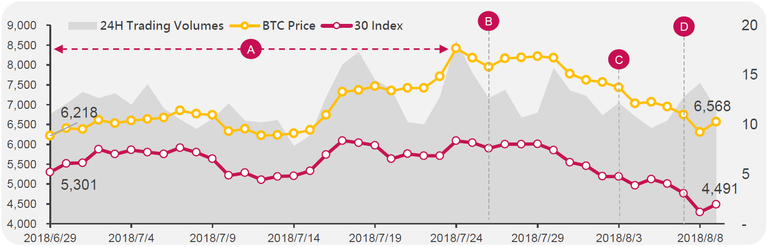

SEC’s possible approval of Bitcoin ETFs gained wide popularity in June and stimulated the BTC price to reach $8,500. However, the rejection on some of the bitcoin ETFs from SEC was announced in July, and SEC raises several concerns. Investors found most ETF applicants can’t erase SEC’s worries on price manipulation. Consequently, the market was hugely disappointed and turned to plummet. The BTC price dropped to $6,500 with a 15% decrease. Altcoins were even worse, decreasing by more than 20%. These events cause the BTC dominance to grow. In our experience, Investors tend to re-examine the intrinsic value of altcoins. The fact is most altcoins don’t have real business application.

Based on the trading volumes collected by Coinmarketcaps, the data show the resistance was stable when the price dropped. But the sell always broke the resistance. The dump of OTC markets caused this sell-off. Many big investors didn’t believe SEC’s concerns could be solved in a short time and then decided to move their money out of the crypto market. Though NYSE’s parent company, ICE, launched its bitcoin trust service and digital platform for some provisional cryptocurrency application such as payments and transaction, this doesn’t provide any help for bitcoin ETF’s approval. The critical role of bitcoin ETFs is to attract new capital from traditional stock markets to the cryptocurrency markets.

June – July bitcoin ETFs’ popularity

SEC announced bitcoin and Ethereum are not “security” but more like the digital commodity. This statement led the market’s expectation for the approval of bitcoin ETFs by SEC. Many companies were applying for ETFs but failed due to the regulatory uncertainties. Once the authority regards bitcoin and Ethereum are digital assets instead of security, this was supposed to increase the approval rate. If so, bitcoin is the best target because of its limited supply and reputation.

B, D: 7/26, 8/09 The delay of SEC’s decision on bitcoin ETFs

SEC rejected the Bitcoin ETF proposed by Winklevoss Capital. In the statement, SEC disclosed this rejection doesn’t represent SEC’s negative attitude towards the value of cryptocurrency. It’s merely because the application doesn’t follow the compliance based on security laws. SEC is still open to cryptocurrency, but there won’t be any approval before the cryptocurrency market proved itself to be well-developed and safe for retail investors.

C: 8/3 ICE launched Battk digital asset platform

On August 3, ICE, the trading colossus that owns the New York Stock Exchange and other global marketplaces—announced that it is forming a new company called Bakkt. The new venture, which is expected to launch in November, will offer a federally regulated market for Bitcoin. With the creation of Bakkt, ICE aims to transform Bitcoin into a trusted global currency with broad usage. The founding imperative for Bakkt will be to make Bitcoin a sound and secure offering for critical constituents that now mostly shun it—the world’s big financial institutions. The goal is to clear the way for significant money managers to offer Bitcoin mutual funds, pension funds, and ETFs, as highly regulated, mainstream investments.

The market has been calmed down. Investors should re-examine the regulation and real business application.

The market craze for cryptocurrency has officially disappeared, especially for ICO markets. Unless the teams are reliable and good at marketing, the ICO fundraising capacities are not as robust as before. A simple whitepaper is not enough for millions of dollars’ fundraising. ICO teams need to propose prototypes and real business application to attract investors. Many blockchain venture capitals also begin to back up their ICO teams for market hypes. On the other hands, some big enterprises spin off their subsidiaries or internal project to launch ICO. It has been impossible for a team to raise millions of dollars with only one whitepaper. The ICO market is intensifying competitive. Besides, most investors’ funds are locked-up, and money is moving to the BTC for the coming of bitcoin ETFs.

The regulatory impact will be huge for cryptocurrency market. Almost every investor IS watching if SEC would approve the bitcoin ETFs or not. We expect the market fluctuation will decrease in August. September will be the critical month for the cryptocurrencies. We recommend investors should put more efforts into following the SEC’s announcements.