Today is the 8th weekly update of the Diversification Protocol. This protocol is designed to allocate a weekly income or funds to be invested mostly to BTC when it is undervalued and mostly to gold and optional stable coins when BTC is overvalued. It also tells you to spend gold for living when BTC is undervalued and BTC for living when it is overvalued. This will create higher returns on your investment through a full cycle and reduce stress in a bear market. HERE you can read the protocol in dept.

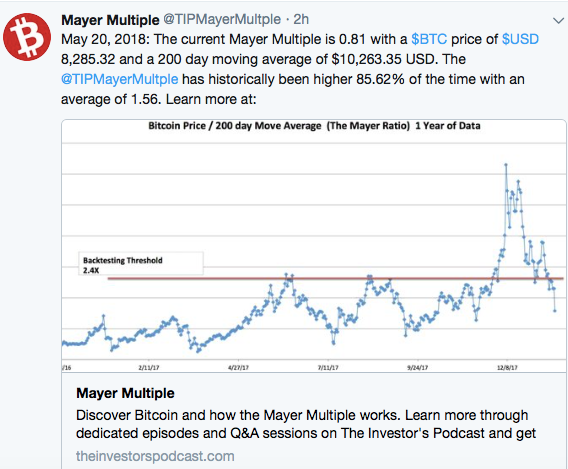

The valuation is done by using the Mayer Multiple and compare it to historical values. The Mayer Multiple is the current BTC price divided by the 200 day moving average. We use data from mayermultiple.com. When you want to be updated on the multiple several times a day you can follow THIS twitter account.

Because I just started the protocol, I didn't accumulate gold and stable coins yet. In this update I will exactly follow the protocol, but since I only start saving gold and stable coins from a multiple of 1.6, I will only be able to execute it 100% according the rules after that point is broken. Funds invested in BTC today will eventually at least partly be converted to gold, since the BTC accumulates in the same wallet and a percentage of the total BTC in this wallet will be allocated to gold at higher valuations.

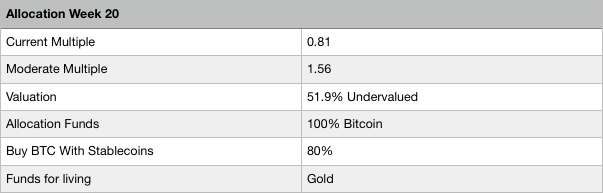

The current multiple

Weekly allocations of funds

The protocol will be slightly boring till we get to a multiple of 1.6, till then we allocate 100% in BTC because it is undervalued. With the current 200 day moving average we need a BTC price of over 16,421 USD to start allocating to gold and Stable coins. This can take days or months, but it is good to be prepared already.

Important news of the week

Consensus failed to pump the price

This week the biggest cryptocurrency conference Consensus took place. In the last 4 years the Bitcoin price has always gone up during and after consensus because of positive announcements and interest of new investors, so the expectations were high this year. Sad enough the price didn’t go up but went slightly down.

http://bitcoinist.com/tom-lee-explains-why-consensus-failed-to-spark-the-bitcoin-rally/

Bitcoin Cash hard fork took place

The Bcash hardfork took place this week, so the block size is now 32 MB and old Bitcoin opcodes are implemented to enable simple smart contracts. Around 20% of the nodes didn’t upgrade and are rejected by the new network, today still 16% of the nodes are offline.

Bitcoin without the need for internet

Samourai is partnering with GoTenna to create an Android app to enable Bitcoin transactions on the Mesh network. This will make it possible to transact with Bitcoin without internet connection. Samourai is heavily focused on privacy and security and with this step they add greatly to the resilience of Bitcoin. It makes it resistant to internet failure.

Rawtz, another Android Lightning wallet available

Rawtz is the 2nd Lightning wallet for Android and available since this week. Rawtz can send and receive instant and extremely cheap payments over the Lightning Network. With more wallets being rolled out, adoption will increase and usability will improve.

https://hadeplatform.com/articles/2018/05/19/4-facts-about-rawtz-bitcoin-btc-lightning-wallet

The Bitcoin price is slightly down

The Bitcoin price went a little bit down from 8597 to 8341 dollar this week. Sadly the expected Consensus boost didn’t happen while negative technicals dominated and decided the direction of the market. The positive sentiment has clearly decreased and the market is waiting for new signals.

Fundamentals and valuation

In the history of Bitcoin the multiple was lower than today only 14,38% of the time. Since the multiple today is 0.81 while the moderate is 1.56, there is 51,9% discount on BTC according to this valuation method!

Long term the prospects are still extremely bullish. Lightning Network is still growing and improving and can boost adoption for day to day payments. Wallstreet, governments and central banks are on the sidelines to come in and could inject huge amounts of money. Short term sentiment is neutral, but for the long term almost everyone is bullish.

Disclaimer

This is no financial advice, just my view on the market.

Never stress in a bear market anymore: Follow my diversification protocol

Store your Bitcoins securely

Ledger hardware wallet

Trezor hardware wallet

Trade Cryptocurrencies

Binance Exchange

Buy Bitcoins anonymous with cash

Localbitcoins

Protect your privacy with VPN and pay with crypto

Torguard

Buy gold securely with Bitcoin and store in Singapore

Bullionstar

Like this post? RESTEEM AND UPVOTE!

Something to add? LEAVE A COMMENT!

you always need to have both. gold is still great not volatile store of value.

Interesting point about using a model to go between bit coin and gold. I look forward to following the syndicator as that had been one of my exit strategies. I sold bitcoin way too early and then held on way too late.

Long term the prospects are still extremely bullish.

I also don't believe in long term investment, investment should be done at proper time and also withdrawal should be done at proper time. For this we need to do certain research.

Hope that it goes like it as predicted.

bitcoin is very powerfull....its have the power to change our life

Last 3 years the price went up after consensus this time around we also have bitcoin cash which unfortunately does not want to peacefully coexistence and is damaging investor confidence in btc by spreading false information and damaging investor confidence in their own fork by performing reckless and unnecessary updates.

cryto's are future...

bitcoin is the best.

bitcoin is the most reliable and the best

Your article is so good.

Give you a thumbs up!

Bitcoin has the right balance of pros and cons. That's why it's so popular.

Interesting strategy. But don't you think one should keep an eye on the global financial markets as another indicator for buying gold? I mean, we're due for another correction. And when it happens, we don't know what the effect on cryptocurrencies would be (it never happened before), but we do know the effect on gold!

What do you think?

We actually covered this a bit here: https://steemit.com/bitcoin/@ledger256/do-you-know-when-the-next-market-correction-is-of-course-you-don-t

The article is very interesting! If you are interested in ico subscribe to me, I will also be mutually subscribed.

Good post