Today is the 11th weekly update of the Diversification Protocol. This protocol is designed to allocate a weekly income or funds to be invested mostly to BTC when it is undervalued and mostly to gold and optional stable coins when BTC is overvalued. It also tells you to spend gold for living when BTC is undervalued and BTC for living when it is overvalued. This will create higher returns on your investment through a full cycle and reduce stress in a bear market. HERE you can read the protocol in dept.

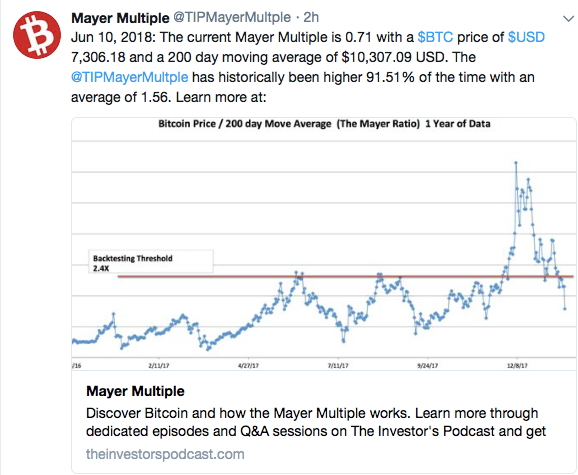

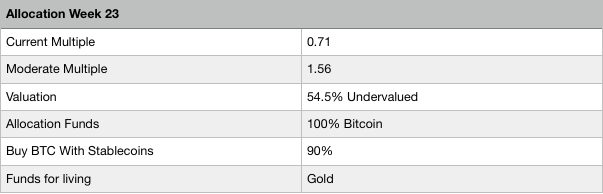

The valuation is done by using the Mayer Multiple and compare it to historical values. The Mayer Multiple is the current BTC price divided by the 200 day moving average. We use data from mayermultiple.com. When you want to be updated on the multiple several times a day you can follow THIS twitter account.

Because I just started the protocol, I didn't accumulate gold and stable coins yet. In this update I will exactly follow the protocol, but since I only start saving gold and stable coins from a multiple of 1.6, I will only be able to execute it 100% according the rules after that point is broken. Funds invested in BTC today will eventually at least partly be converted to gold, since the BTC accumulates in the same wallet and a percentage of the total BTC in this wallet will be allocated to gold at higher valuations.

The current multiple

Weekly allocations of funds

The protocol will be slightly boring till we get to a multiple of 1.6, till then we allocate 100% in BTC because it is undervalued. With the current 200 day moving average we need a BTC price of over 16,491 USD to start allocating to gold and Stable coins. This can take days or months, but it is good to be prepared already.

Important news of the week

First sign that the blockchain hype is failing

R3, a consortium of banks backed by big players like Goldman Sachs and JP Morgan is running out of money according to two ex employees. The consortium was started in 2014 and 107 million was raised to create private blockchains for the financial industry. These rumours make a lot of sense, since private blockchains are actually inefficient databases. Without a decentralised currency the incentive structure is missing and creating the useful features of Bitcoin is impossible. It is looks like the ‘blockchain’ hype to deny the importance of Bitcoin finally start to fall apart.

Funny fact, if these bankers were smart and just invested in Bitcoin it would be worth more than 700 million today LOL.

http://fortune.com/2018/06/07/blockchain-firm-r3-is-running-out-of-money-sources-say/

A perfect explanation why private blockchains don’t work

GMO brings new miners to the market

The Bitcoin friendly Japanese internet giant GMO has started to take pre-orders for it’s B2 miners. The B2 miners are equipped with 7 Nanometer chips and thus more efficient than the S9 miners of Bitmain. This is great news, because mining hardware centralisation and mining centralisation as well is a big problem, but likely to decrease from now.

https://www.coindesk.com/1999-gmo-reveals-details-of-its-new-7nm-bitcoin-miner/

First atomic swap between BTC Lightning and LTC Lightning

This week the first atomic swap between Bitcoin and Litecoin is done over the Lightning Network. This means that BTC can be send to someone who wants to receive LTC instantly and basically for free. This is great news, because it will greatly improve the scalability of crypto as a whole since LN channels for BTC can be opened on LTC when there is network congestion.

These swaps connect the two LN channels and will increase the total capacity and thus make crypto more ready for mass adoption. Furthermore, this is a great way to build (decentralised) exchanges without causing network congestion. Bitcoin Cash will be the big loser of this, since they rejected Segwit they cannot join the group of to be connected networks and will miss out on a lot of new innovation.

Mike Novograts extremely bullish

Mike Novograts thinks that the institutional investors will start to invest in crypto soon and will bring the total market cap to 20 trillion in the next bubble. He compares the rise of crypto with the internet bubble in a very reasonable way:

Hashpower growing enormously

The price of Bitcoin has been tanking over the previous months, but the hash rate is still growing. This might signal positive future expectations, but it can also be the case that miners come online that were ordered before the bear market. Anyhow, it means the network becomes more secure and thus more valuable.

https://blockchain.info/charts/hash-rate

And another 51% attack

After multiple minority PoW coins were 51% attacked over the previous months, it was the turn for Litecoin Cash this week. When this trend goes on (probably, because it is very profitable) exchanges might start to de-list minority coins. This will cause the price to plummet and make an attack even easier. Because of this dead spiral it is advisable to avoid all minority PoW coins like Bitcoin Cash, Bitcoin Gold and Verge.

https://www.ccn.com/litecoin-cash-latest-small-cap-altcoin-to-suffer-51-percent-attack/

Betterhash proposal

Matt Corallo, a Bitcoin Core developer came out with a new proposal to make mining more decentralised. The idea is to enable small miners to find blocks with a lower difficulty, so called templates, so that others in the pool can finalise this block. This creates the situation that individual miners can organise the transactions in a block and not only the pool.

Long story short: small miners can now decide about the transactions to be included in the block themselves while mining pools will lose their political power and will only be able to do what they should do: ensure security. Betterhash will greatly improve miner decentralisation and make it way harder for a pool to attack or censor Bitcoin.

The Bitcoin price is 500 dollar down this week

The Bitcoin price went down 6.4% this week from 7722 to 7230 dollar. While the price was tanking very good news came out that makes the Bitcoin network stronger and more useful, it looks like the weakness is in the uncertainty for alts and the negative effect of bearish technical analysts.

Fundamentals and valuation

In the history of Bitcoin the multiple was lower than today only 8.49% of the time. Since the multiple today is 0.71 while the moderate is 1.56, there is 54,5% discount on BTC according to this valuation method!

Long term the prospects are still extremely bullish. Lightning Network and Segwit adoption are still growing and improving and can boost adoption for day to day payments. Wall Street, governments and central banks are on the sidelines to come in and could inject huge amounts of money. Short term sentiment is neutral to bearish, but for the long term almost everything is bullish.

Disclaimer

This is no financial advice, just my view on the market.

Never stress in a bear market anymore: Follow my diversification protocol

Store your Bitcoins securely

Ledger hardware wallet

Trezor hardware wallet

Trade Cryptocurrencies

Binance Exchange

Buy Bitcoins anonymous with cash

Localbitcoins

Protect your privacy with VPN and pay with crypto

Torguard

Buy gold securely with Bitcoin and store in Singapore

Bullionstar

Like this post? RESTEEM AND UPVOTE!

Something to add? LEAVE A COMMENT!

Keep putting out this report. I love it. I'm not selling my gold for bitcoin but it makes me more aware to hold bitcoin and accumulate more.

The market must be tracked to achieve success

At present, market prices are certainly low

Featured events

Thank you for the great information

bitcoin is one of the biggest opportunities since the invention of the internet itself.... great times to be around....

This post has received a 24.47 % upvote from @boomerang.

alot of information here, well done!

Great post! very in depth information.

I love this weekly uptades. I hope this new week will be a fair one. Thanks @michiel.

Bad Steemian! Bad!@alelerdici you're on the @abusereports naughty list!