Today is the 13th weekly update of the Diversification Protocol. This protocol is designed to allocate a weekly income or funds to be invested mostly to BTC when it is undervalued and mostly to gold and optional stable coins when BTC is overvalued. It also tells you to spend gold for living when BTC is undervalued and BTC for living when it is overvalued. This will create higher returns on your investment through a full cycle and reduce stress in a bear market. HERE you can read the protocol in dept.

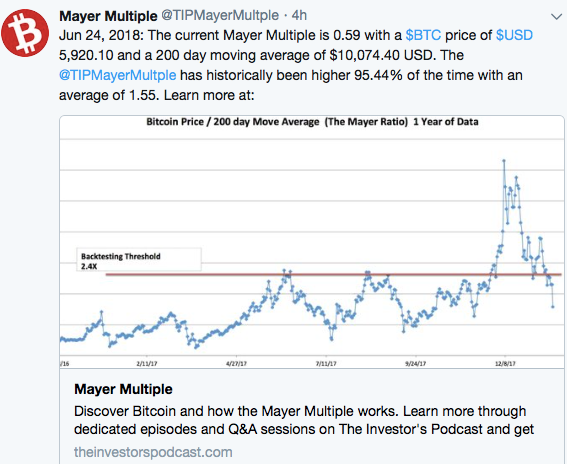

The valuation is done by using the Mayer Multiple and compare it to historical values. The Mayer Multiple is the current BTC price divided by the 200 day moving average. We use data from mayermultiple.com. When you want to be updated on the multiple several times a day you can follow THIS twitter account.

Because I just started the protocol, I didn't accumulate gold and stable coins yet. In this update I will exactly follow the protocol, but since I only start saving gold and stable coins from a multiple of 1.6, I will only be able to execute it 100% according the rules after that point is broken. Funds invested in BTC today will eventually at least partly be converted to gold, since the BTC accumulates in the same wallet and a percentage of the total BTC in this wallet will be allocated to gold at higher valuations.

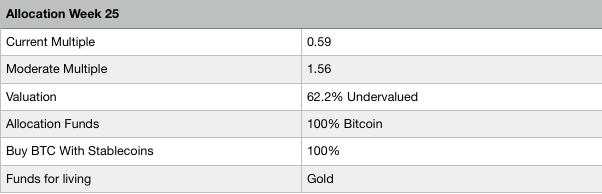

The current multiple

Weekly allocations of funds

The protocol will be slightly boring till we get to a multiple of 1.6, till then we allocate 100% in BTC because it is undervalued. With the current 200 day moving average we need a BTC price of over 16,119 USD to start allocating to gold and Stable coins. This can take days or months, but it is good to be prepared already.

Important news of the week

Mt. Gox trustee will not sell anymore!

Instead of cashing out to pay the victims of the Mt. Gox debacle, bitcoins will be returned to the original owners. This is huge news for the victims and the market overall as well, because the victims will receive much more value back and there will be no more dumping of bitcoins on the market by the trustee.

Seen the fact that many blame the recent bear market on the trustee dumping bitcoins on exchanges through market orders, this news should be interpreted by the market as extremely bullish because many investors have probably been waiting for certainty about future dumps. However, the market totally ignored it and only reacted on the negative news as described below.

https://www.coindesk.com/mt-gox-crypto-bitcoin-exchange-creditors-win/

And another hack

The South Korean exchange Bithumb was hacked and for around 31 million of cryptocurrencies was stolen. Another lesson for all cryptocurrency holders that it is extremely important to store your funds on a Trezor or Ledger so that you are not relying on any 3rd party! It also indicates that holding alt coins that are not easy to store by yourself come with another layer of risk. JUST HODL BTC AND OWN YOUR OWN PRIVATE KEYS!

https://www.coindesk.com/bithumb-exchanges-31-million-hack-know-dont-know/

Japanese exchanges close for new accounts

Japanese bitcoin exchanges halted signups of new members because they were ordered to comply to new anti money laundering laws first. The markets reacted strongly on this news with a big sell off. Japan has been very open to cryptocurrencies and investors are afraid that this approach will change.

https://www.investopedia.com/news/bitcoin-price-tumbles-9-after-japanese-antilaundering-order/

The Bitcoin price is down again this week

The Bitcoin price went down 10.3% this week from 6555 to 5882 dollar. We are broken out downwards of the long term triangle and the short term outlook remains bearish. However, a new bottom could finalise the downtrend and be the beginning of a sideway or bullish pattern that gives a more positive outlook.

Fundamentals and valuation

In the history of Bitcoin the multiple was lower than today only 4.56% of the time. Since the multiple today is 0.59 while the moderate is 1.56, there is 62.2 % discount on BTC according to this valuation method!

Long term the prospects are still extremely bullish. Lightning Network and Segwit adoption are growing and improving faster than expected and can boost adoption for day to day payments, micro transactions and even Dapps. Wall Street, governments and central banks are on the sidelines to come in and could inject huge amounts of money. Furthermore, the Mt. Gox selling fear is off the table. Short term sentiment is bearish, but for the long term almost everything is very bullish.

Disclaimer

This is no financial advice, just my view on the market.

Never stress in a bear market anymore: Follow my diversification protocol

Store your Bitcoins securely

Ledger hardware wallet

Trezor hardware wallet

Trade Cryptocurrencies

Binance Exchange

Buy Bitcoins anonymous with cash

Localbitcoins

Protect your privacy with VPN and pay with crypto

Torguard

Buy gold securely with Bitcoin and store in Singapore

Bullionstar

Like this post? RESTEEM AND UPVOTE!

Something to add? LEAVE A COMMENT!

Is this thing possible that in the last year month, the price was deliberately raised... so that Mt.Gox.... could get sell a large amount BTC ? Because it seems to me that way.

when will cryptocurrency bull market start of 2k18 @michiel

The news regarding MT Gox is big relief to the its investors who lost funds during the hack. The big thing is they will get the invested bitcoins in turn will get huge profit. Many of the investors would have sold bitcoin but this HODL is giving them huge returns. Really patience pays.

This is the Time for the TRUE HODL .. The history repeats, The bitcoin has always touched the Bottom And has rised to an unexpected Peaks. We are not far away from reaching the TOPS.

yaaa u r right

Gox os relife but price isdropping down@michiel

due to hacking of different exchanges market is down

Sir I have Upvoted and Follow You Please Upvote , Follow and Comment on my Post Sir.

https://steemit.com/viralvideo/@ubpsmartgurukul/how-to-make-your-all-youtube-videos-viral-in-2018-just-1-days-with-proof-1st-real-video-hindi

接着是反弹震荡

Then it's a rebound.