Today is the 14th weekly update of the Diversification Protocol. This protocol is designed to allocate a weekly income or funds to be invested mostly to BTC when it is undervalued and mostly to gold and optional stable coins when BTC is overvalued. It also tells you to spend gold for living when BTC is undervalued and BTC for living when it is overvalued. This will create higher returns on your investment through a full cycle and reduce stress in a bear market. HERE you can read the protocol in dept.

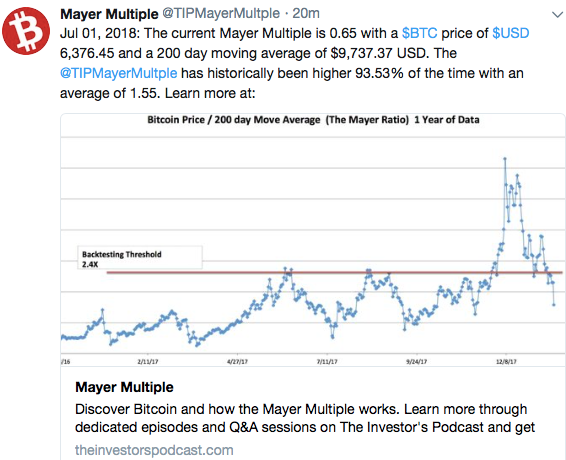

The valuation is done by using the Mayer Multiple and compare it to historical values. The Mayer Multiple is the current BTC price divided by the 200 day moving average. We use data from mayermultiple.com. When you want to be updated on the multiple several times a day you can follow THIS twitter account.

Because I just started the protocol, I didn't accumulate gold and stable coins yet. In this update I will exactly follow the protocol, but since I only start saving gold and stable coins from a multiple of 1.6, I will only be able to execute it 100% according the rules after that point is broken. Funds invested in BTC today will eventually at least partly be converted to gold, since the BTC accumulates in the same wallet and a percentage of the total BTC in this wallet will be allocated to gold at higher valuations.

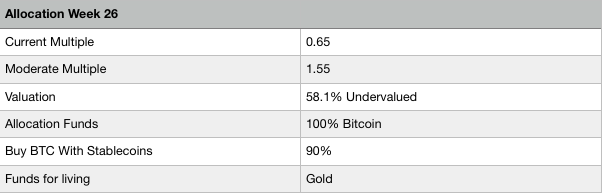

The current multiple

Weekly allocations of funds

The protocol will be slightly boring till we get to a multiple of 1.6, till then we allocate 100% in BTC because it is undervalued. With the current 200 day moving average we need a BTC price of over 15,580 USD to start allocating to gold and Stable coins. This can take days or months, but it is good to be prepared already.

Important news of the week

Facebook rumours

A while ago, Facebook banned all cryptocurrency adds on the popular platform. This week Facebook changed their policy and now allows cryptocurrency adds while the ban for ICO adds is still in place. There are rumours that Facebook is planning to acquire Coinbase and launch their own cryptocurrency or start using an existing one. Either way this could boost Bitcoin because a lot of the exchange will probably happen in BTC because of it’s crypto reserve currency status.

In my opinion Bitcoin Lighting is the only scalable and secure way at the moment to bring crypto to 2 billion people overnight, Ethereum will not be able to handle the volume and launching an own coin on that scale while maintaining security will be extremely hard. However, an own coin would be a hard to resist and easy money grab and the CEO of Coinbase his preference has always been Ethereum. Will be interesting to watch!

Lightning Network adoption accelerates

Lightning Network is taking off! Recently the success of Satoshiplace was celebrated and this week two merchant payment providers announced to implement Lightning and Lighting Spin, a Lightning powered roulette app took off. Lightning network is growing and improving every day. Scaling is happening!

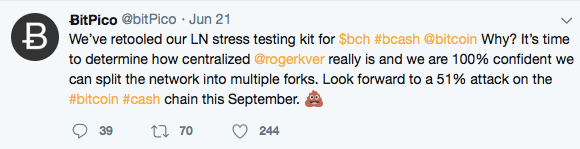

The Bitcoin Cash stress test by BitPico

An anonymous group called BitPico that recently tested the Lightning Network by attacking it shifted their focus to Bitcoin Cash. They claim that they are attacking the network already and will increase the load over the coming 3 months. One of the angles of attack will be to set up more than 5000 nodes and try to split the network into different forks. Also spamming the network will be a part of the attack, and since the BCH community just organised their own stress test, the first of September the network will be spammed by the own community.

The group is certain to be able to crash the BCH network and seen the huge vulnerabilities they could be right. It will be interesting to watch, it will teach us a lot about security and the importance of full nodes that is rejected by the BCH community.

https://bitcoinist.com/roger-ver-bitpico-hard-fork-bitcoin-cash/

Plan for a Bitcoin airdrop in Venezuela

A former bank employer is planning to raise funds to airdrop 300 million in Bitcoin to the people in Venezuela. It is to be seen if he can manage to carry out his plan, but I think it is genius. The people in Venezuela still have all the machines, tools and infrastructure, just the management system called money is missing. It would really interesting to see what happens to the county if sound money is brought back, probably it will flourish within a few year. This way the power of Bitcoin will be shown to the world and the evilness of socialism will be exposed.

https://www.coindesk.com/plan-send-millions-bitcoin-venezuela-taking-shape/

The Bitcoin price is slightly up this week

The Bitcoin price went up 9% this week from 5863 to 6390 dollar. Most of the gains are realised yesterday when a nice short squeeze happened, otherwise we would have been lower than a week ago. It seems to be mostly a game of whales in this low volume environment, so I expect that TA doesn’t work these days and many traders will lose money when they get liquidated when a whale sends the market in the opposite direction by placing a huge market order. When this game goes on sideway moves are most likely. However, everything is possible in Bitcoin.

Fundamentals and valuation

In the history of Bitcoin the multiple was lower than today only 6.47% of the time. Since the multiple today is 0.65 while the moderate is 1.55, there is 58.1 % discount on BTC according to this valuation method!

Long term the prospects are still extremely bullish. Lightning Network and Segwit adoption are growing and improving faster than expected and can boost adoption for day to day payments, micro transactions and even Dapps. Wall Street, governments and central banks are on the sidelines to come in and could inject huge amounts of money. Furthermore, the Mt. Gox selling fear is off the table. Short term sentiment is bearish, but for the long term almost everything is very bullish.

Disclaimer

This is no financial advice, just my view on the market.

Never stress in a bear market anymore: Follow my diversification protocol

Store your Bitcoins securely

Ledger hardware wallet

Trezor hardware wallet

Trade Cryptocurrencies

Binance Exchange

Buy Bitcoins anonymous with cash

Localbitcoins

Protect your privacy with VPN and pay with crypto

Torguard

Buy gold securely with Bitcoin and store in Singapore

Bullionstar

Like this post? RESTEEM AND UPVOTE!

Something to add? LEAVE A COMMENT!

Couldn't agree with this post more. Good job on sharing relevant information and data without making it a personal viewpoint.

You got a 11.55% upvote from @upme thanks to @michiel! Send at least 3 SBD or 3 STEEM to get upvote for next round. Delegate STEEM POWER and start earning 100% daily payouts ( no commission ).

cryptocurrencies are the future

i don't about this. thanks for share this. i also try this one and share my friend.

dont worry mates, hurdles always comes in the way of bitcoin remember those days when 1$ = 1309 bitcoins and today 1btc = 6000$ such a great ruler !!! once a time bitcoins are counted in dollar and now dollars are counted in bitcoin. just leave this bull run or bear run. stand together and accept and using cryptocurrency that is the real solution.

This is the longest period of time for the bearish market for all cryptocurrency. Now, it is slightly changing.

hoping for a market reversal sooner rather than later

As always, I really like your well thought posts. According to you measure of choice - the Mayer Multiple - we are at historically low prices. However, when you look at the BTC Network Value to Transactions Ratio. The NVT Ratio seems to be at the highest since 2014 indicating that BTC could currently be overvalued. What are your thoughts about this measure? I have seen you using similar measurements to indicate that Bcash is over-valuated before.

I would really like your thoughts here.

Link:

http://charts.woobull.com/bitcoin-nvt-ratio/