Today is the 16th weekly update of the Diversification Protocol. This protocol is designed to allocate a weekly income or funds to be invested mostly to BTC when it is undervalued and mostly to gold and optional stable coins when BTC is overvalued. It also tells you to spend gold for living when BTC is undervalued and BTC for living when it is overvalued. This will create higher returns on your investment through a full cycle and reduce stress in a bear market. HERE you can read the protocol in dept.

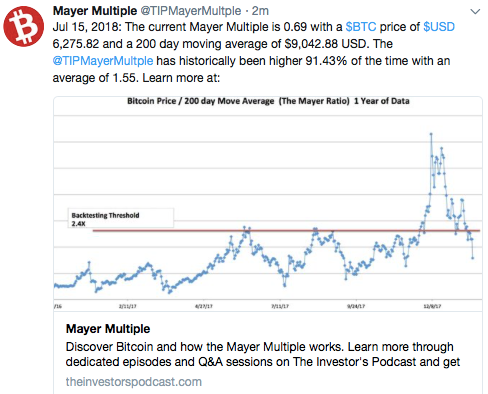

The valuation is done by using the Mayer Multiple and compare it to historical values. The Mayer Multiple is the current BTC price divided by the 200 day moving average. We use data from mayermultiple.com. When you want to be updated on the multiple several times a day you can follow THIS twitter account.

Because I just started the protocol, I didn't accumulate gold and stable coins yet. In this update I will exactly follow the protocol, but since I only start saving gold and stable coins from a multiple of 1.6, I will only be able to execute it 100% according the rules after that point is broken. Funds invested in BTC today will eventually at least partly be converted to gold, since the BTC accumulates in the same wallet and a percentage of the total BTC in this wallet will be allocated to gold at higher valuations.

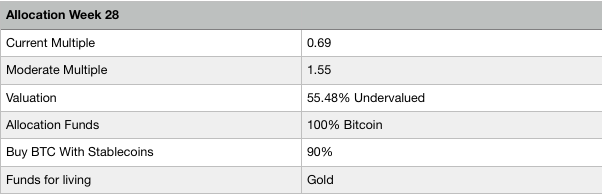

The current multiple

Weekly allocations of funds

The protocol will be slightly boring till we get to a multiple of 1.6, till then we allocate 100% in BTC because it is undervalued. With the current 200 day moving average we need a BTC price of over 14,469 USD to start allocating to gold and Stable coins. This can take days or months, but it is good to be prepared already.

Important news of the week

Many claim a Bitcoin ETF is likely to be approved

It is becoming more and more likely that a Bitcoin ETF will be approved by the SEC soon and this could trigger a huge bull run. Throughout history the first ETF for an asset always caused a big bull market because it enhances accessibility for institutional investors. Next month the SEC will decide about an ETF filed by Van Eck. Previous ETF’s are denied because of the lack of regulation in the industry, the absence of insurance of funds and the absence of custody services. Since the Bitcoin industry have matured through the launch of futures as well as regulation in many countries and Van Eck will offer insurance of the underlying assets the chance of approval is relevant.

https://bitcoinist.com/3-reasons-sec-bitcoin-etf-next-month/

CheapAir implements BTCPayServer for Bitcoin payments

A few months ago, CheapAir asked their customers advice on which payment processor to use because Coinbase has abandoned this service. This week CheapAir announced that they had successfully tested BTCPayServer, a free and open source merchant payment solution that fully eliminates a 3rd party. It is great to see relevant players in the industry make a move to decentralised solutions, this is how Bitcoin originally was intended to work.

https://www.cheapair.com/blog/update-on-our-search-for-a-new-bitcoin-payment-processor/

Bitcoin hater own Lightning node with huge funding

Andreas Brekken, the anti-bitcoin CEO of shitcoins .com has set up a Lightning node and opened channels for more than 35 BTC. This is almost half of the value of the entire Lightning Network and is probably done with bad intentions. The first articles are being written already with a clickbait title that describes that half of the Lighting Network is owned by one individual.

FUD that the Lightning Network is centralised will be spread while this doesn’t make any sense since this huge funding doesn’t give him any power to stop or surveil transactions of other users. Transactions routed through his node are protected by onion routing so he can’t see who the initial sender and final receiver is and when he reject to route a payment the payment will simply go through other nodes.

However, people who don’t understand Lightning will think that he owns 50% and will be influenced by this FUD. Even worse, they might plan to lose these coins to be able to write headlines that 35 BTC is lost because of Lightning failure. This can be played easily since everyone can lose bitcoins when intended to.

This is the reason why I say this today in advance, when something goes terribly wrong with this node it is fundamentally not bad for Lightning at all, but only done to spread FUD. An amount of 35 BTC is worth it to sacrifice in order to destroy Lightning, since Lightning might make billions of dollars invested in alt coins like BCH and ETH worthless in the long run. Roger Ver and Jihan Wu will miss out greatly when Lightning succeeds and companies like Shapeshift will even disappear.

I say it in advance: If the funds in the Lightning node of Andreas Brekken get lost it has nothing to do with the security of Lightning but was is an intended loss to spread FUD.

The fact that someone locks up the same amount of money in Lightning Network as all others involved together doesn’t say that it is centralised. He still owns only 1 of the thousands nodes and even if he owned a majority of the nodes onion routing and the smart contracts of the network will protect the user from surveillance and censorship.

The Bitcoin price is slightly down again this week

The Bitcoin price went down 537 dollar this week from 6837 to 6300. There was no real exiting news this week that influenced the price, I suspect it to be a game of whales. The sentiment is fluctuating, but it looks like more and more prominent people in the space think that the bottom is near. Sideway action or another leg down is likely until positive news like an ETF approval fuels a new bull run.

Fundamentals and valuation

In the history of Bitcoin the multiple was lower than today only 8.57% of the time. Since the multiple today is 0.69 while the moderate is 1.55, there is 55.48 % discount on BTC according to this valuation method!

Long term the prospects are still extremely bullish. Lightning Network and Segwit adoption are still growing and improving faster than expected and can boost adoption for day to day payments, micro transactions and Dapps. Wall Street, governments and central banks are on the sidelines to come in and could inject huge amounts of money. Furthermore, the Mt. Gox selling fear is off the table and an ETF is coming closer. Short term sentiment is neutral, but for the long term almost everything is very bullish.

Disclaimer

This is no financial advice, just my view on the market.

Never stress in a bear market anymore: Follow my diversification protocol

Store your Bitcoins securely

Ledger hardware wallet

Trezor hardware wallet

Trade Cryptocurrencies

Binance Exchange

Buy Bitcoins anonymous with cash

Localbitcoins

Protect your privacy with VPN and pay with crypto

Torguard

Buy gold securely with Bitcoin and store in Singapore

Bullionstar

Like this post? RESTEEM AND UPVOTE!

Something to add? LEAVE A COMMENT!

I think the new etd licence will leave an impact on btc price and what do you think..

You got a 32.66% upvote from @upme thanks to @michiel! Send at least 3 SBD or 3 STEEM to get upvote for next round. Delegate STEEM POWER and start earning 100% daily payouts ( no commission ).

Bitcoin still going to ground level. When will the hope rise? Thanks for your post.

I didn't know what to do these days.

Thanks for the good information. I'll come and see you often.

nice up vote :)

Very nice bro

Good article go on pro

Plz upvote for my posts @haytham1982

Congratulations @michiel! You have received a personal award!

Click on the badge to view your Board of Honor.

Do not miss the last post from @steemitboard:

SteemitBoard World Cup Contest - The results, the winners and the prizes