I had a long thought last night about bitcoin's price which I was basking in the euphoria of its steady growth previously and sadly it's recent fall in price.

This thought actually propelled me to make this research on "The Economics of Bitcoin". When I saw Universities offering postgraduate courses on 'Digital Currency', the zeal to conduct more research keeps burning in my heart.

Take a stroll with me and view my research findings...

QUANTITY THEORY OF MONEY: FISHER’S TRANSACTION APPROACH

The theory that increases in the quantity of money leads to a corresponding rise in the general price was propounded by Irving Fisher, an American Economist.

The quantity theory of money seeks to explain the value of money in terms of changes in its quantity.

The general price level in a commodity is influenced by the following factors;

1. The volume of trade or transactions

2. The quantity of money

3. Velocity of circulation of money

Irving Fisher’s theory on quantity of money could be expressed as below;

PT=MT

Or

P=MV/T

Where P= Average price level

T=Total amount of transactions or total trade

M=Quantity of money

V=Velocity of circulation of money

By Implication, MV which represents money spent on transactions must be equal to PT which represents money received from transactions.

Numerical Example:

Suppose the quantity of money (bitcoin) is $1,000,000, the velocity of circulation is 100 and the total output to be transacted is 2,700 units. Calculate the average price

P=MV/T

=($1,000,000×100)/2,700

=$3,7037.04 per unit of Bitcoin

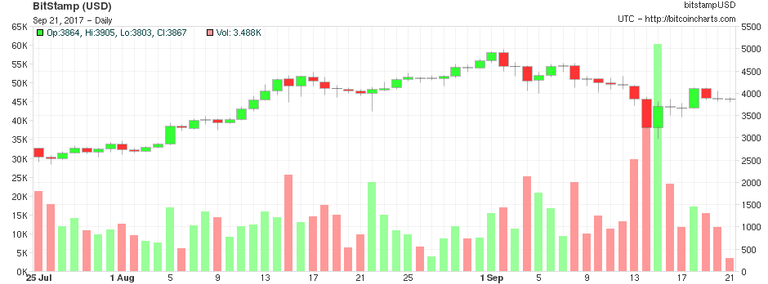

Further research on Irving Fisher’s analysis shows that; Bitcoin tumbled immediately after Chinese bitcoin exchange BTC China announced that it will stop all trading from September 30, following a ban on Initial Coin Offering by the Chinese government.

According to a research produced by Cambridge University in 2017, there are between 2.9 million and 5.8 million unique active users actively using a cryptocurrency wallet most of them using bitcoin.

In conclusion, bitcoin’s rise and fall is determined by the users (All of us). Thus, bitcoin could be termed ‘A positive ponzi scheme’ unlike the conventional ponzi programs, bitcoin is sustainable and could grow higher if we perform more transactions using bitcoin.

Here is a video that explains the power of investors in determining the price of bitcoin

Today (21st of September, 2017), bitcoin has a market capitalization of $64,364,685,621; It’s circulating supply is worth 16,578,112 btc; it’s volume is $1,214,250,000 and its current price is worth $3,882.51

My Prediction for bitcoin between September and October is that it’s price will drop to $3,500 by September ending and soar higher to above $4,200 by the second week of October

Buy and hold bitcoin today !!!!

People's negative view or perception amidst bitcoin fall doesn't count; bitcoin's usage and investment counts rather...

"Thus, bitcoin could be termed ‘A positive ponzi scheme’ unlike the conventional ponzi programs, bitcoin is sustainable and could grow higher if we perform more transactions using bitcoin."

Interesting, now all we need to do is change our human nature to be able to make the most of it! Check out my post for the experience of changing human nature, one nature at a time: https://steemit.com/disruptive/@kimzilla/if-we-are-going-to-change-the-world-with-cryptos-we-will-have-to-change-ourselves

Thank you so much for contributing.

I gat to check your link too

Thank you sir for sharing this post

Thank you too for taking time to read my post

Keep posting and followers and upvotes will follow

I really appreciate you, Sir.

Following you nowThank you so much @knircky

WOW this is very interesting. Thank you for this! I think the crypto field is a very diverse market, and has a ton of legroom to do many things. Stay awesome!