For crypto maximalists, banks getting engaged with cryptos is in opposition to the plain standards on which Bitcoin was made. Cryptos should supplant banks, not advance them. Be that as it may, actually cryptos are not yet prepared to assume control over a budgetary framework that took a long time to create. Regardless of whether crypto supporters like it or not, cryptos should adjust to existing directions.

Indeed, even crypto maximalists require great old banks and institutional financial specialists to get in on cryptos to see the estimation of cryptos increment. On their side, controllers acknowledge increasingly that there is no putting the crypto genie back in the jug, the money related framework should figure out how to exist together with cryptos.

The test for conventional managing an account will be to adjust to this new world, whose framework and center standards are so totally not quite the same as what has ever been done in a pre-Blockchain period. To see how the two biological communities need to develop to suit each other, it is important to first see how every one of them functions.

You are your own particular bank, yet...

The general purpose of cryptos is that you don't have to confide in an outsider to hold your crypto resources. For whatever length of time that you control your private keys, you are the just a single ready to start exchanges and you don't confront any counterparty hazard, you are adequately your own particular bank. While this is awesome for people who need to recover their "fiscal power" to cite Trace Mayer, this isn't perfect with regards to institutional speculators.

Confiding in institutional speculators' interior frameworks to safe-keep conceivably billions of dollars in cryptos is an unnerving prospect. All it would take is one technically knowledgeable representative to take the cryptos. Keep in mind that in the decentralized universe of cryptographic forms of money, exchanges are last and changeless once recorded on the blockchain (except if the network chooses to convey a hard fork, yet we should not arrive). It is along these lines not prudent that each institutional financial specialist build up its own answer for hold the private keys of the cryptos it claims.

Enter custodians

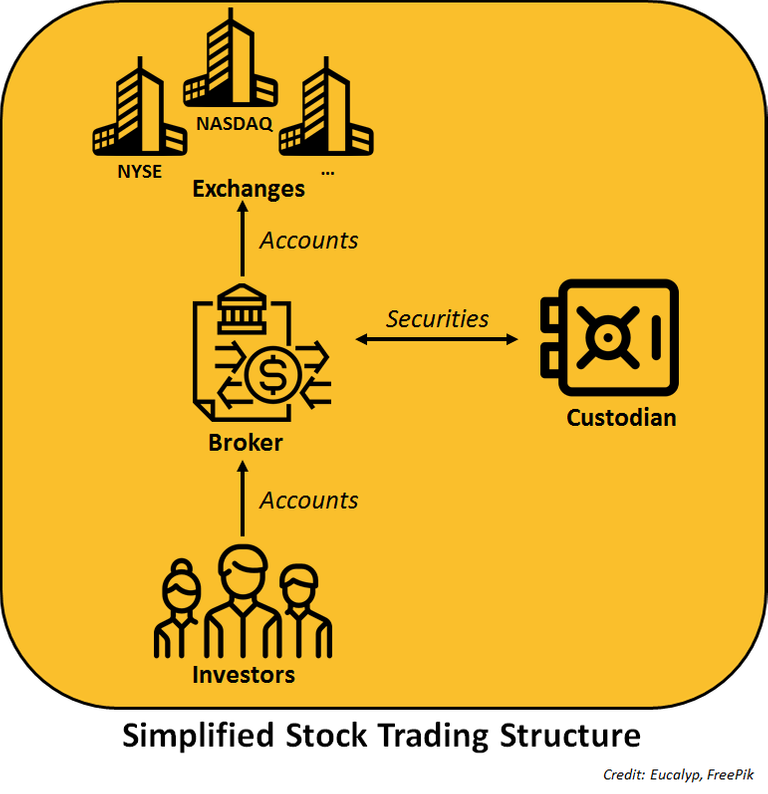

In the previous couple of months, while the market was managing the repercussions of the crypto furor recently 2017, arrangements were discreetly being worked to enable institutional speculators to at long last get in. As indicated by Mike Novogratz, organizer of Galaxy Digital, 98% of the exchanging action so far has been driven by retail financial specialists. This isn't the means by which it should happen, in any event not as indicated by Wall Street. Retail financial specialists as a rule come last to the gathering, after VCs, Wall Street and institutional speculators. However, this time institutional financial specialists had no chance to get of putting resources into cryptos. Inheritance controls everywhere throughout the world typically require these speculators to depend on overseers to safe keep their advantages or to work in-house custodial arrangements. This has been intended to secure financial specialists against misrepresentation by isolating resource administrators from resource caretakers. Along these lines, resource chiefs can't lie on what is in their portfolios nor their valuations as outsiders are really holding their securities for their sake. It additionally incredibly improves exchanging exercises as securities are being held by a couple of worldwide caretakers in the interest of millions customers. Rather than having a great many individual speculators everywhere throughout the world each owning stocks or bonds, a couple of monster caretakers hold the vast majority of the worldwide money related resources for the benefit of a large number of clients (Bank of New York Mellon has authority of $33 trillion of advantages while JP Morgan has $28 trillion under care).

Numerous organizations have been making declarations at or after the Consensus gathering. Record has created specialized answers for caretakers while Coinbase is propelling a custodial administration for instance. Once these arrangements are up and running and gave that institutional speculators get endorsement from their venture boards of trustees to enter the crypto space, the market is probably going to see vast inflows of fiat cash. Relying on a couple and no doubt vigorously managed overseers will decrease the hazard that littler, less technically knowledgeable institutional speculators get focused by programmers. In the meantime, the bigger the caretakers, the more they will represent a fundamental hazard to the entire area in case of a monstrous burglary of their cryptos...

Crypto trades having been wearing excessively numerous caps

Putting resources into money markets has been made less demanding and less demanding in the previous decades. What numerous speculators may not understand is the mechanics that support the straightforward demonstration of purchasing stocks. When one needs to put resources into stocks, one essentially opens a money market fund, stores it with fiat cash and one can consequently begin purchasing and offering stocks. At the point when a purchase or offer request is started by a financial specialist, the representative will course it through a few trades with a specific end goal to locate the best execution cost. Once the exchange has been executed, it typically takes a couple of days to settle (yes, days...). Once the exchange has been settled, the stock is viably exchanged to the investment fund of the purchaser. The broker may not know about which trade has been utilized to execute the exchange. Regardless of whether NASDAQ, NYSE, IEX or some other trade was utilized does not make a difference, the stocks purchased are enlisted to the money market fund of the dealer. Speculators don't need any record with any trade, the financier firm is the one with accounts with the different trades. Be that as it may, this isn't the manner by which it works in the crypto space, not in any way.

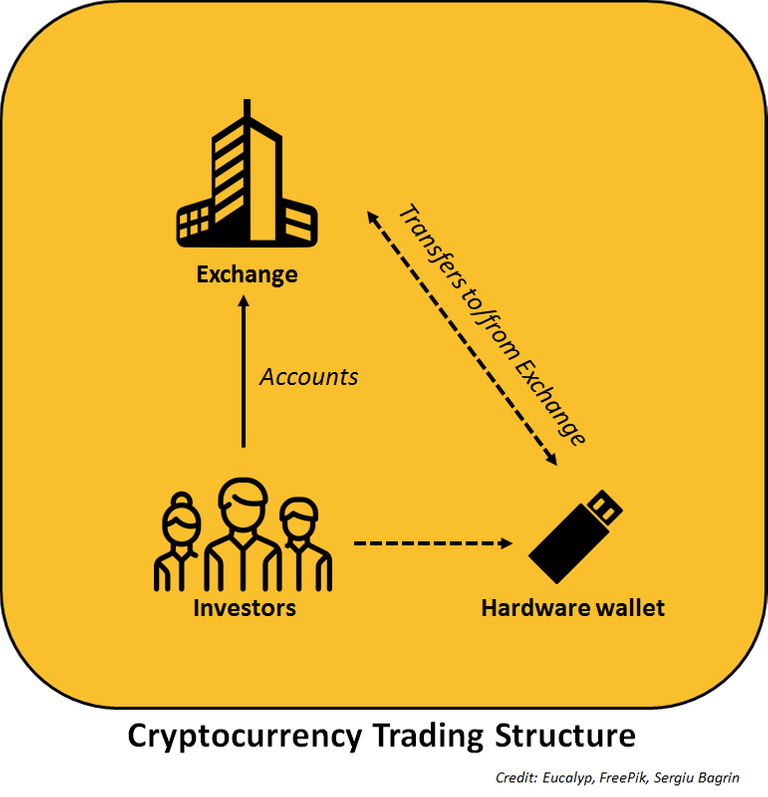

In the crypto biological community, trades have been assuming every one of the three parts of financier firms, trades and overseers, a formula for calamity. There are numerous reasons why money related markets advanced the way they did. Through the span of many years of money related emergencies, liquidations and cheats, controls have been refined to secure financial specialists. In the customary back world, trades don't hold any of the benefits that are exchanged on their stage, everything they do is give a motor that matches purchase orders with offer requests. Yet, since trades are the door to cryptos, the vast majority have expected that they were the same as their investment funds and that they profit by an indistinguishable level of security from with a standard money market fund, not understanding the centralization of dangers underneath.

Brought together trades have been and will stay helpless before hacks on account of the huge measures of cryptos they control. It can never be said enough, on the off chance that you leave your cryptos on a trade, they are not by any means your cryptos. For whatever length of time that a trade is holding your cryptos for your sake, you don't control them and you are helpless before programmers that are endeavoring to take private keys from the trade. When you purchase cryptos from a trade, you ought to quickly pull back them to your own particular wallet, along these lines just you control your private keys and you are protected from hacks that may target trades.

"In the crypto biological system, trades have been assuming every one of the three parts of financier firms, trades and overseers."

To take care of this issue, a second era of trades is developing: decentralized trades, for example, IDEX or EtherDelta. These trades don't hold your cryptos for your benefit however basically give the exchanging motor. Through shrewd contracts, dealers can trade cryptos without hosting to depend on a third get-together in the center to hold their cryptos. This sort of trades have turned out to be progressively prominent for ERC-20 tokens based over the Ethereum Blockchain.

The huge number of crypto trades has additionally made an extremely divided market where value irregularities can be abused by arbitrageurs. In any case, extensive arbitrage openings are probably not going to keep going for long as an ever increasing number of agents are entering the market with new exchanging stages. These new arrangements will empower institutional financial specialists to execute extensive exchanges over numerous trades, which will empower them to advance the cost at which they purchase or offer cryptos.

The squares are falling set up

After some time, it is likely that the crypto biological system will look increasingly like the customary fund environment with intermediaries and caretakers, in any event for institutional financial specialists, which implies that trades may return to just being coordinating motors rather than the one-stop-shops they are today.

Despite the fact that present costs are not intelligent of the advance made in the entire crypto biological community in the course of recent months, the market is developing quick and does not look anything as it completed multi year, two years or three years prior. Cryptos are on the radar of controllers everywhere throughout the world, and it is ideal since it will compel the entire environment to grow up from its present condition of early stages. At the point when and how this may wind up being reflected in crypto costs is a considerably more troublesome inquiry to reply.