Bitcoin’s value is higher than ever before, and the Japanese yen has been the top currency used within bitcoin’s global trade volume over the past year. According to the CEO of the Tokyo-based trading platform Bitflyer, Yuzo Kano, the current bull run is being bolstered by market movers utilizing leverage.

Bitflyer CEO Believes ‘Japan Is Leading the Market Higher’

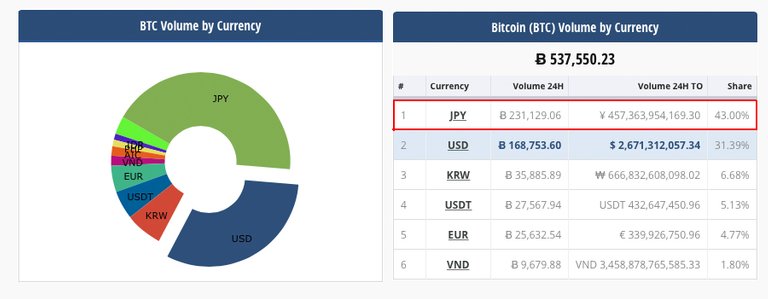

Bitflyer CEO Says Japan and Leverage Is Leading Bitcoin Markets Higher The price of bitcoin has been on fire in 2017 gaining new all-time highs month after month. Every day global exchanges are swapping billions worth of bitcoin, but one particular exchange from Tokyo has been dominating the pack. Bitflyer created in 2014 by Yuzo Kano is one of the world’s top exchanges and usually captures the second and third position among exchanges globally. The Japanese yen has also been dominating the world’s trade volume and at times can be over 60 percent of global BTC trades. At the moment the yen is leading by 42 percent ahead of the U.S. dollar, and the euro. According to Mr. Kano, lots of Japanese traders are fuelling the market by purchasing with leverage of up to 15X based on their initial deposit.

Mr. Kano details in an interview with the Financial Times that a significant amount of demand is stemming from large holders and Chinese mining organizations.

“People who’ve owned them for a long time and have made a fortune — They have ¥10bn, and they’re selling a little,” explains Kano.

I think Japan is leading the market higher

This week the Japanese yen is dominating bitcoin’s global trade volume by 40-48 percent. At times the currency has commanded over 60 percent.

‘No Matter How Big the Position We Can Close It Out’

Bitflyer CEO Says Japan and Leverage Is Leading Bitcoin Markets Higher

Mr. Kano the CEO and founder of Bitflyer believes Japan is leading the global demand.

Out of all the Japanese exchanges, Bitflyer captures the lion’s share of BTC volume compared to other operations within the country. According to global statistics, Bitflyer captures over 70-80 percent of the country’s share of volume at any given time. A few times this year Bitflyer and other trading platforms have also seen far higher prices than the global average. Last week when the price came close to the $17K range, Japanese exchange prices were $1,000-500 higher. Bitflyer’s options and leverage markets trade bitcoin at 75 percent in derivatives and 25 percent BTC which Mr. Kano says is fueled by frequent traders and arbitrageurs.

Even though leverage markets are dominating Mr. Kano’s explains in his interview that he doesn’t fear the risk of a significant market panic which could suck up actual liquidity.

“We have a huge amount of liquidity. No matter how big the position we can close it out. If bitcoin rose 20-fold in a day, then I don’t know. But a day with a 30 percent fall would be no problem,” Mr. Kano emphasizes.

Margin trading and leverage options have been growing increasingly popular over the past few years, and when China dominated the markets, they also dealt with a lot of leverage positions. Mr. Kano also reveals Bitflyer is aiming to cater to U.S. investors and hopes to attract them with the company’s significant liquidity. The exchange recently was approved to receive the Bitlicense in New York and will tend to U.S. customers with its latest cryptocurrency exchange venture.

What do you think about Mr. Kano saying that bitcoin markets are being pushed higher by leverage and arbitrageurs? Let us know in the comments below.

Images via Shutterstock, and Bitflyer.

Congratulations @mmshah! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPThanks for using my service

welcome