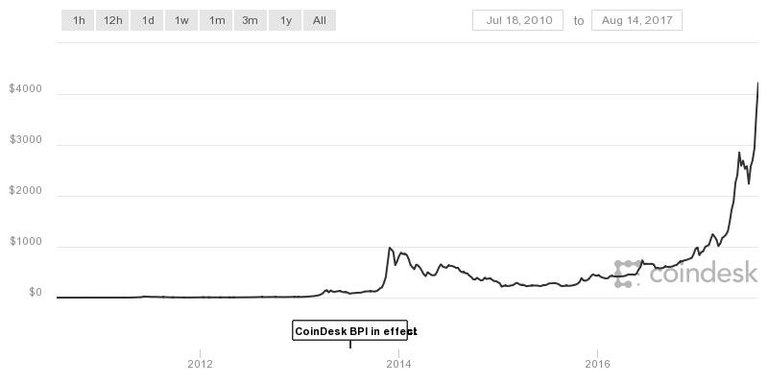

The value of crypto-currency has just reached $ 4,000 per unit! Hyper-speculative, the market is attracting a growing number of investors.

1.Success

The world's most widespread crypto-currency, the bitcoin, is reaching historic highs these days: the Bitcoin Price Index of the Coindesk platform surpassed $ 4,200 on Monday, August 14th. The market capitalization of this market is thus more than 67 billion dollars.

The success of this virtual currency can not be denied. So some analysts, such as Ronnie Moas of Standpoint Research, predict that the bitcoin will cost more than $ 5,000 by 2018. In support of his thesis: a report of more than 122 pages explaining that this crypto-currency becomes A full-fledged asset class and a small fraction (some 4%) of the world's approximately 200 trillion dollars of bonds, gold, or currencies will be converted into bitcoins. In the long term, he forecasts a bitcoin market at 1 trillion dollars, or 2 trillion for the cumulative combination of crypto-currencies.

2.Anonymity

The birth of the bitcoin, which aggregates the English words bit (unit of binary information) and coin - (coin) is nimbée of mystery. This peer-to-peer electronic payment system was created in 2008 by a certain Satoshi Nakamoto. But nobody knows if it's a real person, or a collective of anonymous developers. Published in open-source in 2009, the software platform quickly gave birth to a real world market.

Escaping any monetary or governmental institution, the system is universally accessible and 100% decentralized: it operates without a central authority or a single administrator. Bitcoin - the creation of which is limited to 21 million units - is the subject of transactions based on cryptography. The technology behind the bitcoin uses encrypted and authenticated transaction blocks, which are added to each other. They are verified by the nodes of the dedicated computer network, and irreversibly recorded in a public register called blockchain. This "string of blocks" is considered to be tamper-proof because, in order to modify information, it will have to be changed at the same time by all the users, which is supposed to ensure the stability of the system.

3.Speculation

The bitcoin has the wind in its sails, no one knows whether it is a giant bubble ... or a perennial active. This cryptodevise, which evolves in roller coaster, has nothing in any case of a placement of good father of family. Chris Burniske, who is about to publish a book on crypto-currencies, has established a strong correlation between the evolution of the bitcoin and the frequency of searches of the term "bitcoin" on the Internet, identified by Google Trends.

In particular, he spotted three recent bouts of bubble / crash of the bitcoin: in June 2011, he recorded a drop of 93% between maximum and minimum; In November 2013 -71% ... and in November 2013 -85%!

4.Secession

Not content with being hyper-volatile, the bitcoin is also fragmented: part of the community seceded, on August 1, 2017, to create a new variant called "bitcoin cash". The dispute with their comrades, who remained faithful to the original motto, concerned the speed of transactions.

The process of creating a bitcoin, called "mining", consists in solving complex mathematical problems, via powerful computers. When it appeared, it was easy enough to "undermine" a bitcoin. But as the number of transactions increases and there are fewer units to be created (the ceiling being set at 21 million), this activity has become more and more complex and costly for "minors".

After endless discussions, a group of developers created a second derivative currency, presenting a software patch that allows to manage more transactions per second. However, this brand new bitcoin cash whose value decreases day by day, does not seem to convince large people at the moment.

5.Multiplication

Let us note in passing that the bitcoin, if it has become popular, is not the only crypto-money. There are hundreds of others. According to the list published by Wikipedia the major currencies whose market exceeded one billion dollars, at the beginning of August, are Ethereum (20 billion dollars), Ripple (6,6 billion) and Litecoin (2,2 billion). But we can also cite the most obscure Maidsafecoin, Dogecoin, Monero, Factum, Bitshares, Peercoin, Namecoin, Lisk, Solarcoin ... Together, all crypto-currencies weigh more than 120 billion dollars.

6.Iron arm

But who are these "miners", who devote a very large computer computing power to process transactions in this crypto-currency and are remunerated via newly created bitcoins? Surprise: they are mostly ... in China, which weighs 80% of the global mining activity, far ahead of Iceland or Japan!

The second largest economy in the world produces dedicated computer hardware (servers running on energy-efficient chips), deployed in thousands of computer centers. But its overwhelming domination is challenged by ... Russia.

A Vladimir Putin aide, Dmitry Marinichev, seeks to raise the equivalent of 100 million dollars in cryptodevises, to put the turbo on the mining. Its Russian Miner Coin company will give its investors 18% of the revenue generated by its business.

The Kremlin Internet advisor, according to Bloomberg, explained in a press conference:

"Russia has the potential to capture 30% of the global market for mining crypto-currencies in the future."

7.Scammers

Does a Sino-Russian hegemony worry you? Nothing new under the sun of the bitcoin which, since its creation, is linked to a series of illegal transactions on DarkWeb sites, such as SilkRoad (closed in 2013). Criminal networks in all countries have used this perfectly anonymous currency as currency of choice for gambling, buying illegal drugs or pirated databases.

Moreover, its brief history is punctuated with resounding bankruptcies, such as that of the MtGox exchange in February 2014. The trial of its founder, the French computer scientist Mark Karpekles, accused of embezzlement funds (650,000 bitcoins have vanished ), Opened in Tokyo in July.

8.Refuge ?

These scandals, which are considered marginal, do not seem to discourage the constant inflow of capital into the crypto-currency market. There is, of course, an ever-increasing number of speculative traders, such as hedge funds, attracted by huge returns on investment: 82,000% for the ethereum! The most popular sport of risk-all in finance is the ICO or "Initial Coin Offering": a crowdfunding fund-raising in crypto-currency, that is to say entirely free of any regulation ... and of any guarantee.

Oddly, the bitcoin gradually acquires the characteristics of a precious metal. Like gold, it seems to play the role of safe haven in the face of growing dangers: geopolitical risks linked to tension between the United States and North Korea, economic risks with a sharp rise in US interest rates triggered by uncontrolled The Trump administration.

9.Commoditization

As a result, the bitcoin emerges from its marginality to become almost "mainstream". Important figures of tech, like the CEO of Nvidia Jen-Hsun Huang or the founder of Twitter and Square, Jack Dorsey, promise a bright future. Because institutional investors - elephants of the world finance - are now entering the dance. Last week, the Fidelity mutual fund created a feature that allows its customers to view their crypto-currency holdings from their home accounts. And Wall Street's Goldman Sachs has written a note to its clients that it is becoming increasingly difficult for institutional investors to ignore the bitcoin and the crypto-money market!

Hence a growing concern for regulators about the status of these parallel currencies. How to frame, tax and control this crypto-finance, which threatens to fuel the ever-threatening iceberg of "shadow banking"? With the inherent risks of loss of monetary sovereignty and global crash. Some countries, such as Thailand, have simply banned bitcoin. Others are more open. Everywhere, reflection is underway.

10.Blockchain

If the future of crypto-currencies is unclear, the technology behind it - the "blockchain" or "chain of blocks" - seems promised to a bright future. Its interest goes beyond the financial industry alone. All over the world, hundreds of start-ups and large companies are testing its potential. The blockchain could become the universal means of making transactional registers of all kinds more reliable: cadastre, notarial deeds, civil status, commercial contracts ... The bitcoin would in a way be the tree that hides the blockchain forest.

By Dominique Nora

Journalist

Source: http://m.nouvelobs.com/journaliste/14923/dominique-nora.html

Bitcoin is not anonymous at all, all transactions and their resp. addresses are visibile on the bitcoin blockchain.

nutela thanks

Bitcoin is not unknown or eccentric but almost uncontrollable and non-negotiable material material

Hello, please follow the rules in the group : Resteem to be Resteemed

done

Thanks for helping newbies like me learn more about blockchain and bitcoin! Could you help me Upvote my new post? Thanks! https://steemit.com/addiction/@openmindedtravel/why-men-cant-stop-watching-porn-or-my-application-for-kingdom-works-studios

Done

Interesting article from the journalist about the Bitcoin, but like @nutela said, Bitcoin is not anonymus at all.

Thank you my freind Victoria

good

THANK YOU

https://steemit.com/technology/@amarvaran/learn-about-the-7-best-wonders-of-modern-technology

Amazing post! Upvoted

Thank you Sir gaman