Being fairly new to the trading space, I've been doubtful of the legitimacy of technical analysis. I am not alone in feeling that it feels like an art - sometimes even a 'dark art' - whereby technical analysts look into a crystal ball like some sort of oracle. This prompted me to learn more on technical analysis and I began where most recommend: the 'bible' of TA, "Technical Analysis of the Financial Markets: A Comprehensive Guide to Trading Methods and Applications" by John J. Murphy.

The book covers a large amount of material, most of which has been established as the foundation of TA. It begins with a description of the psychology behind TA. This I found especially interesting as it solidified TA as less of a science and more of an art in my mind; just as psychology is often regarded as a pseudoscience, a field wedged between scientific rigour and social science.

The next chapters give an understanding of the essentials in TA: trendlines, reversal and continuation patterns, moving averages and so on. Through reading the book in an online version, I've compiled notes and screenshots of what I deemed to be important for future reference or if I need a refresher - which I certainly will. There are some chapters that are outdated (mostly centred around computer use), which is understandable given that it was published in 1999 based on his earlier book "Technical Analysis of the Futures Market", published in 1985. Overall I, as many others see it as a comprehensive guide to TA which was most definitely appropriate for beginners.

//

Having joined Steemit fairly recently (I joined in August 2017 but hadn't really used it until December 2017), I've had the pleasure of seeing some calls from well-known technical analyst with the name @haejin. I have yet to evaluate the overall succes rate he has and intend to in the near future - for my own learning benefit and perhaps others' too.

Given these intentions, I have some questions for the community:

- Is it disrespectful to use someone else's content within your own?

I wanted to compare some of his calls (by screen-shotting) with what has really occurred in the markets but I fear it may break some rules. - Is there community interest in posts of this nature?

Here is an excerpt from the book I found online:

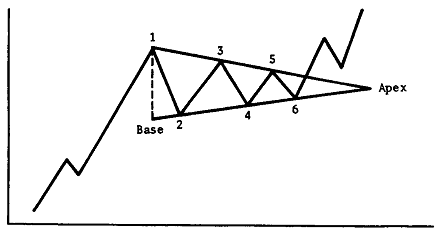

It is a bullish symmetrical triangle formation - regarded as a continuation pattern (so the trend before should continue after the triangle)

And here's a time I found where it appeared in the past for BTC:USD

Let me know your thoughts.

I have learned about these patterns as well and still educating myself. Nice post, the triangle spotting method is interesting and fun to graph out when observing charts. Followed

Good post

&Upvote the postsFollow me @dexabyte,as i did