NJ Bridgewater

24 September 2018

[NOTE: This article is not financial advice. The reader should consult a licensed financial advisor before making investment decisions. All predictions within this article are speculative and/or theoretical.]

Introduction

Bitcoin is a cryptocurrency – a revolutionary new asset class which allows for quick and easy transfer of money and wealth from one individual to another. In other words, it is peer-to-peer digital money. At the same time, Bitcoin is not just a form of money. It is more than that—it is a store of value and a new digital gold standard. Money, as I explained in my article entitled ‘What is Bitcoin’, is an idea-meme. Money has value because we believe it has value. But what makes money money? Why does it have value in the first place? The key thing which distinguishes money from other asset classes is that it is scarce and fungible. In other words, there has to be a limited supply of money, and it has to be mutually interchangeable with other denominations of itself. For example, gold can serve as money because it is limited in supply and can be denominated in various coins and measures. I could exchange two gold half sovereigns for one gold sovereign, for example, or I could exchange one gold sovereign for another. I can weigh gold and determine its value relative to its weight. Moreover, gold does not rust or deteriorate over time, so it is a good long-term store of value. Modern-day currencies, however, such as the United States dollar (USD), the Great British pound (GBP), and the Euro (EUR), do not qualify as real money. Rather, they are referred to as ‘fiat currencies.’ In other words, they are created by fiat, i.e. decree. Most of the supply of these currencies is digital, meaning that they consist of 1s and 0s on a digital database, created out of thin air and with nothing to back them up. Bitcoin is different. It isn’t a fiat currency. Instead, it has a fixed supply of 21 million Bitcoins, which means that it is scarce, as well as being immutable, fungible and inherently valuable.

Here are ten of the main reasons for buying Bitcoin.

- Bitcoin is peer-to-peer digital money

Bitcoin is the first truly peer-to-peer (p2p) money system. Bitcoin was invented by the pseudonymous Satoshi Nakamoto in 2008, when he released his whitepaper, entitled Bitcoin: A Peer-to-Peer Electronic Cash System. This should not be misunderstood. Bitcoin is not merely a new payment system, or just a form of electronic cash. That would make Bitcoin no more unique or valuable than the United States dollar, which is also a form of electronic cash. Digital payment systems such as PayPal or VISA already exist. So, what is the unique feature which Bitcoin possesses? Bitcoin, in contrast to PayPal, VISA or USD, is “based on cryptographic proof instead of trust, allowing any two willing parties to transact directly with each other without the need for a trusted third party.” While PayPal and VISA transactions can potentially be reversed, Bitcoin transactions are completely irreversible, protecting users from fraud. Moreover, Bitcoin solves the double-spending problem, in which the same digital cash is spent twice, by using “a peer-to-peer distributed timestamp server” which generates “computational proof of the chronological order of transactions.” In other words, Bitcoin cannot be spent twice because all transactions are immutably recorded on the blockchain, which is a distributed ledger. Since every node on the Bitcoin network has a copy of the blockchain, all transactions can be verified, ensuring that no fraud or double spending occurs. This also ensures that new Bitcoins cannot simply be created out of thin air, fraudulently. In other words, Bitcoin functions as a form of digital gold, as gold, like Bitcoin, has a fixed and limited supply, which we will explain further below. A word of caution, however. We should not take the use of the term ‘electronic cash’ to mean that Bitcoin is literally a payment system, and nothing more. This is the mistake of Bitcoin Cash enthusiasts, who fundamentally misunderstand the intent of the Bitcoin whitepaper. Rather, as Satoshi himself explained in 2010, Bitcoin is more properly understood as being “more like a collectible or commodity.” More on that below.

- Bitcoin is scarce and limited

Following on from what we have said about Bitcoin as electronic cash, let us consider what Bitcoin actually is. Is it merely a digital payment system, like PayPal, or is it something more? As Satoshi Nakamoto himself affirms, “Bitcoin is an implementation of Wei Dai‘s b-money proposal on Cypherpunks in 1998 and Nick Szabo’s Bitgold proposal.” In other words, Bitcoin is a direct implementation or realization of Nick Szabo’s Bitgold. So, how does Nick Szabo explain the whole Bitgold concept? He describes it as “a protocol whereby unforgeably costly bits could be created online with minimal dependence on trusted third parties, and then securely stored, transferred, and assayed with similar minimal trust.” In other words, Bitcoin is analogous to “precious metals and collectibles” in that they have “an unforgeable scarcity due to the costliness of their creation”, while removing the main problem that gold and silver face, which is the costliness of repeatedly assaying metals for common transactions, and the difficulty of transporting gold over long distances. One can thus have the benefits of gold, i.e. a consistent store of value, while also transferring value from one party to another over great distances and without any intermediary, i.e. peer-to-peer electronic cash. The concept of ‘electronic cash’, therefore, must be understood within this context. The main proponents of Bitcoin Cash (BCH), commonly called ‘Bcash’, which is a hard fork of the Bitcoin blockchain, fail to understand the original motive and purpose behind Bitcoin.

Bitcoin is extremely limited and scarce. There will only ever be 21 million BTC. Why is that? Because, every four years, or thereabouts, the difficulty of generating new Bitcoins doubles, and will continue to do so, until eventually no new Bitcoins can be created. This allows for a minimal inflation in the supply of Bitcoin, until the last BTC is generated, by which time, if Bitcoin still exists, its value will be worth millions of dollars by today’s standards. How are Bitcoins created? As I explained in my article, ‘What is Bitcoin’: “This is how it works: a block of Bitcoin transactions is chosen from the list of all currently-pending transactions, called the ‘mempool’. These are recorded into the distributed ledger, consisting of an ever-growing number of blocks, collectively called the ‘blockchain’, with a new block being created roughly every 10 minutes. The integrity of this system is maintained via Proof of Work (PoW) hashing. Bitcoin miners must unlock a cryptographic puzzle called a ‘hash’, with each new correctly-hashed block releasing a pre-determined number of newly-created Bitcoins.” The cost of mining 1 BTC can be calculated based on the computing power used and the amount of electricity used to unlock this cryptographic puzzle. This varies widely from one country to another, based on the relative electricity costs in each country. As of March 2018, for example, it costs as little as $3,172 USD to mine a Bitcoin in Saudi Arabia, $4,758 in the United States, $8,402 in the United Kingdom, and as much as $26,170 in South Korea. This was calculated at a time when Bitcoin was valued at $11,332 USD. With one Bitcoin currently worth around $6,700 USD, it would be profitable to mine Bitcoin is some countries, but not in others. The inherent value of Bitcoin may be determined based on the cost of creating one Bitcoin. This could also factor in addition costs, such as hardware, premises, etc. This is in line with the economist David Ricardo’s argument that “the value of a commodity, or the quantity of any other commodity for which it will exchange, depends on the relative quantity of labour which is necessary for its production...”

- Bitcoin is valuable due to the network effect

Bitcoin’s value, as we learned in point 2 above, can be calculated based on the amount of energy used to create Bitcoin. This makes Bitcoin a valuable commodity, like gold, which has, Ricardo argues, “an intrinsic value, which is not arbitrary, but is dependent on their scarcity, the quantity of labour bestowed in procuring them, and the value of the capital employed in the mines which produce them.” To this may be added an even newer concept: Metcalfe’s law, developed by Robert Melancton Metcalf (b. 1946), which states that the effect of a telecommunications network is proportional to the square of the number of connected users in the system. The example may be given of a fax machine. A single fax machine is useless, and, therefore, its value is extremely low, since it cannot be connected to other fax machines. If there were only 1 Bitcoin in the world, and 1 Bitcoin full node, which contained 1 copy of the Bitcoin blockchain, then the value of 1 Bitcoin would be virtually $0.00. This is rather similar to how Bitcoin sceptics regard the value of Bitcoin. Since they regard Bitcoin as an arbitrary creation, a sort of ‘magical internet money’, they see the value as being arbitrary. Quite often, they characterize Bitcoin as a Ponzi scheme. A Ponzi scheme involves the collection of money solely by recruiting more people into the Ponzi scheme, until no new users are recruited and the whole system collapses. Another way they criticise Bitcoin is by comparing it to the tulip mania which occurred during the Dutch golden age, finally collapsing in February 1637, or the South Sea Bubble, in which the value of stock in the South Sea Company peaked in 1720 before collapsing to little above its flotation price. None of these comparisons are apt, however, as they do not take three factors into consideration: the essential or intrinsic value of Bitcoin, the network effect, and the nature of sound money.

The intrinsic value of Bitcoin is strongly related to the network effect. As we have already mentioned, Bitcoin takes a considerable investment to create, and that investment is tied into the maintenance of the network, as the Bitcoin blockchain is maintained and verified by thousands of full nodes distributed across the planet. Bitcoin miners verify the blockchain while be financially incentivized through the creation of new Bitcoins. This is a self-perpetuating system—even with the existing Bitcoin user base, Bitcoin’s value can be maintained. In other words, while the value of Bitcoin does increase when its user-base increases, it does not rely for its value on the constant recruitment of new users. In other words, it cannot be classified as a Ponzi scheme. As for tulip-mania, again the analogy is inapt. First of all, tulip-mania is largely a myth. It did not result in the wholesale destruction of the economy, as suggested by the story, and it did not really affect all levels of society. It was merely a minor speculative bubble. Every commodity or asset class is subject to speculative bubbles. Gold prices, for example, used to be based on the gold standard, with gold being fixed at $35 per ounce. When America went off the gold standard in 1973, gold became a speculative asset, reaching an all-time-high (ATH) of $1,895 on September 5, 2011. As of September 23, 2018, the price of gold is $1,202 USD. These facts negate the argument of Ray Dalio, founder of Bridgewater Associates, the world’s largest hedge fund, who argues that Bitcoin is “not an effective store of wealth”, since “it has volatility to it, unlike gold.” It is clear that gold has volatility, but it also has inherent value, just as Bitcoin does. All commodities, regardless of their relative utility as stores of value (SoV), are subject to speculation. Has the rise in the price of gold been the result of ‘a bubble’? Perhaps. But that does not negate the underlying value of gold, which is related to its scarcity and immutability. The value of Bitcoin, likewise, is based on scarcity and immutability, as well as Metcalfe’s law.

Economists, bankers and other critics who hold that Bitcoin has no essential value mostly belong to the generation before the internet. When the World Wide Web was launched by British scientist Tim Berners-Lee in 1989, a new, digital world emerged. Robert Metcalfe originally used his law to calculate the value of Ethernet—his own creation—which was a widely used local-area network (LAN) launched by Xerox PARC in 1973, and it is still used today. Metcalfe’s original law was based on the square of the number of users, as it was based on the idea that the value of a network grows in proportion to the number of all possible connections, assuming all nodes can connect with each other. Wheatley argues that this should be adjusted and updated, as, in reality, if N is 1 million, the average user only connects to 10,000 other users. The number of active Bitcoin users would therefore be an exponent of 1.69, rather than Metcalfe’s original exponent of 2. Haoski uses 1.59. He calculates that, as of 2018–05–22, the value of 1 BTC according to Metcalfe’s law would be $2700 USD. However, this is just one factor in determining the real or intrinsic value of Bitcoin, and does not take account of Ricardo’s ‘labor theory of value’, which argues that the value of a commodity is equivalent to the labour required to produce the raw materials and the machinery used in the process, i.e. the cost of mining 1 BTC, including both hardware and electricity costs. In either case, however, Bitcoin has an intrinsic value, and the intrinsic of Bitcoin is well above zero, thus refuting the arguments of Bitcoin critics who see it as mere ‘magic internet money’. Bitcoin’s value is economically determined, being based on tangible economic factors.

- Bitcoin is divisible to 100 million parts

Here again, Bitcoin differs from gold quite significantly. Gold is a metal, and, as such, can be divided into smaller and small parts, down to the atomic level. However, human beings can only cope with measures which are visible, easily weighed, and portable. As such, gold is usually divided into various manageable divisions, including coins and bars. In Britain, for example, there is a half sovereign, which used to be equivalent to half a pound sterling, ten shillings of 120 old pence, being currently worth slightly more than melt value, i.e. around £130 GBP. The British sovereign was originally worth one pound sterling, being struck from 1817 until present. Using gold sovereigns and half sovereigns is all well and good, of course, unless you want to buy items which are less than £130 in value. And what if you want to buy items worth more than a single sovereign, let’s say, £10,000 or more? Would you use gold sovereigns, which are worth about £197.61 each? If so, you would need about 50 coins, or 51 just to make up the amount. One gold sovereign weighs about 7.98 grams. 7.98 grams x 51 = 406.98g, or about 0.89723 pounds of gold. This must then be carried, and is at risk of being stolen, lost or confiscated by authorities. Bitcoin, in contrast, can be sent anywhere in the world at a relatively low cost, without any chance of being confiscated, lost or stolen along the way. Furthermore, each Bitcoin can be divided into 100 million parts, meaning that one does not have to waver between 50 or 51 coins. Rather, Bitcoin is divisible into 100 million Satoshis, allowing for transactions of any size. For more on the difference between Bitcoin and gold, see my article, ‘Bitcoin vs. Gold: A Comparison’.

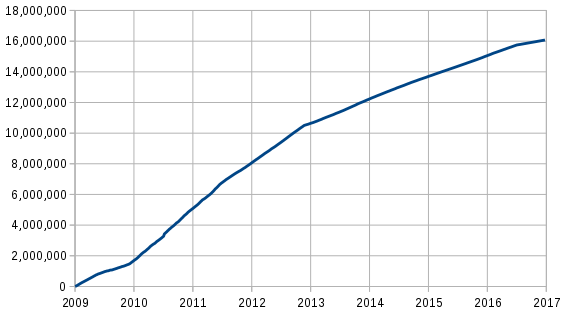

The divisibility of Bitcoin brings up another interesting question: are there enough Bitcoins for everyone on Earth? Many people, when first encountering Bitcoin, are depressed to find that they cannot afford a single Bitcoin, at least since it reached $1,000 in value, and its current floor of $6,000. But that’s beside the point. The point is, how much Bitcoin do you want? Not everyone can afford one Bitcoin, of course, since there are only 21 million that will ever be created. In fact, by the year 2140 CE, some 122 years in the future, there will be 20,999,999.9769 BTC in circulation, not counting the vast amounts that have been lost when people lost hard-drives or private keys, and not taking account of the large amount of Bitcoins owned by Satoshi Nakamoto himself, which have not been touched or moved in years (these will probably be lost forever). Gill (2017) calculates that there will be 16 billion people on Earth by 2140, with about 2 billion Bitcoin wallets in use; and each Bitcoin can be divided into 100 million parts (called Satoshis), resulting in a total supply of 2 quadrillion Satoshis. He calculates, therefore, that the average person will be able to own about 131,250 Satoshis.

Is that quite enough for everyday usage? Well, what will one Bitcoin be worth in 2140? The total value of all the world’s easily accessible money is about $36.8 trillion USD, including coins, banknotes and checking deposits, with the total value of the world’s money being about $90.4 trillion USD, including the above plus money market accounts, savings accounts and time deposits. If we count derivates and other investments, the amount is much higher, but let’s just stick to that moderate amount. $90.4 trillion divided by 21 million BTC gives us a rough figure of $4,304,761.90 USD per BTC in today’s values. To put that into perspective, Jeff Bezos, the richest man on the planet, with $112 billion USD, would only be able to afford 26,017.69 BTC. And this is assuming that there will be 21 million BTC available. Roughly 4 million BTC have been lost forever, further increasing the value of each Bitcoin due to deflation. The United Nations projects that the world population will increase to about 11.2 billion by the year 2100 CE, with a medium estimate of 8.494 billion by 2150, a high estimate of 16.722 billion and a low estimate of 3.921 billion. This all depends, of course, on whether the birth rate slows down or not, which is a matter for debate. Gill seems to have been using the high end of this spectrum.

In addition to population size, we also have to consider economic growth. This must take into consideration the World Gross Domestic Product (GDP), also called the Gross World Product (GWP), which was $127 trillion USD in terms of purchasing power parity (PPP) in 2017 (using 2017 dollars). Robert H. Samet (2009) estimates that this will increase to $150 trillion USD by 2050 (in 2000 dollars), $225 trillion by 2100 and $320 trillion in 2150. In other words, the world’s gross domestic product will be two and a half times greater than present. Assuming a money supply of $320 trillion, and a population of, let’s say, 9 billion in 2150, we’d have about $15,238,095.23 USD per BTC, with a supply of 21 million BTC, or $18,823,529.41 USD per BTC, with each Satoshi being worth roughly $0.188235 USD according to the latter projection. Each of the 9 billion people on Earth could have roughly 188,888.88 Satoshis, worth about $35,555.50 USD, equally divided. This would never happen, of course, as the Pareto principle (80/20 rule) ensures that the top 20% of society always controls 80% of the wealth, and this only accounts for the money supply, and not all the wealth in the world, derivatives, gold, land, etc. In real terms, I wouldn’t be surprised if each Bitcoin were worth the value of $100 million USD or more. Moreover, these calculations also don’t take into account the Bitcoin standard hypothesis, proposed by Saifedean Ammous (see Reason 9 below).

- Bitcoin is sound money, which increases in value

What is sound money? Sound money may be defined as money the value of which is independent of government control and is, rather, determined by the market. Money under a gold standard, for example, may be classed as sound money, as the value of gold fluctuates on the market, and is determined by supply and demand. Bitcoin is a perfect example of sound money. The value of Bitcoin, as we have already established, is decided by the market. As supply decreases and demand rises, the value of Bitcoin continues to rise. This can result in speculative bubbles and price crashes, but such fluctuations do not account for the steady rise in the value of Bitcoin over time, which is due to these twin factors—a slowing rate of supply and an increasing demand for Bitcoin. Since the price of Bitcoin fluctuates on the market, we can say that it has a perceived value. I have already mentioned the fact that money is an idea-meme, as defined by Richard Dawkins. In other words, money is an idea which we transmit from person-to-person and perpetuate through culture and society. It is something deeply rooted in the human psyche, and it has been an important part of the human consciousness since the earliest origins of humanity. This is a topic that I discuss at length in my four-part article entitled ‘The Origins of Wealth’.

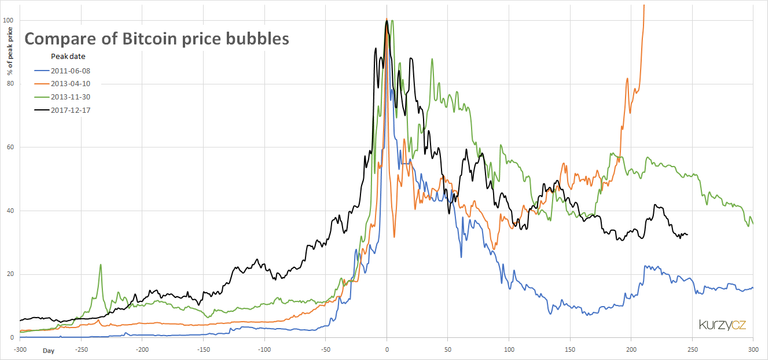

The USD price of Bitcoin, therefore, depends on fluctuations in market sentiment. When the cryptocurrency market is bullish, Bitcoin goes on a bull run and sharply increases in value. This leads a large number of investors to sell their Bitcoins for fiat currency, in order to take gains from their investment, resulting in a sharp decline in price. This is followed by a bear market, which is a natural part of the market cycle. Yet again, another bull market comes along, and the value of Bitcoin increases yet again. The cycle repeats itself, again and again, and has been doing so since at least 2010. The smaller the cryptocurrency market, the greater the volatility in the price of Bitcoin. As the market grows in size, however, and achieves a greater equilibrium, price fluctuations will become much smaller, and the value of Bitcoin will begin to rise steadily as it becomes adopted by more and more banks, institutions, nations and investors. Since Bitcoin is the hardest money there is—real ‘sound money’, in contrast to the USD, GBP, EUR etc.—it is an excellent hedge against inflation. Inflation is government manipulation of the money supply (see Reason 8 below). Sound money allows the individual to put his or her wealth into a more secure store of value, which will beat inflation and continue growing independent of government control or censure.

- Bitcoin is decentralized and has no leadership

In line with Bitcoin’s nature as sound money, it has no leadership. There is no central authority which brings Bitcoin into existence. Indeed, as Satoshi Nakamoto himself wrote: “The nature of Bitcoin is such that once version 0.1 was released, the core design was set in stone for the rest of its lifetime.” In other words, the core design of Bitcoin is set in stone and it is incredibly difficult to change anything about the Bitcoin blockchain. This is evidenced by the almost-universally-acknowledged failure of the Bitcoin Cash (BCH) fork, which occurred on 1 August 2017, resulting in the creation of a new cryptocurrency called Bitcoin Cash (BCH). Bitcoin Cash was based on the idea that the block size of Bitcoin had to be increased in order to make the base layer quicker and more efficient for day-to-day transactions. In other words, the purpose of BCH was to ensure that it would always be easy and cheap to buy a cup of coffee or a stick of gum using the Bitcoin blockchain. This is based on a fundamental misunderstanding of the economics behind Bitcoin. Roger Ver, and others, interpreted the whitepaper’s mention of “peer-to-peer electronic cash” literally, ignoring the fact that it a direct implementation of Nick Szabo’s Bit gold proposal, which called for the creation of a new digital gold standard, rather than a super-efficient base-layer payment system. If Bitcoin’s purpose is to make it easy to make electronic payments, then it has already been defeated by PayPal and VISA. Rather, Bitcoin’s essential use case is as sound money and a store of value. For this to be possible, it must be extremely difficult to change the Bitcoin protocol, so there mustn’t be any form of leadership of the community.

Bitcoin thus stands in contrast to BCH, which is led by a few individuals (including Roger Ver), XRP, which is led by the Ripple Foundation, ETH, which is led by Vitalik Buterin, Cardano (ADA), which is led by Charles Hoskinson, LTC, which is led by Charlie Lee, NEO, which is led by Da Hong Fei, and Tron (TRX), which is led by Justin Sun. Only a truly decentralized, leaderless cryptocurrency can represent truly sound money. And this is only possible with Bitcoin. Why? Because Bitcoin arose and grew out of obscurity before all the other cryptocurrencies. It grew organically, over a period of about 10 years, from a small community of Cypherpunks, to millions of users today. No such project could get off the ground now, without having an ICO (Initial Coin Offering), TGE (Token Generation Event), or other regulated and organized fundraising project, set in motion by a centralized group, company or foundation, resulting in a lack of decentralization. Bitcoin, in other words, is a unique cryptocurrency—one which cannot be replaced by anything like it. Bitcoin Cash is a prime example of the impossibility of replacing Bitcoin, as BCH lacks the essential component of decentralization which makes Bitcoin unique. As Nick Szabo, the original creator of the Bit gold concept (and thus of the Bitcoin idea itself) wrote: ““Bitcoin Cash” is centralized sock puppetry.”

The secret to Bitcoin’s success, Nick Szabo argues, is not its scalability. Bitcoin Cash is an alleged attempt to provide scalability by increasing the block size. Roger Ver and Jihan Wu’s attempt to scale Bitcoin in this way represents a misunderstanding of the purpose and philosophy behind Bitcoin. Rather, Nick Szabo informs us, “the secret to Bitcoin’s success is that its prolific resource consumption and poor computational scalability is buying something even more valuable: social scalability.” He describes “social scalability” as being about how individuals’ and participants’ behaviours are constrained or motivated. Bitcoin provides social scalability “via trust minimization: reducing vulnerability to counterparties and third parties alike. By substituting computationally expensive but automated security for computationally cheap but institutionally expensive traditional security, Satoshi gained a nice increase in social scalability.” The most distinctive characteristics of Bitcoin which he highlights are: “independence from existing institutions for its basic operations, and ability to operate seamlessly across borders”. Bitcoin thus sacrifices computational scalability for social scalability, “sacrificing performance in order to achieve the security necessary for independent, seamlessly global, and automated integrity.” This means that it cannot achieve VISA-like transactions on the blockchain-layer, but it can do so via secondary layers and payment services, which operate as “a less trust-minimized peripheral payment network (possibly Lightning).”

- Bitcoin is censorship-resistant

This has already been mentioned and referred to above, especially in Nick Szabo’s comments regarding trustlessness and decentralization. Data integrity, Szabo informs us, is achieved via the blockchain—via computer science, rather than reliance on traditional law enforcement, e.g. calling the cops. Here, censorship resistance means that Bitcoin can be used as a means of transferring wealth and value on a peer-to-peer basis, without the control of any government body. Traditional financial institutions, banks and governments can control access to your funds. They can freeze your bank account. They can deduct taxes without your consent. They can take a portion of your income and forcibly give it to your ex-wife or ex-husband. An oppressive government can devalue or debase the currency, reducing your hard-earned savings to a fraction of their original value. They can prevent you from sending money to countries which are under government sanctions. Bank accounts can be frozen, preventing access to your money. Perhaps you criticise the government, and the government decides that you are now a threat to national security. You could be labelled a terrorist or rebel, and your bank accounts and assets could be frozen, confiscated or appropriated by the government. This isn’t isolated to tin-pot dictators and tyrants. On the contrary, one day in 2013, Cypriots woke up to find that their bank accounts had been raided by the government due to a “one-off levy” as part of a €10 billion bailout deal agreed with the European Union and other international leaders. Imagine that the government decides that they need your money rather more than you do, and decides to confiscate a portion of it. How would you feel if they did this to you?

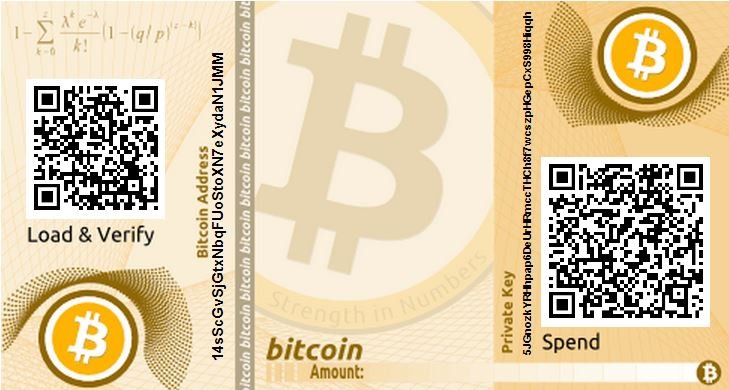

With Bitcoin, such a thing is impossible. As long as you hold control of your private keys, you control your Bitcoin. You can send it to anyone, anywhere in the world, in a matter of minutes, without any bank or government intervening. You can bypass sanctions, send money to political dissidents, or otherwise evade government and legal restrictions. A government might have an oppressive tax regime, for example. Imagine if the economy were on the brink of collapse, and the government decided that it wanted to tax everyone at a rate of 90%. You could put all of your wealth into Bitcoin, hide your private key, or memorize it and destroy any physical copies, and your wealth would be secure from confiscation. What if the regime in your country collapses, or your country devolves into civil war, like Syria? What then? You could, again, put all of your wealth into Bitcoin, memorize the private key, or put it onto a USB storage device (e.g. LedgerNano, TREZOR), paper wallet, etc. and flee the country with your wealth secure. You couldn’t do this with traditional fiat currencies, as these require banks and infrastructure. Nor could you do it with gold or silver, which would likely be lost or stolen along the way. With Bitcoin, you could simply memorize your private key and carry all your wealth with you, stored securely on the blockchain. These are all hypothetical scenarios and thought experiments, of course, and not financial or legal advice. Another famous example is Wikileaks, which began to accept donations in Bitcoin back in 2011, amassing more than 4,025 Bitcoins (worth $26.6 million USD). The Pirate Bay, likewise, began accepting Bitcoin donations back in 2013, raising 10 BTC in little more than a single day (then worth about $1,300 USD). Similar censorship-resistant projects will benefit from being able to use BTC in the future.

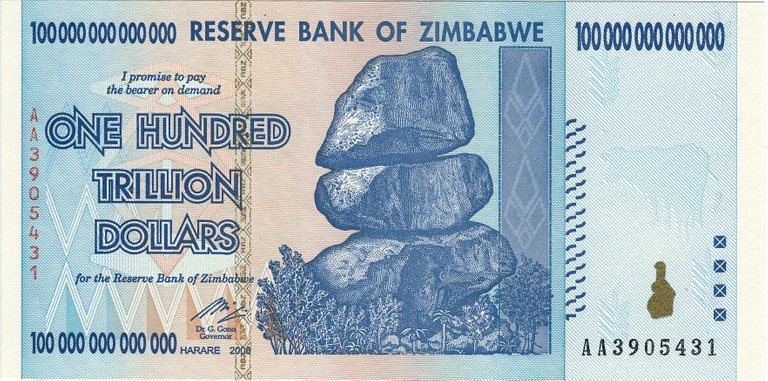

- Bitcoin prevents inflation and government debt

Now we come to the heart of the economic question—inflation and debt. We live in a fortunate era in many respects, but also unfortunate in some respects, such as the lack of sound money. Most (if not all) governments around the world use a system of fiat currency, or money created by decree. The value of a USD is based solely on trust and confidence in the United States government and its ability to pay its debts. Of course, the US government can always pay its debts, because it can simply print more dollars to pay those debts, thus inflating the money supply. The more USD in circulation, the greater the rate of inflation. Inflation may be described as a form of hidden taxation, in that it reduces the purchasing power of each individual without overtly forcing them to give more money to the government through overt taxation. Thus, you may think you have the same amount of money, but the amount of things you can purchase with that money decreases day-by-day, until the value of $1 is only a fraction of what it used to be. This is a point that I make in my article, ‘What is Bitcoin’:

“There are several ways of measuring the total money supply. M1 is a metric used to refer to all the paper money and coins of a currency, as well as all the checking accounts, demand deposits and negotiable order of withdrawal (NOW) accounts. M2 is a wider metric used to include everything in M1 plus savings account deposits and money market account deposits. In February 2015, the total M1 money supply in the United States was $2.9882 trillion USD. That’s 2,988,200,000,000 U.S. dollars! In late 2016, the supply of U.S. dollars increased dramatically, at a 46-month high of 11.2%. As of October 2017, the total M1 money supply in the United States had reached 3.5947 trillion U.S. dollars! What do you think that does to the value of your savings? It is decimating to them! How much does it cost to create these trillions of dollars? Surprisingly little. Paper money costs hardly anything. $1 and $2 notes cost 4.9 cents to make, $5 notes cost 10.9 cents, $10 notes cost 10.3 cents, $20 and $50 notes cost 10.5 cents and $100 notes cost 12.3 cents. However, this includes only the printed/minted money supply. As of 2017, that amounts to $1.59 trillion USD, of which $1.55 trillion USD is Federal Reserve notes, i.e. paper money. Wait a minute! That’s $1.59 trillion out of $3.5947 trillion USD. That’s a huge discrepancy! Here’s the rub: most U.S. dollars are 100% digital. How much does it cost to produce them? Nothing. U.S. dollars are, for the most part, created out of thin air and exist as nothing other than debt. Fiat currency = debt.”

Inflation, therefore, is an inevitability. As governments increase spending over time, and as more and more money is needed to service existing government debt, inflation will continue to eat away at your savings. By putting money in the bank, i.e. fiat currency, you are automatically committing your savings to gradual decimation and reduction. Even if the bank account has an interest rate of 1% or 2%, how will that make any difference if the rate of inflation is 3% or 5%? As of financial year (FY) 2018, the US federal government debt amounts to $21.48 trillion USD, which is an amount that can never be reasonably paid back. The only way it can ever be paid back would be through a massive increase in the money supply, resulting in massive inflation. At the moment, all that is being done is successive governments pushing the problem down the road for future generations to deal with. The situation in the United Kingdom is not much better, with the national debt amounting to £1.78 trillion GBP, which is 86.58% of total GDP, with the annual cost of servicing the debt standing at £48 billion GBP.

Where does all of this lead? There are only two possibilities. Eventually, governments may decide to default on their debts, or there will be periods of hyperinflation, as seen in the Weimar Republic in Germany, modern-day Venezuela, and Zimbabwe. In the case of social security and healthcare provision, governments are between a rock and a hard place. The US government has borrowed heavily from the Social Security trust fund and the Medicare trust fund, issuing non-marketable IOUs in return. There are cost-of-living escalators built into Social Security payments, preventing simple inflation as a method of paying out on these debts. Whatever happens, there will eventually be a severe debt-related economic crisis that upends the existing financial order, making existing fiat currencies incredibly volatile and potentially worthless. Bitcoin is a hedge against economic crises, as it is essentially deflationary and increases in value over time, while fiat currencies do the opposite. Bitcoin is, therefore, a safeguard against inflation.

- The future economic system will be based on a Bitcoin standard

The inevitable economic crises that will shake the world over the current century will lead to a reassessment of the current economic world order. Just as we moved from seashells to precious metals, and from a gold standard to fiat currencies, including paper and digital cash, the next inevitable stage in the development of money is the adoption of a cryptocurrency standard. For the reasons already mentioned above, i.e. network effect, immutability, decentralization, scarcity, trustlessness, and fungibility, that standard has to be Bitcoin. Bitcoin will be, in other words, the new digital gold standard for the world financial order. How will this work, given that Bitcoin, as Nick Szabo admits, has sacrificed computational scalability for social scalability? Bitcoin has a capacity, at the moment, to verify some 350,000 transactions per day, which is, Saifedean Ammous informs us, sufficient to allow for the existence of a global network of 850 banks which can each have one daily transaction with every other bank on the network. In other words, Bitcoin would function as a global settlement layer, in much the same way that gold used to do during the Gilded Age. Wait a minute, though, you might protest, isn’t the whole point of Bitcoin to get rid of central banks? Isn’t the point to allow individuals to make peer-to-peer transactions on their own? That is correct. Bitcoin is a censorship-resistant peer-to-peer digital store of value and sound money. There’s nothing to stop individuals from owning Bitcoin and using it directly. That will always be possible. One would imagine that people will own fractions of a Bitcoin as a personal savings account, and it will still be used directly for major purchases, such as buying a house, dowry/bride price for a wedding, investment in a trust fund, paying for college, etc. Financial institutions would also no doubt use Bitcoin in ETFs and hedge funds. Nevertheless, are you going to use it directly to buy coffee with? Probably not. Due to high demand for Bitcoin, direct transactions might take several minutes and cost a few dollars, so it wouldn’t really be worth it to use the blockchain for direct transactions. Bitcoin Cash (BCH) seeks to address this issue by endlessly increasing the block size, but it misses the point entirely. NOBODY needs or wants to use Bitcoin to buy coffee.

As Nick Szabo informs us, from the very beginning, when he made his Bitgold proposal (which was directly implemented as Bitcoin according to Satoshi Nakamoto himself), he foresaw that two layers would be needed—a basic settlement layer, and a slightly less-trustless payment layer. In other words, the blockchain would be used for settling accounts while the payment system would be used for everyday transactions. This secondary layer of Bitcoin, called the Lightning Network (LN), is currently under development and is already being used in Bern, Switzerland. energyKitchen, which is located in Switzerland’s capital, has begun offering coffee, drinks and food using both Bitcoin and the Lightning Network (LN) as payment methods, meaning that you can already use the secondary payment layer that Nick Szabo envisaged when he created the concept behind Bitcoin. The purpose of a central bank, as it is currently understood, is to be a lender of last resort to the banking sector during a financial crisis, as well as printing the national currency and having other supervisory and regulatory powers. This seems to differ vastly from central banks as Ammous appears to conceive them. According to the Lightning Network whitepaper, “the blockchain as a payment platform, by itself, cannot cover the world’s commerce anytime in the near future”. In order to achieve greater scalability than VISA and other existing payment systems, the Lightning Network uses a network of micropayment channels to scale to billions of transactions per day without relying on a separate trusted network.

There are currently about 181 central banks in the world, serving the traditional purpose of a central bank, which is to control the money supply. This will not be the case in the future. Ammous describes the 850 central banks he envisages as “a network of global peers, rather than a global hegemonic centralized order.” As no individual bank can inflate the money supply, Bitcoin becomes “a more attractive store of value proposition than national currencies whose creation was precisely so their supply can be increased to finance governments.” The question arises: who creates these central banks, and what authority do they have? I think the answer to that may vary. In some cases, existing central banks, if they still exist, may take on such a role, perhaps under government influence. In other cases, the free market may simply bring these banks into existence. Individuals, investors, and financiers may come together and set up Bitcoin-based banks, which then become dominant as countries and nations shift away from fiat-based currencies to a Bitcoin standard. In other words, they are created through individual initiatives and financing, and they take on the role of central banks through natural evolution. The market has a need, and the market provides. They settle at around 850 such institutions, due to the capacities of the Bitcoin blockchain. In other words, they will organically be created and take on the role that Ammous projects. Banks which fail to adjust to this economic shift will fail and collapse or go out of business. Governments may set up sovereign wealth funds in Bitcoin, thus further reducing the available supply, which will already be limited to no more than 17 million BTC. Thus, the earlier projection of around $18,823,529.41 USD, which I made above, is probably quite low. If more than 200 sovereign nations each set up strategic Bitcoin reserve funds, and 850 central banks also try to maintain a Bitcoin reserve for settlement purposes, then the demand for Bitcoin will be incredibly high, while the circulating supply will be incredibly low, meaning that 1 BTC would probably be worth in the 100s of millions of USD by today’s standards. That figure is not based on anything substantive; it’s just a speculative stab in the dark.

- Bitcoin is a legacy for future generations

Given everything that we have established above, assuming that you accept the arguments laid out as being valid, then Bitcoin is an increasingly valuable asset. The first Bitcoin transaction consisted of a purchase of two pizzas from Papa John’s for 10,000 BTC on May 22, 2010 (worth roughly $82 million USD as of May 2018). This has gone down in history as ‘Bitcoin Pizza Day’. At the time, those 10,000 BTC were worth about $30. The person who spent these Bitcoins was Laszlo Hanyecz and the person who sent him the pizza was called jercos. Hanyecz hasn’t disappeared, however. He’s still around and still using Bitcoin. This February (2018), he repeated the transaction, sending $67 worth of Bitcoin (0.00649 BTC) to a friend in London in exchange for two pizzas to be delivered to him in Florida, this time using the Lightning Network (LN), which keeps the fees of the transaction incredibly low. From January 2009 until March 2010, Bitcoin was being mined on people’s hard-drives and had no monetary value at all. On 17 March 2010, the first Bitcoin exchange, BitcoinMarket.com, which is now defunct, started up and 1 Bitcoin had a value of $0.003, which is less than a third of a penny. By July of the same year, the price had increased to $0.08, by October $0.125, and, from February to April 2011, it traded at about $1.00. By July of the same year, it reached $31 USD, before crashing to $2; then up to $13 again by December 2012, until it reached another all-time-high, this time of $266, on 11 April 2013. Again, this was followed by a crash to $130, and down to $100 by June 2013. In November 2013, Bitcoin reached $1,242 per coin, before crashing hard to $600. This was followed by an extended bear market, with Bitcoin going from $200 to $300 in March of 2015. By November 2016, Bitcoin had reached $780, as the Chinese Renminbi depreciated against the US dollar, eventually accelerating to $1,150 by January of 2017, and it reached $1,290 by the 2nd or 3rd of March. By May 2017, the price of Bitcoin had accelerated to $2000, by August to $4,400, by September to $5,000, by November to $8,000 and, amazingly, by 15 December 2017, Bitcoin reached $17,900. The price crashed thereafter, falling to $13,800 and finally, on 5 February 2018, it hit a low of $6,200 USD. Since then, it has traded mostly in the $6,000 - $7,000 range. Anyone who looks at the broad picture can see that Bitcoin’s value has exploded since 2010 and has gone through periodic market cycles, including both bull and bear markets, price explosions, all-time-highs and price crashes. The crashes, however, never reduce Bitcoin to a value of zero. Rather, over all, the price continues to rise throughout time, and its eventual rise to $30,000, $50,000, $100,000 and even $200,000, $250,000, $500,000 and $1 million are all simply mathematical and economic inevitabilities, for the reasons explained in the 10 points above, as well as in my ‘What is Bitcoin’ article, and ‘Bitcoin: What is it?’ video.

The price of Bitcoin has been notoriously difficult to predict, as its value depends on a number of factors, and market sentiment is often affected by the spread of ‘Fear, Uncertainty and Doubt’ (or FUD for short), as well as other geopolitical factors. Factors within the Bitcoin community, such as hard-forks and disagreements, e.g. the Bitcoin Cash (BCH) hard-fork, can also affect the price. Thankfully, the complete failure of the Bitcoin Cash experiment, and its further fragmentation, should deter future attempts to split the blockchain and Bitcoin community. There are several prominent Bitcoin predictions at the moment, each of which could be more or less right or wrong or could be less or more accurate than the others. Notable among these include predictions by Tim Draper, John McAfee, Max Keiser, Mike Novogratz, Marc Van der Chijs, as well as sundry predictions from various organizations, financial institutions, funds and think tanks. At the lower end of the prediction range, Daniel Mark Harrison predicts that Bitcoin will be worth $30,000 by 2020. BTCC CEO Bobby Lee predicts that Bitcoin will surpass $60,000 by 2020, reaching a total circulation value of $1 trillion USD. Arguing that “world’s central banks are disintegrating”, Max Keiser (in May 2018) predicted that $28,000 is “still in play” for 2018; he had earlier, in 2017, predicted that Bitcoin would eventually reach $100,000. Saxobank’s Kay Van-Peterson also foresees a $100,000 Bitcoin within ten years, e.g. by around 2026. Jihan Wu of Bitmain predicted in 2017 that Bitcoin would reach a value of $100,000 by 2022. Marc van der Chijs, Dutch millionaire and entrepreneur, predicts that Bitcoin will hit $150,000 by 2021. Tim Draper predicted (in April 2018) that Bitcoin will reach $250,000 by 2022, multiplying by 30 times within four years. John McAfee, the creator of McAfee anti-virus, meanwhile, maintains his prediction that Bitcoin will hit $1 million USD by 2020, which is, by far, the most extreme prediction. Iqbal Gandham, the UK managing director of eToro trading platform, argues that Bitcoin will have to eventually reach $1 million in value before it can become a viable monetary unit, with each Satoshi being worth about 1 penny. Such predictions, whether true or not in the short term, can become self-fulfilling prophecies due to their effect on market sentiment and awareness of Bitcoin. They are also useful for gaining a perspective on the potentialities of Bitcoin and its eventual, inevitable rise in value over the long term.

This is not to forget, of course, the notorious predictions of anti-Bitcoin economists, usually of the Keynesian tradition, who gloat at every dip in Bitcoin’s price and always predict that it will eventually reach $0.00, which is a virtual impossibility (even if it fails overall, people will still treat Bitcoin as a collectible, so it will always have value). Notable among these FUDders and nocoiners extraordinaire are: economists Joseph Stiglitz, Paul Krugman, Robert Shiller, as well as Jamie Dimon, CEO of JP Morgan. These individuals are simply out of their time and unable to understand the vast paradigm shift that Bitcoin has brought to the world. In fact, some of them are so brazen, e.g. Joseph Stiglitz, as to say that Bitcoin should be outlawed. It is ironic that distinguished economists should be so myopic and short-sighted—not to mention malicious in intent towards Bitcoin—as this. A Nobel prize, it seems, does not a good economist make. Nevertheless, the only thing that can account for such malice and negativity towards Bitcoin, on the part of these distinguished economists and financiers, is fear. Either they fail to understand the economics of Bitcoin, or they fear what it represents: a complete revolution in the financial world order—the replacement of the existing fiat currency-system with a Bitcoin standard. Surprisingly, perhaps, other notable individuals, such as Christine Lagarde of the International Monetary Fund (IMF), argue that Bitcoin should not be dismissed as it could have many useful applications. Even Jamie Dimon admitted, eventually, that he regretted calling Bitcoin a fraud, and that he believes in the technology behind it. This, of course, is another obfuscation, as blockchain technology and Bitcoin cannot really be separated, since Bitcoin is the only real application of blockchain technology as sound money. All of this FUD, of course, should be ignored, just as one should rightly have ignored the critics of other new technologies, such as the aeroplane or the internet.

Buying and holding Bitcoin means investing in the future that Bitcoin will bring about. As old financial systems and currencies fail, the economic aftermath will be devastating. Countries now face unsustainable sovereign debt, without holding sufficient quantities of tangible assets which will bring stability later on, e.g. silver, gold, platinum and palladium. Nixon took the US off the gold standard in 1973, resulting in high inflation and high unemployment, according to Kadlec (2011). Gordon Browne, who was Chancellor of the Exchequer in the late 1990s and early 2000s, sold off 395 tonnes of gold, helping to drive the price of gold to a 20-year low. The value of the gold was about $3.5 billion dollars; however, had he waited until 2009, it would have been worth about $10.5 billion. This decision is characteristic of the times we currently live in, when the currency is allowed to be debased and devalued to serve political agendas. Eventually, as the economic situation of the world becomes unsustainable, and peoples and nations need to have a solid store of value, a Bitcoin standard will gradually emerge, as more and more nations, banks, hedge funds and individuals turn to Bitcoin as a safe haven and hedge against inflation. Bitcoin will allow for the emergence of a new type of economy, and a new golden age of commerce, free market capitalism and prosperity—an economic boom the like of which we have never witnessed before.

“The world needs,” Saifedean Ammous writes, “a liquid and easily-accessible sound money.” Moreover, “the real significance of bitcoin is that it has given everyone in the world the chance to save their wealth in easily-accessible sound money that cannot be inflated by any authority in the world.” By buying and holding Bitcoin, you are investing in a future of economic prosperity and growth—a new Gilded Age.

NJ Bridgewater