2 November 2017

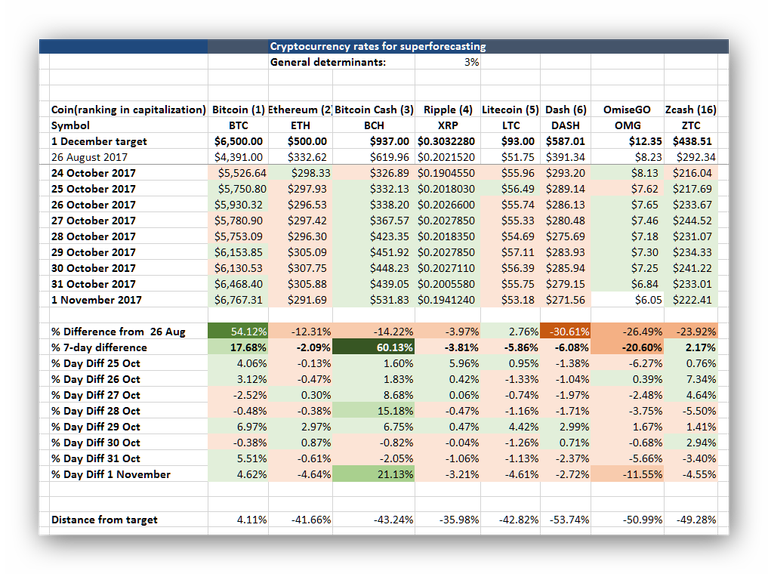

Nothing that happened on the markets this week contradicted my previous commentary: bitcoin remains the dominant game in town, largely scoring off the alt coins. Its dominance of the crypto market reached 62%. There are two developments that can explain its current resurgence (see below).

Ethereum continues on its rocky road while investors/speculators pile their cash into bitcoin. But on a 7-day comparison it was only 2% down. It lost 4.6% of its price on 1 November, wiping out previous gains.

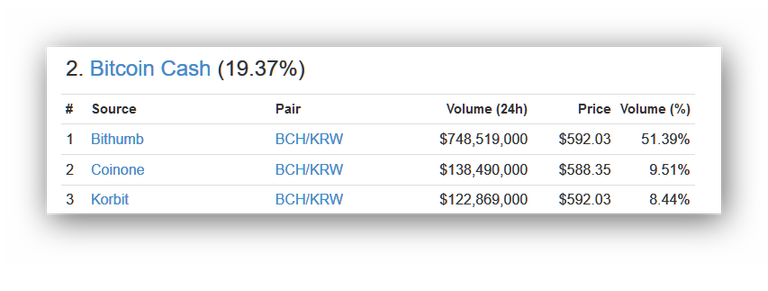

Bitcoin Cash (BCH) might seem the outlier, climbing 64% in the week that saw the 9th anniversary of bitcoin's launch, but the top three trading exchanges were all in Korea.

altcointoday said on 28 October: "No one knows for sure why the Bitcoin Cash price is increasing now, though. More specifically, there is no apparent reason for this currency to go up in value over any other altcoins in existence right now."

My immediate judgement would be that Korean refuge investors are balking at the BTC price, thinking it cannot hold, and counting on BCH to come into balance with it.

Major losers included three coins I am following and/or have bought: Cardano/ADA (down 26.54% at midday on 2 November), ARK (down 20%) and Monaco, which has finally announced its prepaid Visa card in Singapore (down 22.13%). All three are minor figures on the cryptoscene, however, and I have therefore not included them in my line-up.

Background to tokens followed

I've profiled the seven tokens I am tracking here.

Crypto developments

The two developments that have given bitcoin added strength are:

CME announces plan for crypto hedge trading

The new futures contracts will be settled in cash, based on the CME 'CF Bitcoin Reference Rate', a once-a-day reference rate of the U.S. dollar price of bitcoin, CME said.

Jemima Kelly of Reuters observed: "The aggregate value of all cryptocurrencies hit a record high of around $184 billion on Wednesday, according to industry website Coinmarketcap, making their reported market value worth around the same as that of Goldman Sachs and Morgan Stanley combined."

Its main benefit to cryptocurrency investors is that they can mor easily hedge against potential losses.

Others were skeptical. CNBC's headline was: Bitcoin futures approval sparks fears: 'The financial crisis all over again'. This because of concerns that investors might get in over their heads. But CME hasn't yet said who will be able to trade, and some analysts expect the market to be limited to largescale professional investors.

Score: +1% for crypto validity

(I'd put it higher but it is not operational yet.)

Amazon buys three cryptocurrency domain names

Following weeks of rumours that Amazon might accept crypto for purchases (denied last month), USA Today reported on 1 November that the company had secured three domain names to cryptocurrency.

Citing DomainNameWire, USA Today said: "The domains are: amazonethereum.com, amazoncryptocurrency.com, amazoncryptocurrencies.com." Amazon reportedly registered them on 31 October.

"According to Coindesk, Amazon signed up for the domain amazonbitcoin.com three years ago. Amazonbitcoin.com now takes you straight to Amazon.com," USA Today added.

Score: +1% for crypto validity

(Not so much for the story as its diffusion by a mainstream non-specialist media outlet.)

U.S: Congress to approve law allowing crypto investment

One of the major crypto tipsters (with something like 80,000 followers), Teeka Tiwari of the Palm Beach Research Group's Palm Beach Confidential, reported that the U.S. Congress is due to pass a new currency law to go into effect on 1 January.

This, he predicted, could send bitcoin & co soaring. "When the same law was passed in Europe, Bitcoin jumped 80% in two weeks," he said. "When a similar law passed in Japan earlier this year, it helped send the entire crypto market over 100% and break out to all-time highs."

The difference in the assets investors hold in the U.S. vs Japan and Europe could pump the bitcoin price considerably, he notes. He is offering an "emergency briefing" via his site on 2 November 2017 at 8pm U.S. Eastern time, repeating at 8pm Pacific time.

Score: +1% on validity

(would be higher, but not confirmed, worth scoring because of Tiwari's influence.)

Minor news

BookMaker.eu Becomes First Online Gaming Industry Site to Accept 60+ Cryptocurrencies

Bookmaker.eu announced on 30 October it has become "the first and only website in the online gaming industry to accept more than 60 cryptocurrencies for deposit and withdrawal".

More than 90 percent of the website’s customers use Bitcoin to fund their accounts, said blockchain news.

"Clients at BookMaker can withdraw funds for free using the cryptocurrency option. They are afforded one free payout per day, five free payouts per week and 25 free payouts per month."

Its website currently makes no announcement of the news, offering only the bitcoin option.

New Zealand Regulator: Cryptocurrencies Are Securities

The statement on 25 October is interpreted by coindesk on 1 November as saying that cryptos are securities.

It sets out legal obligations for firms offering cryptocurrency services, including registration.

This ruling contrasts with U.S. systems that consider cryptos as property (subject to capital gains tax).

Coindesk also reported that the regulator, could provide exemptions from current laws to companies in an effort to "promote innovation and flexibility".

(Not scored because of the limited size of the New Zealand crypto market.)

Monaco cryptocurrency prepaid card program receives green light

Cryptoninjas reported on 31 October: "Monaco [...]announced today that its Visa prepaid card program has received the green light from the card issuer, a leading company in payment processing and issuing products in Singapore.

The global rollout of the programme is expected to follow, cryptoninjas reported.

"The Monaco Visa prepaid cards work anywhere Visa is accepted, allowing users to spend legal tender currency converted from cryptocurrency without currency exchange fees. All cryptocurrency exchanges to legal tender currency will be managed by Monaco before users transact on the Visa network."

Kris Marszalek, co-founder and CEO of Monaco, said over 17,000 cards had been reserved. Only the no-MCO-investment card carries the Visa logo on the website.

It suggests users will save 5-8% on high street bank and exchange charges, and save €30.40 on every €500 equivalent spent.

Slovenia 'Primed to Become a Blockchain Haven'

This was the verdict of Slovene commentator Zenel Batagelj on bitcoin magazine last Tuesday (31 October 2017). He was reacting to a speech by the Slovene Prime Minister published on 17 October.

PM Miro Cerar declared: "We want to position Slovenia as the most recognised blockchain destination in the European Union, which will have established all of the infrastructure necessary for its implementation and development."

He added:

Slovenia as a whole is [...] setting itself up as a blockchain-friendly destination, and to that end it is establishing the pillars of a national blockchain ecosystem in the area of the transfer and spread of information, the adoption of legal regulations and the promotion of a supportive environment for the development of companies working in the area of blockchain technology.

He said a Blockchain Think Tank, connecting all stakeholders, will serve as a single contact point for discussions with the state. "The think tank’s activities will be focused on education and awareness-raising, the drafting of legislative proposals and solutions, and linking Slovenian knowledge and awareness with respect to Industry 4.0."

The bitcoin magazine commentator observed: "The first clear signal that the government was prepared to make some serious moves was during July’s Blockchain Meetup Slovenia 2017, which hosted more than 300 blockchain enthusiasts."

He noted that Slovenia is "the country from which the most significant EU blockchain companies originate, including ICONOMI, Cofound.it and Bitstamp, and the country with the highest market capitalization per capita of blockchain projects."

Vietnam's Central Bank Announces Cryptocurrency Ban, Fines

On October 28, the state-owned newspaper Người Lao Động, which translates to "The Worker", reported that the measures would go into effect on January 1, 2018.

"Those caught using bitcoin, which the article mentions by name, or other cryptocurrencies as a means of payment will be subject to a fine ranging from 150 to 200 million đong, equivalent to roughly $6,600 to $8,800 at time of press," reported Adam Reese of ethnews on 30 October.

coingeek's Cecille de Jenus pointed out: "No mention of mining and blockchain technology in its entirety, however."

Average energy cost of a bitcoin: 20 barrels of oil

Daryn Pollock of the cointelegraph has calculated that with the Bitcoin mining industry consuming 22.5 TWh of energy annually, the equivalent of 13,239,916 barrels of oil, and 12.5 bitcoins being mined every 10 minutes, the average energy cost of one Bitcoin equates to 20 barrels of oil.

"It seems an inordinate amount of oil to be spending on mining a digital currency, yet when considering the worth of one coin, which is now valued at more than 100 barrels of oil, it becomes understandable," he points out.

On the other hand, "the total energy consumption of the world’s Bitcoin mining activities is more than 40 times greater than that required to power the entire Visa network."

China has some of the world's cheapest electricity, so no wonder it has been a bitcoin mining hub. Russia had thought of subsidizing mining, but both countries are not so keen on allowing bitcoins in their ecosystem.

"Many mining companies are looking to places like Iceland and Kazakhstan, where the temperatures are lower and there’s no need to spend money on cooling," Pollock notes.

Russia Picks Vladivostok as Pilot City to Launch Two Cryptocurrency Agencies

Vladivostok has been selected as a pilot city in Russia to launch two cryptocurrency agencies, following mandates by president Vladimir Putin. Seminars will be offered where participants can receive certificates allowing them to engage in crypto professions as well as learn to protect themselves from cyber attacks, reported bitcoin.com.

One business is a crypto-advisory agency; the other is a crypto-detective agency, according to Victor Fersht, the director of the Inter-University Center for the World Trade Organization (WTO), as quoted by Prima Media.

President Vladimir Putin has ordered cryptocurrency regulations to be finalized by July of next year. Tass reported the Vladivostok crypto-advisory agency will be the first in Russia aimed at providing advice to citizens who want to work with cryptocurrencies. The agency

"will begin work on November 15 and will be open to all, anyone will be able to come and get advice." There will also be regular seminars starting on that day for people who want to work with cryptocurrencies, such as advisors and mentors.

Prima Media said the crypto-detective agency for the Far East will be based on Interpol. It will help citizens "learn to protect themselves from fake cyber-wallets, phishing sites, and hacker attacks." It quoted Fersht as stating: "If this project proves [to be] successful, then in the middle of next year, this structure will join the federal crypto-detective agency."

Coinone, Korea's No 2 exchange, incorporates Litecoin trading

Within 24 hours since its integration of Litecoin, Coinone has processed $3.4 million worth of Litecoin-to-Korean won trades, becoming the ninth largest Litecoin exchange in the market, reported Alex Tomzack of ethereumworldnew.com on 30 October.

The largest, Bithumb, delivers 25 percent of the global-LTC-trading per daily. That part concludes with $38.2 million worth of LTC-KRW trades being paired in Bithumb which is double the volume of GDAX, he notes.

Coinone targets retail traders, high profile investors and institutional investors in the financial industy and community, he adds.

Indicators

I've listed my seven indicators and explanations of what I consider important here.

Previous days' commentaries

Excel version

Click here for an Excel 1997-2003 version of this table with records key records, free for download.

There's also an Excel version of the shorter summary screenshot used above.

i have done its your turn to my post