Closing summary: Bitcoin futures fall as CME trading begins

Time for a recap.

Bitcoin has made a subdued debut onto the world’s largest futures exchange, as a series of politicians and officials voiced concerns about the digital currency.

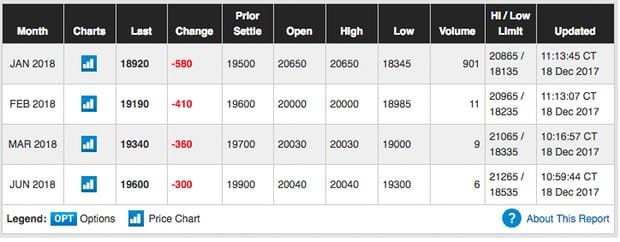

The Chicago Mercantile Exchange (CME) became the second exchange to offer bitcoin derivatives trading last night. And right now, bitcoin futures contracts which settle in 2018 have all fallen below their opening value.

The January 2018 contract, which initially spiked over $20,000, has now dropped back to $18,920 - having been originally priced at $19,500.

Contracts that mature in February, March and June are all in the red (although they’ve received little attention compared to the January option).

Futures contracts allow traders to bet against an asset, so today’s moves could suggest that bitcoin’s stunning rally is running out of steam. But, less than 1,000 contracts have been traded today (each one is worth 5 bitcoins).

The spot price of bitcoin has also dipped, currently down 1.6% at $18,640 - having hit a new alltime high near $20,000 last night.

CME’s launch of bitcoin futures was accompanied by a series of warnings. For example:

Denmark’s top central banker said bitcoin was dangerous, and investors shouldn’t blame regulators if they lost their money.

A senior Singaporean regulator said bitcoin had no intrinsic value

France’s finance minister is pushing for the G20 to debate bitcoin regulation

UBS’s chairmen, Axel Weber, said regulators should take a closer look at digital currencies

Analysts at ING also put the boot into bitcoin, saying it would eventually become just a ‘niche product’ again.

ING cited bitcoin’s volatility, scalability issues, and the shadow of regulation among several reasons why it would not replace traditional cash.

So those buyers who are hoping to sell their bitcoins at an even higher price in the future may be disappointed, they say:

We are enthusiastic about blockchain technology, and the current attention for Bitcoin could boost blockchain and digital currencies’ development. But as we have argued above, we doubt whether Bitcoin itself has what it takes to become a serious mainstream payment systems contender. Instead, we think it is more likely for Bitcoin to return to its roots as a niche payment system. A niche asset adopted worldwide could still have a substantial user base and hence value. It is therefore impossible to say whether the current Bitcoin market price is “too high” for a niche asset.

Then again, we join the crowd of analysts observing typical bubble characteristics: the idea of an asset that is new, revolutionary, almost magic – hard to understand, but let’s invest anyway because it will become huge. This idea is a form of “this time it’s different”-thinking. “Yes we know about all those previous bubbles that popped, but Bitcoin is really, really different.” We are not so sure.

Not indicating that the content you copy/paste is not your original work could be seen as plagiarism.

Some tips to share content and add value:

Repeated plagiarized posts are considered spam. Spam is discouraged by the community, and may result in action from the cheetah bot.

Creative Commons: If you are posting content under a Creative Commons license, please attribute and link according to the specific license. If you are posting content under CC0 or Public Domain please consider noting that at the end of your post.

If you are actually the original author, please do reply to let us know!

Thank You!

More Info: Abuse Guide - 2017.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.theguardian.com/business/live/2017/dec/18/bitcoin-bubble-ubs-futures-trading-20000-cme-stock-markets-tax-business-live