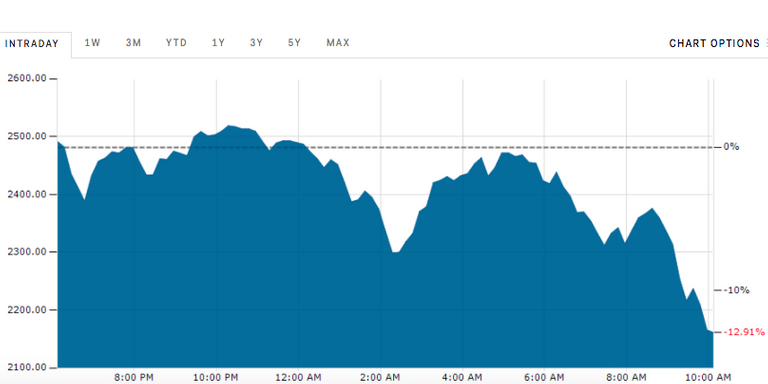

It's an unpleasant begin to the week for bitcoin. The digital money exchanges down 4.38% at $2,483 a coin, a one-week low.

Monday's activity is by all accounts a continuation of the offering that grew last Wednesday, the day match Ethereum streak slammed from $296 to $0.10 before recuperating its misfortunes.

Bitcoin is down around 9.5% since Wednesday's opening print.

The current shortcoming in bitcoin comes following a keep running up of over 200% to begin the year. Bitcoin's 2017 increases have been impelled by overwhelming purchasing from China and Japan.

Late quality has gone ahead the heels of China's three greatest trades continuing withdrawals interestingly since February and Japan naming bitcoin a lawful installment technique back toward the beginning of April. Also, Russia's biggest online retailer started tolerating bitcoin despite the fact that has Russia said it wouldn't consider the utilization of the cryptographic money until 2018.

Yet, the enormous additions have made some suspicion starting late. Extremely rich person Mark Cuban called bitcoin a "rise" as the cryptographic money hit its then unsurpassed high on June 6. "I believe it's in an air pocket. I simply don't know when or the amount it revises. At the point when everybody is gloating about how simple they are making $=bubble," Cuban tweeted.

About seven days after the fact, Goldman Sachs head of specialized technique Sheba Jafari composed bitcoin was looking "substantial" and due for a drop to as low as $1,915 before observing a rally. It put in a low of $2,076 before arousing to practically $2,800.

There still stays one major obscure. Back in March, the US Securities and Exchange Commission rejected two bitcoin trade exchanged assets. It has since taken open remark on its choice with respect to an ETF begun by the Winklevoss twins, yet it has not made an extra running the show.