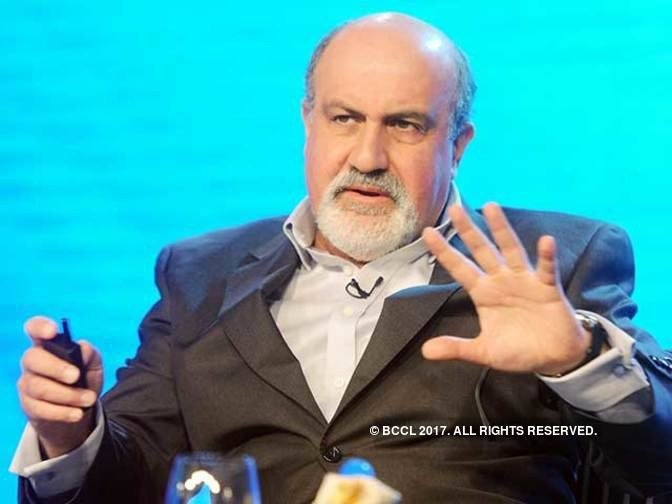

One more bullish view got added in favour of bitcoin last week. This time it came from Nassim Nicholas Taleb, an American-Lebanese academic and hedge fund manager, who believes that bitcoin can touch $1,00,000 and there is no way to properly short the bitcoin ‘bubble’. One of the top modern philosophers, Taleb is known for predicting black swan events. He predicted the 2008 crisis, 2016 US presidential election and the outcome of Brexit vote. In his tweet Taleb said, “No, there is NO way to properly short the bitcoin “bubble”. Any strategy that doesn"t entail options is nonergodic (subjected to blowup). Just as one couldn’t rule out 5K, then 10K, one can"t rule out 100K.” He tweeted just before the future trading in bitcoin went live last night. Taleb has around 2.28 lakh followers on Twitter. In another tweet, he said, “Note that Bitcoin has a limited number of natural sellers. The entire concept is very concave supply (it costs more and more to extract). The number of producers shrinks with time.” Bitcoin recently surpassed the $19,000 level last week. The e-currency was trading at 22 per cent up at $16,796.16 at around 11.25 am (IST), according to the data available with coingecko.com. The sudden spike in bitcoin prices were witnessed on Monday after first-ever bitcoin future began trading on Sunday, as the increasingly popular virtual currency made its debut on a major US exchange. Cyber security pioneer John McAfee in a tweet earlier said, “Those of you in the old school who believe this is a bubble simply have not understood the new mathematics of the blockchain, or you did not cared enough to try. Bubbles are mathematically impossible in this new paradigm. So are corrections and all else.” Back home, the government is planning to set up a panel to decide on bitcoin policy, ETNow reported on Monday quoting agencies. Meanwhile, the Reserve Bank of India (RBI) had also warned the public of the risks of virtual currencies (VCs). The apex bank last week reiterated its stand that “it has not given any licence or authorisation to any entity or company to operate such schemes or deal with Bitcoin or any VC.” "In the wake of a significant spurt in the valuation of many VCs and rapid growth in Initial Coin Offerings (ICOs), RBI reiterates the concerns," the central bank said in a statement.