Another uneventful 24 hours has passed in the Bitcoin market with little to no conviction in either direction, save trending slightly further to the downside. So what can we expect, what is going on and what are the indicators telling us?

Starting at the 2 hour, we are in a down trending channel battling with the 77 (orange) period moving average. The prior break of this key moving average occurred at $18,000 and took us down to $10,700 (41% decline), the most recent break down occurred at 7 p.m. yesterday at a price of $14,700; a similar decline would put us at $6027. This is unlikely but it is a possibility. It is entirely more likely that we will break $10,000 to the downside and find support at longer term moving averages from the 1 day, 3 day etc. If you look at the chart provided you can see how this average acts as support to the downside but also as resistance to the upside.

At 3 points on the chart provided you will see that this average served as a bounce point for further gains during the bull run. You will now more than likely see it act as resistance to the upside as we enter decidedly more bearish territory. We are below 0 on the MACD, but we are oversold, highest volume has been to the selling side so expect more ranging behavior with each high being lower than the one before until we find a true bottom. Based on current behavior I would look for a high in the neighborhood of $14,200-$14,500 before it breaks down again to test a lower low.

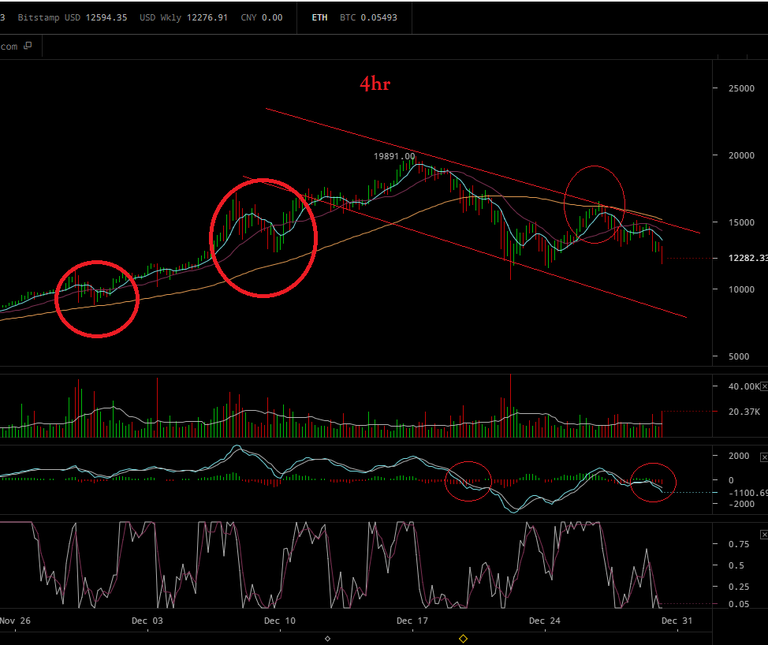

Moving to the 4 hour time frame the story is essentially the same. In the past the 77 has provided support where it now provides resistance. In this time frame we are still in a downwards trend, demonstrating lower highs and lower lows. The majority of the volume has been to the selling side, Stoch RSI has us oversold, and we are below the MACD 0. Rough interpretation, ranging behavior to be expected with lower highs and lower lows until a floor is found.

On to the 6 hour where things look better for those interested in trading the trend, but decidedly worse for those HODLING. We again see that the 77 is acting as a strong ceiling against further gains, we also now see that this moving average has reached an apex and is trending in the downwards direction. This coincides with my opinions of what is to occur based on the aforementioned smaller time frames. As this moving average continues downwards expect it to provide resistance to the upside at ever decreasing price points. As we are so far below the average for the moment, expect BTC to battle its way back up to it in the coming days before breaking down once more to test the bottom. The MACD 0 will also serve as resistance to the upside, leading me to the opinion that the current path of least resistance is down.

If I were a Bitcoin enthusiast looking to make big money on Bitcoin over the next week or so, I would really not be loving the 12 hour time frame save the fact that we may be at the bottom of the current selling period for this frame (too early to tell). Regardless in a MOST BEARISH way price has broken below the 77 period moving average for this time frame as well. That said all is not lost as the 7 and 21 period moving averages have not broken below the 77 so we may as well get a bounce upwards as price fights to stay afloat. The other information we can gather from this chart is that after the 7 (blue line) broke below (small red circle) the 21 (purple line), the 21 served as resistance to the upside (large red circle) for the shorter term moving average.

If you look at it now, the 21 appears to be driving the 7 into the 77 which will create two possibilities. The 7 breaks the 77 leading to a sharp decline which pulls the 21 below the 77 as well; in which case we are well on our way towards a full bear market. In this eventuality the 77 will serve as resistance to the upside forcing prices lower as it reaches an apex and likewise begins to head south. Think of it like a game of “whack a mole” price will get smacked down, come back up to the 77 and get smacked down again until we find a bottom that investors feel confident in.

The 1 day, looks slightly better in the short term, but not much; we are still in a descending channel. As is the case in the 12 hour time frame, the 7 broke below the 21 and the latter served as resistance to prevent upwards price movement. I would, based on this chart, expect a pull upwards as the 7 tries to break upwards of the 21 again. This will probably occur in the 1nd – 2nd week of January (maybe sooner) around $15,000 or lower. If the 7 fails then we will again see a lower low.

On a positive note, the MACD histogram for this follow up selling period has not allowed price to break below the 77; it seems to have slightly less conviction than the selloff preceding it. We are still above the MACD 0 line, divergence is to the downside (meaning price will come up to eliminate the disparity) and the RSI has us very oversold; all indicators of positive price action to come.

The key battleground will be $10,000, if we can hold that things may turn around. If it fails the next key battle could be fought at the 21 (already broken) and 77 ($5800) of the 3 day chart.

Ethereum and LiteCoin (I am just going to copy what I wrote yesterday as nothing has changed and those points remain valid)

DO NOT GET TRAPPED IN THESE. I all capped it as this is important. There is really no need to go heavy in either of these at the moment as the most probable path is uneventful at best. In the event that BTC takes a dive, ETH and LTC will follow so you lose. In the event that BTC takes off with confirmation of recovery ETH and LTC will MOST LIKELY not follow. For those of us that were around during the $3000 to $1700 crash of BTC and corresponding crash of $400 to $130 for ETH, you will remember ETH shooting to $212 as BTC bottomed out, and then down to $185 as BTC took off on a tear back up to $3000 and beyond. A great many people were left sitting on ETH hoping that it was about to shoot back up to $400 as BTC made its recovery; didn’t happen.

Money cannot be in two places at the same time. People started pulling from ETH and LTC to jump on the BTC train. I would not look for super gains again in either of these till BTC full corrects and trades sideways. This is not to say that there are not gains to be made. The current price of LTC at $250 seems to be a pretty safe bet to go up at some point, and will likely craw to $315 or better before leveling out while BTC does its thing. It is also just as likely to range in the $250-$300 area for the next few weeks in much the same fashion as it did in the $40-$60 ranges a few months ago while BTC was tearing up the charts.

Previous Analysis:

https://steemit.com/bitcoin/@pawsdog/12-29-2017-the-market-view-and-trading-outlook

https://steemit.com/bitcoin/@pawsdog/12-28-2017-the-market-view-and-trading-outlook

https://steemit.com/bitcoin/@pawsdog/12-24-2017-the-market-view-and-trading-outlook

https://steemit.com/bitcoin/@pawsdog/12-19-2017-the-market-view-and-trading-outlook

https://steemit.com/bitcoin/@pawsdog/12-17-2017-the-market-view-and-trading-outlook

https://steemit.com/bitcoin/@pawsdog/12-15-2017-the-market-view-and-trading-outlook

https://steemit.com/bitcoin/@pawsdog/12-12-2017-the-market-view-and-trading-outlook

As I'm still a beginner in trading, I needed this level of analysis. Thank you Pawsdog, it does help. Have you heard about the «Dead Cat Bounce» ? It's a pattern to look at to try to anticipate a bubble explosion. It basically says that after a severe drop, it bounces once and then goes down a lot more. I'm wondering if the little rebound has already happened on the 26th and if we are now on the way down for good (meaning it's a long way to come back higher, even if in crypto space it seems that everything goes faster). The thing I struggle with the most for the moment is to know what period of time is the most relevant for this kind of analysis.

Thanks, I have not heard of that pattern but will look it up

I think you can be assured that BTC has still a lot to grow. A good indicator for that are the Alts, as long as they are moving as beautifully as now there is still plenty of momentum in the market. Best of luck to you and a happy / successful new year!

Great balance between technical and fundamentals, and wonderfully written as always, really enjoyed reading this. Thanks @pawsdog :)

Then you should really enjoy the article of today or the one from yesterday..:)

I always look forward to reading updates from you. Be it your analysis, or your views on the Haejin-Sanders saga. You are well articulated and put a lot of thought into your articles. Like a proud, meticulous military man.

Keep up the great work sir.

Why thank you for the kind words

@pawsdog, I've found your post to be worthy of a resteem and upvote from me. I'm an actual person and I am doing this on behalf of the Resteem - Upvote movement. Join the movement, read about it here: https://steemit.com/grassroots/@jackmiller/the-resteem-and-upvote-movement-you-can-make-a-big-difference

Why thank you. I too being an actual person appreciate it. I am following now, how else may I be of service in a way the benefits the community first, you and lastly myself.

People helping people, it doesn't get simpler than that!

I try and do my part by up voting the comments from lower level members as well as through curation.. Though my .04 does not get people that far.. Just a matter of time until I can be a real force of good. I do appreciate the resteem..

https://steemit.com/stories/@cutminajn/first-childbirth-childbirth-experience-a043973b0b6b9

@cutminajn My friend I am not a big flagger by any means and love for authors to promote their articles. That said I tend to view simply coming in and dropping a link without adding anything to the conversation to be in bad form. As I see your reputation is already a 10, you may be going about it wrong. I did take the time to look at the article and at a glance it does not appear to be a copy paste thing and may be original. Please do revise your above comment, add content relative to the original article or I will flag (which I hate to do) to avoid page spam. I would much rather you add something constructive so as I could upovte you.. thank you.

Feck knows, think you might told me if read more than first sentence but going to follow you and read in morning!

? ok, thank you I think.. whats wrong with the first sentence?

This analysis it the best of your series! You score some kind of TA all time hight!

We shall see.. I get lucky sometimes and sometimes I don't.. lol

I had been a sergeant in Slovenian liberation war 1990 and you also have military experience maybe greater then I have. Thanks god our war was short and not so bloody. But in mili language I can say also:

Private well done! Continue exercise!

p.s. TAF on the end is a force, we should respect some military rules!

Well from one Soldier to another I salute you...:)

Salute returned!