Is Bitcoin Dead?

I ask this not to spread FUD (Fear, Uncertainty and Doubt), but in order to really examine Bitcoin as a product in a competitive market place. Its pro's and con's vs those of its primary competitor.

With the debut of Bitcoin Cash on Coinbase it has instantly become accessible to hundreds of millions of people throughout the globe. This jump onto the premier US based exchange also served to legitimize its status as a true Rival to Bitcoin Core. What is it that makes Bitcoin Core so far superior to Bitcoin Cash that it cannot be killed off? They both strive to achieve the same purpose as a store of value and payment system, yet one (BTC) has brand recognition and the other (BCH) has technological innovation.

Bitcoin |

Bitcoin cash |

|---|---|

Maximum block size of 1MB |

Maximum block size of 8MB |

Allows for 250,000 daily transactions |

Allows for two million daily transactions |

Uses a scaling tool called SegWit2x |

Bigger blocks eliminate the need for a scaling tool |

Average block processing time of ten minutes |

Block processing time adjusts automatically in response to network conditions |

I have no loyalty to either coin, nor do I care which one ends up reigning supreme. For the purposes of this article I am simply looking at them from the standpoint of and investor weighing their respective performance, cost effectiveness, ease of use and ability to be a profitable investment. In the first two categories, and essentially every category related to technology Bitcoin Cash has a significant advantage. It's faster, cheaper, and for all intents and purposes a better product.

In terms of ease of use Bitcoin Core has the overwhelming advantage as an established product. It is accepted more places, has many more applications built around it, and probably of the greatest importance, has established itself as the medium of payment for purchasing Alt Coins. However, it is considerably slower, more cumbersome and the fees associated with its use are several hundred times higher than those of Bitcoin Cash.

Perhaps the only drawback to Bitcoin Cash revolves around the concept of loyalty, decentralization and the threat of a 51% attack. Wherein a single miner, able to generate more than 51% of the blocks, could perform a double spend attack. While this could theoretically be possible; what long term benefit does the miner gain by slaughtering his golden goose? Essentially inciting panic in the network and crashing the price? A quick payday? With the level of sophistication required to mine coins like BTC and BCH and the tens of millions that have been spent on infrastructure to accomplish this task it would be highly unlikely for a miner or group of miners to collude in order to sabotage the very product that makes them profitable.

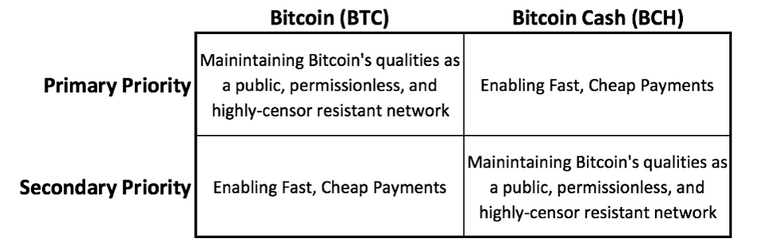

Maybe it is a matter of priorities between the two competing camps. While they both have the same goals they are polar opposites in terms of priority.

Bitcoin core is about privacy and decentralization first, fast and speedy payments come second. Bitcoin Cash puts the business side of the equation first and the people side of the equation second. Bitcoin cash also has extremely high aspirations of going head to head with the likes of paypal. To me this is an absolutely foolish move and one in which the block chain just cannot compete successfully against database driven payment processors.

For example when when John makes a payment to Jane, PayPal can simply update its database to reflect the change in ownership of the money being sent. In contrast to this, to accomplish the same task Bitcoin cash would need to notify tens of thousands of nodes throughout the globe that the transaction occurred, wait for the transaction to be verified and then request that all of these thousands of nodes store record of the transaction forever.

When looking at it from the standpoint of architecture, Bitcoin Cash has little chance of pushing paypal out of the market utilizing the block chain. It will always be simpler to modify a single database (Paypal) as opposed to mass updating thousands of scattered databases around the world (Bitcoin Cash) and requiring that each one store the transaction forever.

So from that standpoint Bitcoin cash is likely chasing an achievable dream and will likely fail. Even then, it would still have technological superiority over Bitcoin Core for the tasks it is performing now.

As I have stated many times before, there is no loyalty in the crypto world and infidelity runs rampant. If one coin is saving money or making money at a faster rate than another, people switch to that coin and leave the other behind.

Ask yourself, if BTC continues dropping 3-5% per day, and BCH gains 4-8% how loyal are you? Are you loyal enough to ride it into the ground? I believe that if BTC fails to make significant improvements in a big way and fast, it is going to watch its market share continually erode. Depending upon how you look at it, in just 4 months, BCH has already captured 20% market share on a the decade old and well established BTC.

Again I am not advocating for either coin, I am loyal to neither, trade them like Pokemon cards, and only care about the end game in terms of investment profitability.

What are your thoughts?

Great writing. Thanks for the read.

I'm not sold on your assertion that only a centralized database can complete enough transactions per second to satisfy the world.

Are you aware of Bitshares? It is on absolute fire right now, (as are many others, I know...) It is on fire because people are now looking for technology which will provide the next step in Bitcoin's evolution. Most are taking a scatter-gun approach to the alt-coin space. Some are more focused.

There is another network available, ready for the primetime... Proof of Work is TOO MUCH WASTED WORK.

I have to agree with you on the debate of centralized ledgers vs decentralized ledgers. Not only will the centralized ledgers not be able to satisfy the sheer quantity of the world's transactions they will also be more expensive in the longer run. DLTs have the potential to drive transaction cost close to zero. A lot of people on eBay would consider switching if they don't have to pay for PayPal fees.

There is also the issue of security. Which is one of the primary selling points of cryptocurrencies in the first place. The blockchain will eventually eliminate these hacking problems like the one faced by Equifax earlier this year.

The last point that you mention about Proof of Working being a wasteful is at the source of the speed problem. Future algorithms will be more efficient and this should speed up transactions.

Interesting take on it.. I believe it will take bit but we will get there eventually

I think these things will happen if blockchain and DLTs reach their full potential. You never know how things will play out. We don't know how PayPal and Visa will react to all of this.

I agree and that is what I find to be disconcerting about the issue. Paypal and Visa have, at their disposal plenty of capital to make a good stand. If I were a corporate executive for either and I saw a threatening fledgling ICO etc. I would either buy it or have the folks in R&D clone it and use our market share to roll it out before the competition could ever get off the ground

Yup, innovation through acquisition... or piracy. There was an estimate by IBM thrown out there that at least 15% of banks will be using blockchain technology by the end of this year.

I think some companies are thinking that they will wait for the dust to settle and after that, they will pick and choose the best innovations and try to merge them into one product.

It always seems to work out that way..

I agree, and I do believe that we will at some point find a block based technology that can compete with the likes of Visa, Mastercard and their ability to process 25,000 transactions a second. We are just not there yet with the current technology, and BCH is most certainly not going to accomplish the task. There is I'm sure an alt coin in the making or one that has yet to be built that will come from no where and rule the space.

I just wrote a post on this topic. I think Bitcoin is living off it's name. $20 transaction fees on my last transaction and it's been stuck for hours now. Just had to speed it up with a parent pays for child (another $40) and it's still stuck. It's slow and expensive.

It was great to start the crypto revolution but it is a dinosaur now. There are faster and cheaper alternatives.

I agree the name is saving bitcoin. That and a store of wealth as well as being traded as the main form of transaction to buy altcoins. I'm not even sure higher transaction fees can bring it down now. Over the long term we shall see.

I read an article on here the other day about an exchange that just started, where the main coin to trade all others was Bitcoin Cash. We might see more adopt this approach in the future.

yeah I don't think it will be to hard for BCH to quickly take the place of BTC. All it really takes is a bit of retooling, some code work and poof, exchanges can now use it as the payment medium. Also what is the link to your article, I don't mind if you post it here. I love a good read. Glad you enjoyed my work...@originalworks

Yeah I agree, like you say it can't be hard to make Bitcoin cash the default payment method over BTC.

https://steemit.com/bitcoin/@somecoolname/is-bitcoin-simply-living-off-it-s-name

I don't normally post my articles in others posts in case by clicking it it takes people away, but since you said it was ok haha :)

I'll put a link to yours in mine to be fair.

Sharing is caring, if I can help you succeed I am only benefiting myself as well. I will read and comment on your article.

I have wondered about this myself. BTC being the first mover allowed it to build name recognition and a critical mass of users which has driven up the price.

However, there are disadvantages to being the first mover. Sometimes the first mover ends being the first to fail. There are advantages to being second and the advantage is being able to learn from the mistakes of the first mover.

Most of the new cryptocurrencies out there address some initial weakness of BTC. Whether it be speed of the transaction, choosing proof of work vs proof of stake, or technical capabilities like smart contract integration.

Sometimes the ones that come later end up winning, Facebook was definitely not the first social network.

Myspace what? lol. You are correct.. I think there is a strong possibility that BTC could die... and BCH or even its successor could take it's place. In a technological field you must keep advancing your technology to stay ahead bitcoin has failed to do this.

great post! glad our little debate ended up in a new contact that provides this kind of content :-)

At the moment I feel I'm holding to much BTC, it makes about 30% of my portfolio. With the new wave coming, I'm going to sell a chunk and reinvest it in some more Alts, I guess BTG and BCH will be on my list.

Diversification is key imho, best wishes!

Edit: I didn't see you mentioning the lightning update for BTC, keep that in mind

I am glad you enjoy the post, and I thank you for your kind words. I can see through this connection that STEEMIT does have potential as even though we started off on the wrong foot we were able to come to an understanding and begin nurturing a networking opportunity.

well I've found our discussion not anyhow upsetting but very constructiv instead.

there were unfortunately some other members that got quit emotional and it is a pitty if this is what draws your image of the community. Keep up your work!

Why thank you, I did find it quite odd that so many individuals on both sides (bernie and haijin) were so emotionally attached to the issue, that they went as far to attacking and down vote me as well. I have no horse in that race and as I always do was looking at the issue from an outside, analytical perspective in regards to the long term survival of the STEEMIT ecosystem. I tried to come in from a more neutral perspective, and point out potential flaws within the system that allow the type of conduct that has created all the hate and discontent in regards to the issue. I randomly tweeted at ned this a.m. as apparently we need a ruling from up high on way or the other to get off the issue and back on track. Whether or not there will be a response I have no idea, but we all need to find a solution and stop stacking ourselves up on different sides of the fence, poking each other over the top with pitch forks. I may write an article about the entirety of the issue today as it seems to be a hot topic within the community. I'm just not sure that I want that type of heat on my account, of course any press is good press to some extent. Again, thanks I look forward to speaking with you more in the future.

Bitcoin is grandpa and is slow and senile. My last transaction is confirming from yesterday 11th o'clock. Coins are for trade. They are not collectible items.

So really R.I.P Bitcoin it's time to go into history!!

I'm thinking that you may be correct, it will be interesting to see what the end result of all this is.

At the end of the day I think that there is a possible use of all three forks of bitcoin. I wouldn't want any of these coins to hit zero and I feel that this is just the beginning, regardless of the problems the coins still have to overcome. The crypto scene has matured quite a bit since 2013 but it still has a lot of growing up to do. I think that bitcoin might be used for large and long-term storing of value in the long run due to the high transaction fees. After experiencing high transaction fees myself, at this point it's cheaper to send money via bank transfer, and I would never ever consider buying a $5 latte using bitcoin if the transaction is gonna cost me more than a 7% state tax fee. If sending $55 worth of bitcoins from one wallet that I own to another wallet that I own costs me $16 on a "low fee" warning that took two weeks, I don't even want to know how tedious using bitcoin for everyday transactions would be.

@MINNOWSUPPORT @ORIGINALWORKS

The @OriginalWorks bot has determined this post by @pawsdog to be original material and upvoted it!

To call @OriginalWorks, simply reply to any post with @originalworks or !originalworks in your message!