I have been a little surprised recently to learn that the global liquidity supply roughly correlates with Bitcoin price patterns. In 2024 global liquidity has surged predominantly due to relentless money printing by central banks and the permitted expansion of debt, both governmental and personal. Bitcoin's price has increased by 100% during this period.

However, let's not forget that Satoshi Nakamoto created Bitcoin as an alternative financial system to the wholly corrupt central banking systems used across the world. It was designed to push back on traditional financial systems that rely heavily on monetary expansionist policies. Yet we are seeing a close alignment emerging between Bitcoin price and liquidity expansion.

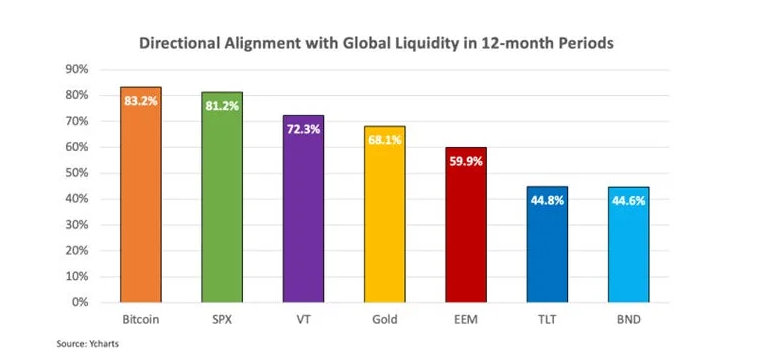

A recent report by investment strategists Lyn Alden and Sam Callahan which studied the price correlation between Bitcoin and global liquidity supply during a 12 month period found the price moved in exactly the same direction 83% of the time. That's a damn close alignment. It means this puts Bitcoin above any other asset class when it comes to finding a pure barometer for tracking global liquidity patterns. For some people Bitcoin is now even used as the most purest of global liquidity barometers. See the following chart.

(Source: lynalden.com)

As you can see it seems that when the cartel decide it's time to print more money we also see a simultaneous price increase in Bitcoin. But why? Well as far as I can tell there appears to be a few reasons.

When the cartel, i.e the central bank, the main private banks and government, makes their decision to press that button and start creating more new money and then flooding the economy with that new money and then we see Bitcoin increase in price, most of the time, surely some of this cartel owned and deployed money is finding its way into the cryptosphere and Bitcoin, no?

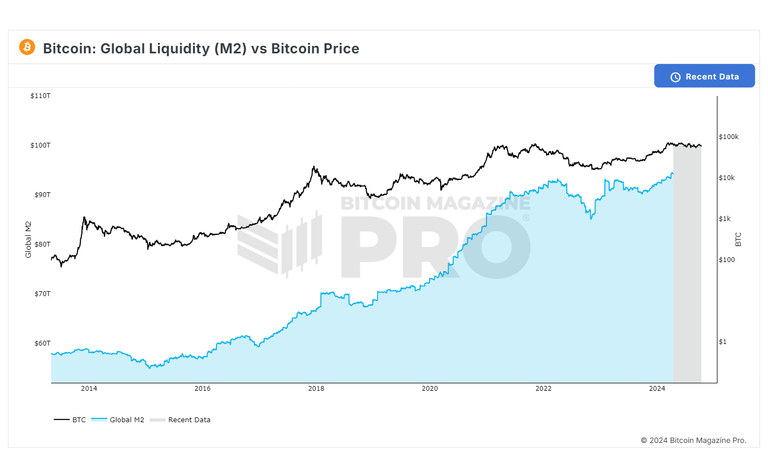

See how the graph below shows a more distinctive Bitcoin liquidity alignment trail.

(Source: BitcoinProMagazine)

This is just one explanation but it does seem that more fiat is flowing into the crypto space these days which might give us a short term boost but what about the long term implications for Bitcoin? As most of us who have been in crypto for a long time know, sure the government and the banks want a slice of the pie, but as we also know those people are sick enough to want the whole pie for themselves. And then want more. That's the problem here. When do they get to control the whole space is my major concern?

There is of course another reason which might explain this close alignment. In a pro-liquidity market investors are prepared to take on more risk and move capital into riskier assets, they will be prepared to back more volatile assets like Bitcoin and other cryptocurrencies. This is why when liquidity is weaker investors move money into safer assets.

Or almost conversely is it that investors are using Bitcoin as a more secure investment because they don't like the inevitable devaluation that will occur in fiat markets from endless money printing, or quantitative easing as governments cutely like to call it? So people are worried by all this money printing and Bitcoin is now becoming the hedge, again. Perhaps that would explain more the Bitcoin alignment with global liquidity supply.

It's obviously important to mention that despite this close alignment with global liquidity supply and Bitcoin price it doesn't tell the whole story. Bitcoin will clearly have episodes which are autonomous of the liquidity supply and there will also be crypto specific events that occur which will not relate to liquidity in any capacity.

Perhaps on the one hand the correlation is encouraging. If the Bitcoin alignment with global liquidity is to continue then as right now liquidity is soaring that could well mean we are in line for an almighty liquidity compelled bull run in the cryptosphere. Now that would be welcome news wouldn't it!

Peace!

Greetings @peaceandmoney ,

You said....'the whole pie for themselves. And then want more. That's the problem here. When do they get to control the whole space is my major concern?'

When they create ETFs...that is when....however it is also the inevitable end of BTC....many years away yet.

Also there are enough holders of BTC who can band together and hold down the price of BTC by selling and they do....the price goes down and they buy more.

It has been said that BTC reflects the true market as everything else is controlled...but that was said some time ago...I do not know if it's true now....because there are some powerful holders now.

Thank you for something to think about....had not reflected on this aspect...interesting.

Kind Regards, Bleujay

!BBH

You're right to point out ETFs but there are also other mechanisms these maniacs can bring into the space to control it. But, at the current time, I think we still have enough grassroots BTC holders in the space which is a real force, even now. It is stiff competition for the big boys.

I can totally see why BTC reflects the true market value because BTC was supposed to be decentralised, uncontrolled and for everyone. But that was a little while ago and as we know things have changed. Nonetheless, as I have just mentioned, us little people still have the ability to push back, let's just make sure we do it.

I am glad you enjoyed the post @bleujay, thank you for your comment and support.

If you had a monopoly money printer whose fiat was excepted as legal tender what would you buy with the unsecured paper? Bitcoin! There seems no surprise to the correlation. The good part is that with the limits on the amount of Bitcoin available they can only buy up so much. Any BTC that you might have to sell off then sell it off to friends and family, not Blackrock and the like.

[ NOTE : Not meant as financial advice. ]

This is an excellent point. You're absolutely right to point out that Bitcoin has literally programmed into its code that a finite amount of BTC can ever exist. This is a real security against the elites, to an extent. Just keep grabbing as much Bitcoin as you can!

Congratulations @peaceandmoney! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 60 posts.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts:

@peaceandmoney! @bleujay likes your content! so I just sent 1 BBH to your account on behalf of @bleujay. (1/1)

(html comment removed: )

)

@peaceandmoney, I paid out 0.205 HIVE and 0.000 HBD to reward 1 comments in this discussion thread.