If anyone was able to show me a market with higher volatility than the crypto one, I would eat my hat! (if I had one).

Basically every main cryptocurrency skyrocketed last year. Bitcoin price news were all over the place, even on mainstream media, and this attracted a lot of new people and more money to maintain crazy growth rates.

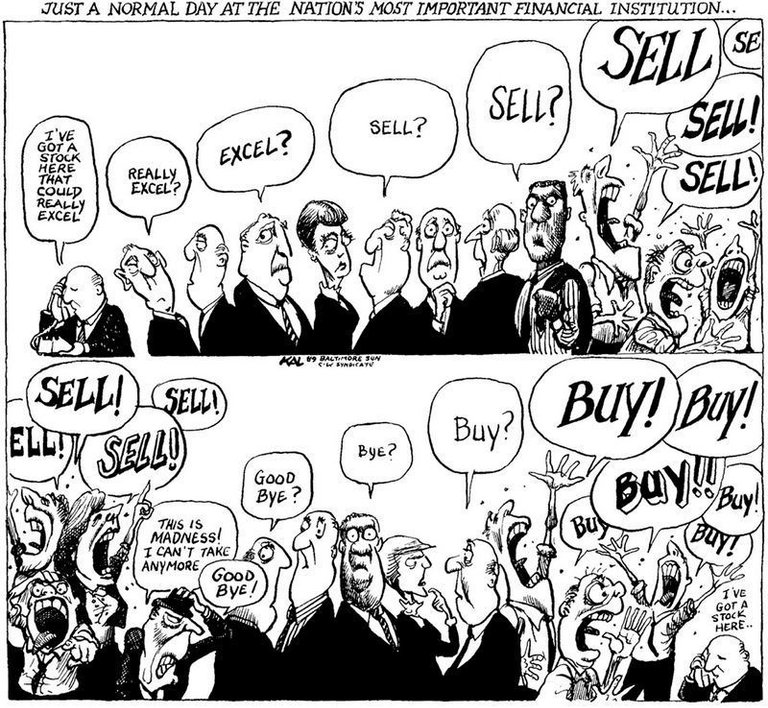

But what happens when some veterans see that their coins have already passed the moon? They call it a day and cash out their returns, tilting the market on the opposite direction. As this happens, newcomers see a loss on their investment and cash out too. Media reports that the trend has shifted, convincing more people to sell, dropping the price even more and starting the 100th crypto apocalypse.

And I haven't even mentioned misinterpreted declarations or fake news.

Image by Kevin Kallaugher

This cycle has happened over and over again, not only in the crypto market, but also in Forex, stocks and commodities markets. There is no way to precisely know when the inflection points will take place, but if we see a strong trend that has been on going for a while, it might sign that a change in direction is overdue. At this point it is better to go against the flow.

Lets remember that we are barely starting to see the potential for cryptocurrencies. Because of this I would not recommend to sell your coins when price drop is getting close. Instead just stop buying more coins and wait for the actual drop to start investing again. The short term loss is likely to be eclipsed by long term returns.

Be fearful when others are greedy and be greedy when others are fearful

-Warren Buffett (I KNOW, I KNOW! the guy has stated several times that he is not interested in crypto, but that's a topic for another day).

Invest only what you are ready to lose. It will always be better to do small but steady investments rather than mortgaging your home to buy coins. That would be playing Russian Roulette.

Finally, remember to always do your own research on what you are investing in. If it sounds too good to be truth, it probably is.

Right, Carlos?

I agree with everything in this post. Well put! :D

If I were to add one thing here it would be that although I agree it's probably the safest bet to stop buying and hold rather than trying to catch the perfect sell, for those that are very risk tolerant and ambitious there are a lot of extra coins to be made as a temporary bear.

And I don't know if spelling corrections are appropriate steemit comments (I'm new here), but you used the word loose instead of lose.

Totally agree with you! diversification is always recommended. If done correctly it may even help to decrease the volatility (risk) for your portfolio as a whole.

They totally are! Thanks for pointing that out! It has been corrected.

See you around!