Come here to find like-minded friends!

First of all, let's take a look, why do you say that money comes from debt?

In the classic economics textbook, Adam Smith, the originator of economics, will be given a discussion about the origin of money.

In a village, people exchange goods, and then they produce a general equivalent of one currency, so money is also a commodity, a product of the "market."

This story is so deeply rooted in the hearts of the people that few of us doubt its authenticity. However, more and more anthropological evidence has recently told us that in the process of human society development, the world of pure barter exchange has actually Nothing has ever existed.

In fact, a long time later, Adam Smith himself admitted that the so-called village was his fiction.

According to credit currency theory, the so-called economy is a huge barter system, and there is no way for such a system to leave the currency, no matter what form the currency exists. In ancient times, it was cattle, salt, shells, and later Gold and silver

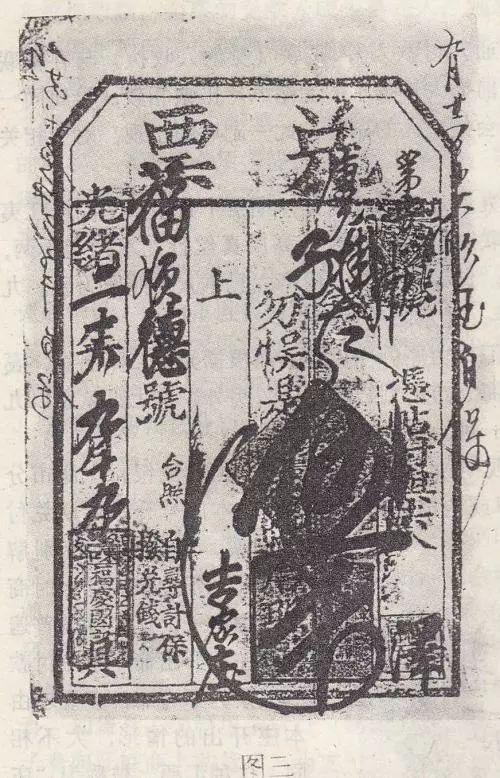

In other words, they think that money is a necessary condition for the market, it originates from the debt relationship that people generate in exchange, and because the debt is considered by people's "credit", so we often see the currency unit: yuan, pound Mark is an abstract unit of measure, which is essentially a measure of "credit."

Unlike traditional economics, where money is derived from the exchange of goods, it is “commodity that acts as a general equivalent.” Credit currency theory believes that money comes from debt. It is an abstract measure that measures people’s debt relationships.

In fact, in the textbook example, you may have an illusion that the barter exchange is a person holding three ducks for five chickens, but in the real world, such exchanges do not exist. What does a real exchange scenario look like?

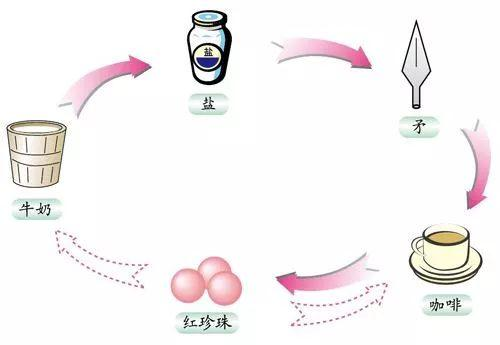

Zhang San bought a chicken from Li Si, then he would write an owe, or some kind of certificate to Li Si, promised that I would give Li Si the same value as this chicken, then Li Fourth, when he went to Wang Wu to buy a pair of shoes, he gave this owe or certificate to Wang Wu.

In this way, the process of barter exchange in a community is actually the process of this debt or the circulation of this certificate. When the voucher was long enough for circulation, people gradually forgot who its original owner was. At this time, the debt was a "circulating, transferable" bill, which acted as a currency.

In other words, in the process of barter exchange, the debt relationship is quantified in the form of money, and the value of the unit currency represents the degree of trust in the issuer of the debt.

This process can happen in a small village. There is no problem when the barter system is very simple, but if we go into a big city, when the exchange system becomes very complicated, this is a problem.

The biggest problem is that one, two, and three owed articles can't satisfy our needs. At this time, we must provide more owed, so that all people can use such currency for daily transactions. Otherwise, if they owe The number is not enough, and that is "deflation."

So the number of owed is not one or two in a big city, but millions or even tens of millions.

Knowledge|currency comes from debt