The Truth About the ETFs And Why the SEC Won’t Pass Them

For the last few weeks, there has been a not-so-subdued hysteria surrounding the possibility of whether or not a Bitcoin ETF will be approved by the SEC this year.

According to must Bitcoin bulls/’maximalists’, the approval of such an ETF will lead to a ‘swarm of institutional investment in the protocol that will drive the price to new heights that were previously inconceivable’.

There were posts such as this one by Cointify and others that were being pedaled around the crypto space in late July:

In that statement, they claimed, “None of the ETF proposals being postponed are from CBOE (VanEck and SolidX), which are currently under discussion by the wider crypto community.”

Ironically, they called those that were noting the likelihood of a postponement on the decision for that ETF specifically ‘manipulating media’, despite the fact that they appeared to be participating in the manipulation.

Did you just say manipulation?

Absolutely. And the reason why is because their tones changed entirely when the ETFs were finally delayed (as expected).

Check out this new post that Cointify has circulating around Telegram:

As you can see, the authors of this channel have done a complete 180 on their stance when it comes to ETFs.

Why?

Because it’s convenient and the market (AKA us and YOU, more specifically, as the reader and consumer of the content), has not made the conscious decision to call out flip-flop analysis that is neither grounded in reality or logic.

However, before we get to dissecting all of the ‘points’ made within that post and others, let’s review how we got here.

Winklevoss Rejection

If you remember the messaging that was sent throughout the community originally, it was that ETFs were a positive thing no matter what and that it was a good thing that the Winklevoss (among others) were all applying for an ETF.

The community argued that surely, one of these groups had to receive approval from the SEC, right?

Just check out the following tweets:

Of course, one cannot forget this article that was published by CoinDesk:

Winklevoss Brothers Win Crypto Exchange Patent - CoinDesk

_Winklevoss IP, the company owned by Gemini founders Cameron and Tyler Winklevoss, has been awarded with a patent claim…_www.coindesk.com

Notably, they published another one that more or less reiterated the same exact thing that was stated in the first article (which was published in May) in June:

Winklevoss Brothers Score Another Crypto Investment Patent - CoinDesk

_Crypto exchange Gemini founders Tyler and Cameron Winklevoss have long sought the creation of a bitcoin exchange-traded…_www.coindesk.com

The Narrative Changed Completely When the Winklevoss ETF Was Denied

Notably, on July 26th, the ETF application that the Winklevoss twins had filed with the SEC was formally denied.

Here’s an article detailing the denial by the SEC (don’t worry we’ll be digging into this much more in-depth later in this article):

Winklevoss twins bitcoin ETF rejected by SEC

_The Securities and Exchange Commission rejected a second attempt by Cameron and Tyler Winklevoss, founders of crypto…_www.cnbc.com

Soon after the news began to seriously proliferate around the cryptosphere that day, the narrative changed from,

“Wow, look at all the patents that the Winklevoss twins have been winning plus their obvious commitment to staying within compliance with the SEC! They may have a legitimate shot at getting added!”

To this:

SEC Rejects Winklevoss Bitcoin ETF: Here's Why it Doesn't Matter

_As Bitcoin matures into a viable asset class investors demand easier ways to join the burgeoning market. Apart from…_blockexplorer.com

and this

Winklevoss Bitcoin ETF was Rejected, But VanEck ETF has a Chance to be Approved | NewsBTC

_Following the US Securities and Exchange Commission's (SEC) decision to deny the Winklevoss's Bitcoin ETF application…_www.newsbtc.com

Winklevoss Brothers Bitcoin ETF Rejected By SEC for Second Time - CoinDesk

_The U.S. Securities and Exchange Commission (SEC) has once again rejected an effort by investors Cameron and Tyler…_www.coindesk.com

Let’s take a little bit of time and review the respective arguments that these publications cited above and other sources gave for the denial of the ETF as well as the reasons why it is of ‘no concern’ for crypto investors that saw the approval of an ETF as a necessary or important event.

Reasons Given by the ‘Mainstream’ Crypto Media For Why the Winklevoss ETF Was Rejected

According to CoinDesk, one of the reasons why it was rejected, was that,

“ The agency [SEC] notably highlighted that its decision doesn’t constitute a judgment against cryptocurrencies and blockchain in general, but rather the structure of the proposal that was pitched.”

Essentially, CoinDesk laid the blame upon the Winklevoss twins’ proposal as the primary reason for why the ETF was not accepted.

When reviewing the actual decision letter/document that the SEC issued as it rejected the Winklevoss ETF, it becomes immediately apparent to anyone honestly reviewing the feedback from the SEC that what CoinDesk is purporting is wholly untrue.

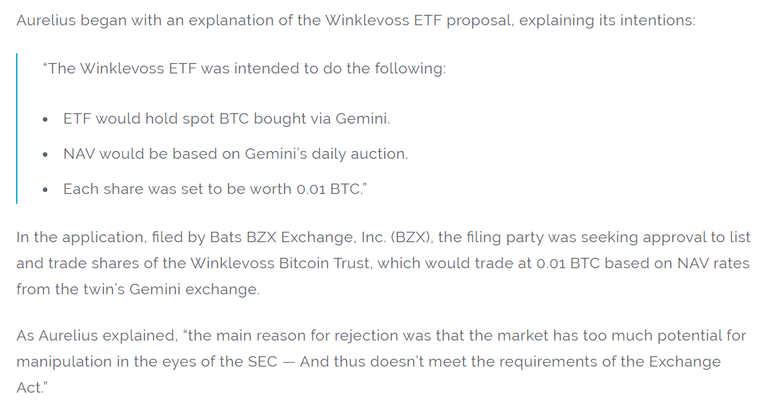

Above is an excerpt of what newsbtc wrote about the rejection.

Once again, this is a very untrue and inaccurate description of the core reason for why the SEC rejected the Winklevoss ETF.

Why Would All of These Entities Simply Lie or Obfuscate the Truth About the Real Reason That the ETF Was Rejected?

Because it is in their best interest to do so.

As noted in some of this author’s previous articles, CoinDesk is a subsidiary of DCG, which stands for the Digital Currency Group.

You can visit their website right here:

Home - Digital Currency Group

_Our mission is to accelerate the development of a better financial system. We build and support bitcoin and blockchain…_dcg.co

The group is owned by an individual by the name of Barry Silbert.

DCG’s Ownership of CoinDesk Presents a Clear Conflict of Interest

For those that are unfamiliar with Barry Silbert, he is a very wealthy individual (now), that has his hands in a lot of companies, exchanges and moving parts in the crypto space, overall.

More importantly, however, he is someone that has attempted to file his own ETF with the SEC several times (unsuccessfully).

That’s detailed in this article here:

SEC Delays Decision on Barry Silbert's BIT after Receiving Scathing Comments - Bitcoin News

_March has been a busy month for the U.S. Securities and Exchange Commission (SEC). Following its March 10 decision on…_news.bitcoin.com

This is when Barry Silbert had attempted to have an ETF passed in the past (which he has still been successful in doing).

However, that has not stopped him from attempting to do so once again, and leveraging support through all of his channels of communication (CoinDesk primary), to convince others to write in comments to the SEC to convince them to approve the remaining ETF applications that have yet to receive a decision.

Given the fact that Silbert’s ETF application has come under absolutely zero criticism or scrunity, it feels like the clear conflict of interest between his trust’s ETF application and CoinDesk will remain the unspoken elephant in the room for quite some time to come.

Why the Reasons Given for the Winklevoss Rejection Are Bogus

As noted above, CoinDesk and others insisted that it was the Winklevoss’ fault that the ETF was not accepted.

However, this is not the case.

If you read this article by CNBC very carefully, you’ll see how they actually detail the reasons that the ETF was rejected:

Winklevoss twins bitcoin ETF rejected by SEC

_The Securities and Exchange Commission rejected a second attempt by Cameron and Tyler Winklevoss, founders of crypto…_www.cnbc.com

One major key can be found in this excerpt from the article:

Let’s review that letter by the SEC, shall we?

Here is the direct link in case you were unable to find/access it from CNBC’s article:

Staff Letter: Engaging on Fund Innovation and Cryptocurrency-related Holdings (January 18, 2018)

_As you know, the U.S. investment fund market is one of the most robust, varied and successful markets for investment…_www.sec.gov

What Did the SEC Say About Bitcoin ETFs in Janaury 2018?

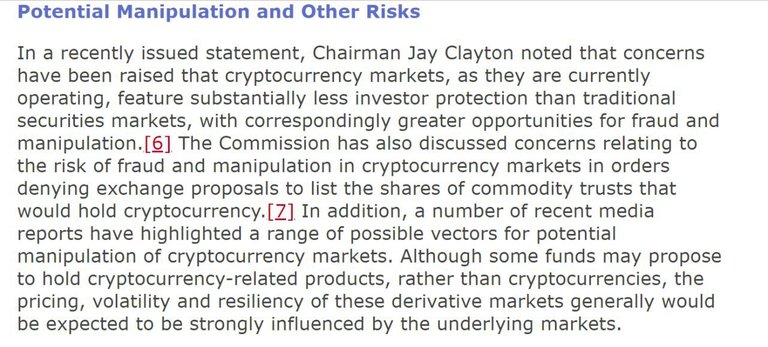

These excerpts are perhaps the most important to look at:

The highlighted portions of the excerpts above are worth paying special close attention to because it essentially explains the SEC’s primary qualm with Bitcoin.

As you can see, their primary issue with a Bitcoin ETF has nothing to do with who is filing the application but rather the lack of control over the underlying factors related to Bitcoin.

The SEC has stated explicitly that they are more concerned with manipulation of the underlying markets related to bitcoin.

This does not mean Gemini, this refers to markets such as OKex, Binance, and others that are not under the purview of either the CBOE or the Winklevoss twins.

This is something that would be obvious to anyone that has looked at the statements that the SEC has made. However, people have trusted publications such as CoinDesk and others to deliver the news accurately, when they have failed to do so on numerous occassions.

Rather than insulting your intelligence by providing a subjective interpretation of the press release that the SEC put out in January of this year, the reader is encouraged to review the statements that the SEC made by themselves.

Unregulated Markets

Yes, it’s back to this argument again.

You may be angry at the fact that, what seems to be one of the greater benefits of Bitcoin, are turning out to be its biggest downfall (in terms of seeking an ETF). However, it is something that the SEC is adamant about having.

Here is what the SEC posted in response to the Winklevoss’ ETF:

The above screenshot is in response to the Winklevoss ETF that was denied. As you can see the issues they had w the ETF were with the systemic underpinning of Bitcoin trade.

This is not something that the CBOE or anyone else could/can remedy.

“But there’s manipulation on the traditional markets too!”

Yes. But there are at least rules and measures in place to at least apprehend those that try such things.

Not saying they’re always enforced, but they are at least there and there are people that have actually faced some sort of penalty for market manipulation (the guy the show ‘Billions’ on HBO is based on is an example).

There really aren’t any such measures in place for most crypto exchanges.

For example:

Binance is #2 in volume. The exchange that is currently #1 (at the time of writing) is accused of essentially hosting an exchange with 95% fake/wash-traded volume.

The fact that there does not appear to be any higher authority in the cryptosphere that these individuals must listen to is something that the SEC really does not like.

What’s to really stop CZ from front running his own exchange?

How do we know if the exchange is trading against other customers or placing false orders up?

And that’s just one example. And that’s the SEC’s concern in a nutshell.

The BULK of traded volume of Bitcoin has little to no oversight or transparency. And you can’t expect a REGULATORY agency to tolerate that.

Recent Crypto Exchange Criminal Inquiry

In addition to everything stated above about the general lack of regulation in the cryptosphere, some major players are currently under a formal criminal investigation by the CFTC and DOJ.

U.S. Launches Criminal Probe into Bitcoin Price Manipulation

_The Justice Department has opened a criminal probe into whether traders are manipulating the price of Bitcoin and other…_www.bloomberg.com

As additional intel has been leaked regarding the situation, it appears that this investigation is fairly wide reaching and it is premised specifically on the idea that certain major players in the cryptosphere have been leveraging their platforms to influence and manipulate the price of Bitcoin specifically.

Thus, this is not something that the CBOE or any other organization can wave a wand and fix, and this is definitely something that will undermine any potential for an ETF to be accepted…either now or in the near future.

Conclusion

CoinDesk and many others in the space deserve to be called out for their dishonesty in reporting on the ETFs in this space.

They have consistently moved the goalposts in order to keep the fervor and excitement alive in order to create an exuberance that moves the price of bitcoin up.

Rather than analyzing any actual statements by the SEC in the same way that this article has, they have merely told everyone their version of what the SEC has stated.

Yeah something new I read after long time ... request to all pls vote him to apriciate his hard work

Excellent!!! Best research-analysis I 've read recently!!! Congrats!!! Thinking the same before reading you after a simple and fast research and the use of simple logic and simple economic rules... I upvoted resteem and follow you!!! Have a nice day and keep posting!!!