Since the beginning of 2019, there has been a dramatic increase in the number of people that are now leverage trading Bitcoin and other major cryptocurrencies.

Consequently, many novice traders now beg the question: what is leverage trading and why is it so popular?

What is Leverage Trading: Explained Simply

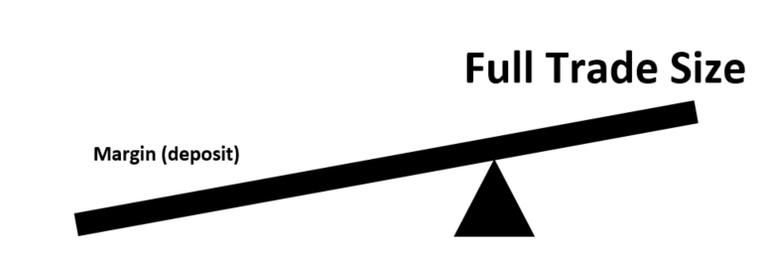

Leverage trading, aka margin trading, is a high-risk/high-reward trading strategy, whereby a trader can increase their position (trade) by so many multiples with the assistance of a broker/trading platform. The amount the trade is increased by is called the leverage, e.g. 100x leverage would increase a $100 position’s size by 100, making it as profitable as if was a $10,000 position.

Why is Leverage Trading Bitcoin Popular?

Obviously, Leverage trading Bitcoin is incredibly popular because it significantly increases a trade’s profitability while only having to outlay and risk a small amount in comparison to the reward. The profits are proportional to the leveraged (increased) trade, whereas the loss is limited to the margin, aka the initial investment deposited into the margin account - before leverage was added.

Furthermore, margin trading allows for both long and short positions, which means you can bet with or against an asset, depending on whether you feel its price will go up or down. E.g. a long position on Bitcoin (going long) will profit from Bitcoin’s price going up, whereas a short position against Bitcoin will profit from Bitcoin’s price going down.

How is Risk Increased by Leverage Trading Bitcoin?

The margin is the amount of capital that can be used as collateral if the market turns in the opposing direction, and because the position is much greater than the margin, it can be eaten up very quickly - which may cause a position to be liquidated without much resistance. The higher the leverage, the higher the risk, as the margin is proportionately minuscule.

Also, Bitcoin and crypto-asset markets are highly volatile so opposing movement is expected and should be planned for.

Managing Risk

Fortunately, leverage trading requires less of a trader’s own funds and this opportunity should be intelligently taken advantage of, by only trading with what you are willing to risk losing.

Additionally, risk can be reduced by placing opposing positions (aka hedging), set a ‘stop-loss’ and/or ‘take profit’ order, keep some additional funds in your margin account to accommodate some volatility, and of course, you can simply not using as much leverage.

Greed and overconfidence are incongruent attributes when leverage trading Bitcoin, due to the fact that you can never be 100% sure what the market will do. The key is to have a calculated plan and stick to that plan.

Best Platform for Leverage Trading Bitcoin?

PrimeXBT is the clear leader in this department, as the only bitcoin trading platform to offer up to 100x on 9 major crypto-assets, alongside some of the lowest trading fees. The platform is modern, ergonomically friendly, and highly customizable. It features advanced order types, hundreds of valuable technical indicators, and a powerful trading engine and charting technology.

If you’re still left wondering ‘what is leverage trading’ after this basic explanation and want to know more, check out this video tutorial that dives a little deeper into the mechanics, here: