It helps far more to forget price in times of Bear markets and Look at other 'uptake' Signals or Asset Potential and Health Indicators.

With Bitcoin, we will look at 4 indicators that are Glowing bright Positive right now:

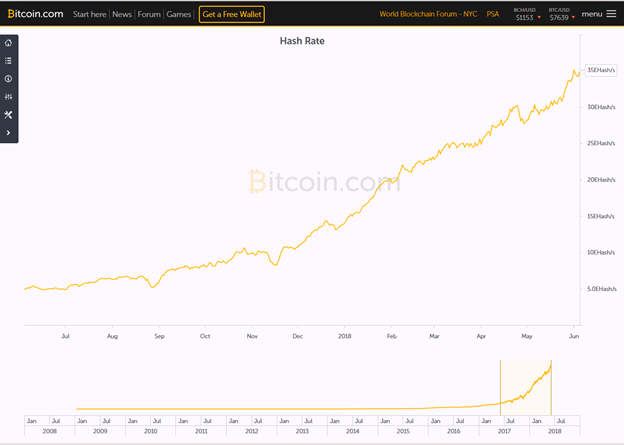

- Hashrate

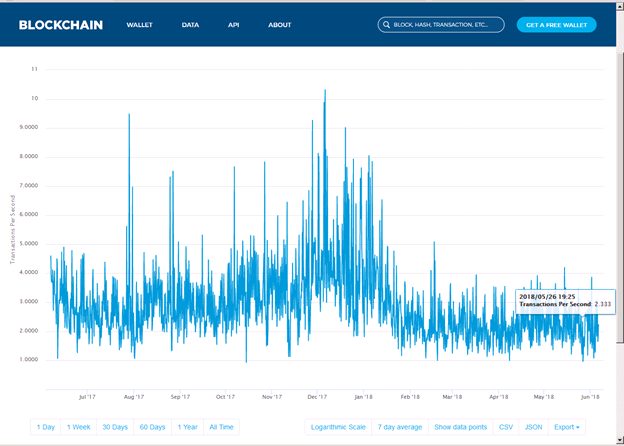

- Transaction rate - number of transactions on the Bitcoin network (how much activity)

- Transaction fees to Miners rate - Miners don't only mint Bitcoin when mining - they also earn transaction fees

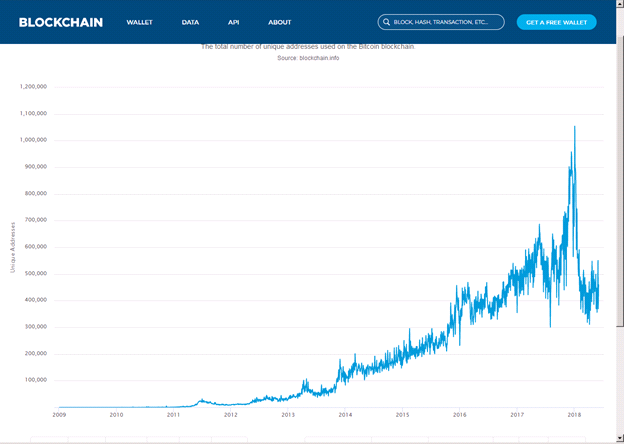

- Unique or New Address use rate on the Bitcoin Blockchain - pertaining to Metcalfe's Law

unsplash, Victor Freitas

unsplash, Victor Freitas

Current Bitcoin Hashrate Chart - the number of computations to solve Bitcoin math challenges in confirming blocks and thus earning or minting a Bitcoin for Miners who's mining machines manage to solve the challenge.

This is Definitely an indicator of the health of the Bitcoin Network.

Transaction rate Chart the rate or number of transactions on on the Bitcoin Blockchain.

Showing no signs of continued decline - its business as usual and a very healthy indication.

Transaction fees to Miners rate the fees cost, charged by miners to those who make Bitcoin transactions.

Free Charges miners are receiving are at almost an all time low.

While fee rate or expense can be viewed in vastly opposite ways, if we look at it in conjunction with Hashrate we see that although miners are receiving about what they received in fees in the 2014 Bitcoin doldrums, Mining equipment and Legislation surrounding Mining is vastly more expensive and difficult than it was in 2014 or in any other time in Bitcoin history.

Yet seasoned Miners and new Miners entering the space are buying and setting up Mining operations at breakneck speed more and more and their confidence cannot be unfounded.

This does not happen in other assets like Gold Mining for instance. Once the Gold Mines stop making Money they start to close down, unless they are lucky enough to have Streaming lifelines.

Unique or New Address use rate an indicator of unique transactions on the Bitcoin Blockchain (possibly new uptakers or users)

In and of itself, this indicator is not full proof particularly when using it as a measure of Metcalfe's Law which is an indicator of a Technologies uptake and growth, but certainly, used in conjunction with other indicators it is an indicator that should not be left out.

It follows the Bitcoin price but is not necessarily related to the price and therefore should be followed separately.

The chart below shows there is now divergence to the downside that would indicate fewer addresses are being used and thus suggesting a signal showing a problem with Bitcoin activity.

In conclusion, one of the greatest profits for Warren Buffett and Berkshire Hathaway (NYSE:BRK-A) has been Coca Cola.

Buffett had noticed when looking at Coca Cola shares that the price of Coca Cola shares were down considerably, but when he went out and about - everyone was still drinking Coke, no other indicators were saying Coca Cola was in trouble.

Buffett then bought nearly half a Billion shares in Coca Cola and still owns them today.

This true story shows us that looking at price alone can be very deceiving.

Yours Contrarianly

Ptychadina Wealth

/ᐠ-ᆽ-ᐟ\