Brief

Charts

t

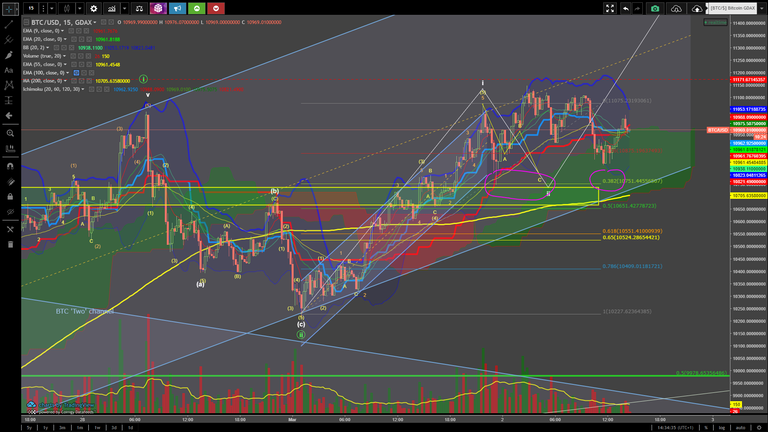

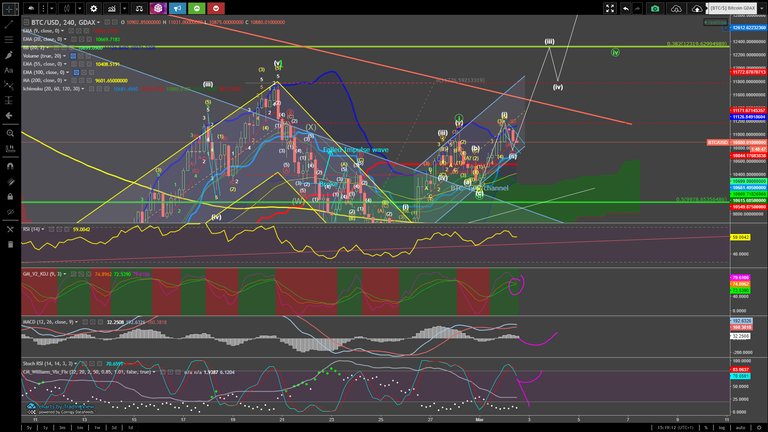

Last night, I left you with a retrace target of $10,751 for white ii. Said target was hit with high precision and Bitcoin continued its move up from there. Look at the chart below (the yellow box was/is our support zone).

We hit the expected, shallow, 0.382 retrace. I have not changed anything in this chart yet, just to show you that although the lines in terms of time were incorrect, we did hit our retrace target, which is more important.

Volume has been declining since that local high, as expected.

I have attempted to label nearly all subwaves of this current uptrend as accurately as possible. Of course, 3 different Elliott wave traders may give you 3 different counts, but unless you are a day trader, these should not differ much in terms of the larger degree trend, which is clearly up. What can differ (depending on your count) are your targets for (3) and (5) for example. In this regard, it is important to check your Fibonacci levels. Observe this count.

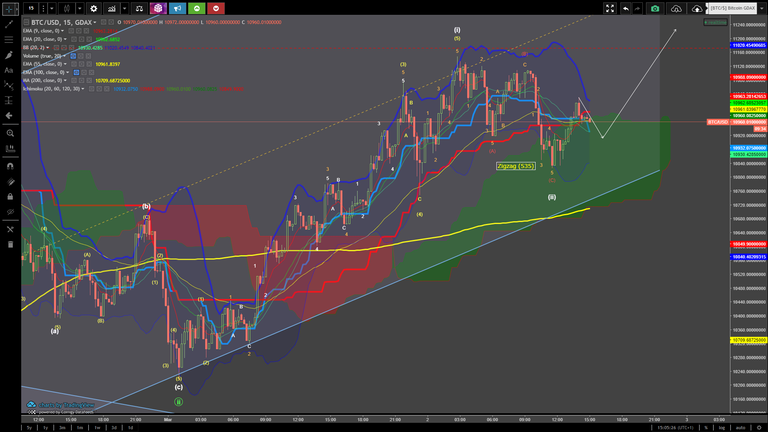

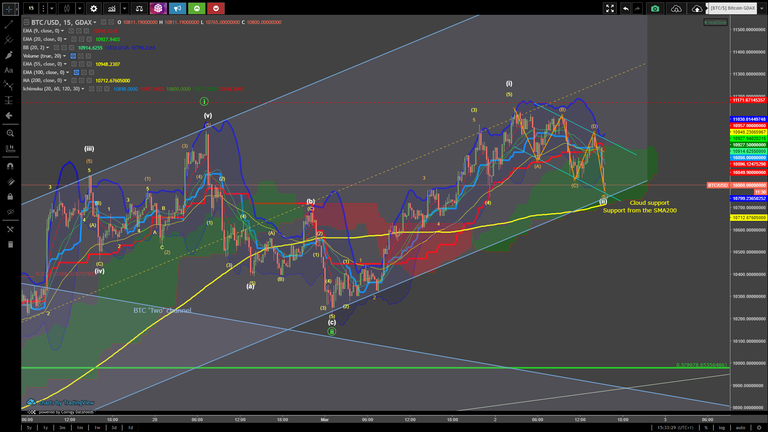

On the 1H time frame, we can see that we are currently bull flagging. I have removed the minor subwaves to reduce clutter.

Technicals

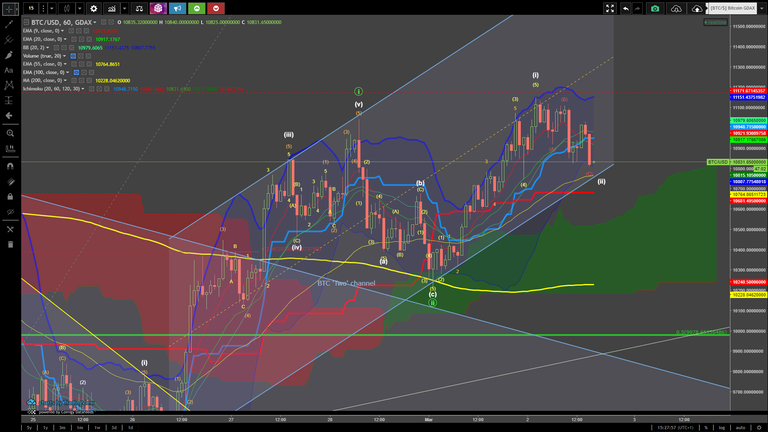

Looking at the 1H technicals, the stoch RSI has room to move upwards, as does the MACD. The RSI should hold above the cyan trend line, and should (ideally) move above the previous two touches of the upper dotted overbought area line and into the overbought bull zone. Keep in mind that the RSI is not an indicator for price, but rather, an indicator for momentum and strength of the asset or currency.

The Williams Vix bottom finder, is giving us slight hints via the recent green dot that Bitcoin is trying to find a bottom to bounce off of and continue on its white (iii) pathway.

The 4H technicals are what worry me most.

The stoch RSI looks to be coming down (though it can turn and go back up). Again, this is an oscillator that does not indicate price, but rather indicates momentum. We're about to get a cross on our GM KDJ too, which isn't great. These technicals sting in terms of the projected Elliott Wave count, but luckily the daily still looks quite healthy.

Daily

Big picture

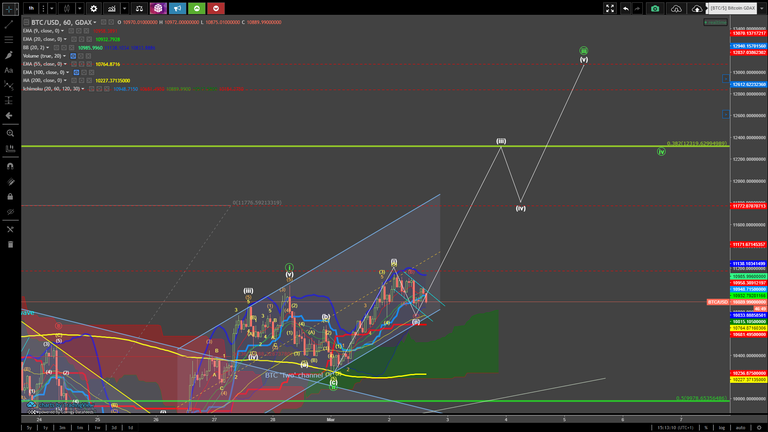

We continue our formation of the right shoulder of the second iH&S.

If we look at our Daily EMA rays, we can visually see that we are attempting to cross back over into the uptrend order (as seen in November, December).

Again, in terms of the 4H, the rays look like they want to turn and cross, but if the previous run up throughout February is of any indication, they can flare out massively before even considering turning and crossing over bearishly.

If anything spectacular were to happen throughout the day, I will inform you about it.

EDIT

As I was writing this blog, it looks like Bitcoin corrected past an acceptable and countable ABC retracement. I hinted at the bull flag, and by the looks of it, we have currently put in a bottom on the lower bull flag trend line. This is also the area in which it can find support on the 200SMA, the Green Kumo Cloud and the lower trend line for this upward moving channel.

Food for thought - the Linear Regression channel on the 1H and 4H.

On the 1H (it's not easy to see), it has also found support on the 55EMA, an important trading EMA. It overlaps the Linear Regression bottom line perfectly at the candlestick touch.

Last but not least, let me draw your attention to the fact that Bitcoin Dominance has been going up.

Regards,

Arch