Please read my core post blogs to stay informed about the overall count and bigger picture!

In short

I will keep these posts extremely short, unless I decide to post a CORE POST. These cores will include way more detail and will be written well in time before any important event.

These short updates serve as frequent, throughout the day updates to keep everyone up to date with the development of price and momentum.

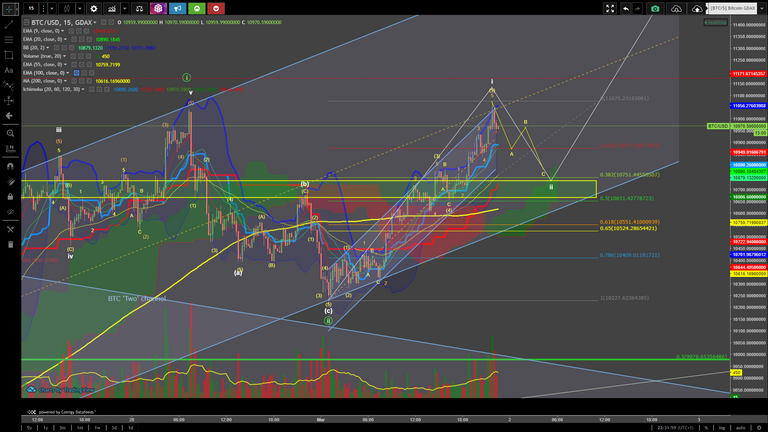

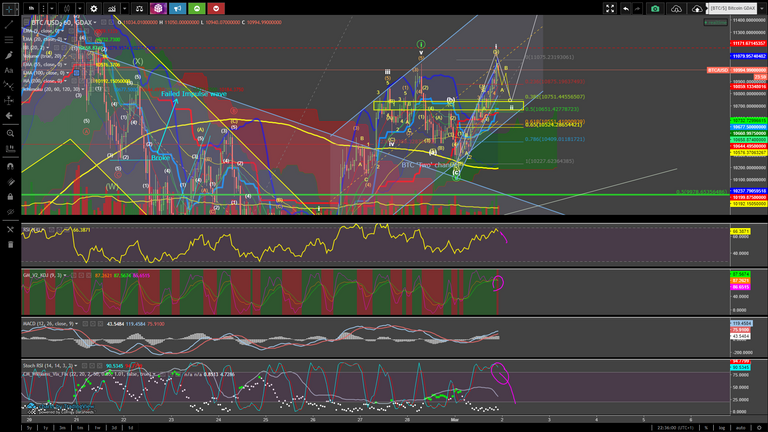

The 1H Stoch RSI has to come down. The 4H can still go up slightly, but either way, we are bound to go down (in the short term), as shown by the chart below. We knew this well in advance, though, and it doesn't change anything about the count.

We have put in a higher high than the green circled i, which was VITAL! This means that the uptrend has been confirmed. Volume is great, though I expect it to decline slightly and pick back up once white wave iii has printed a couple of candles on the 15min.

The cloud will act as support in any case, as will the blue channel, if it were to retrace to the 0.5 Fib level. I expect bullishness, though and have put my target at around $10,750.

The correction will most likely unfold as an ABC (535 zigzag if you dig deep enough in a low time frame), or irregular flat (335 with a retest of $11,075 on the B wave).

Note the support zone.

1H time frame; notice the technicals.

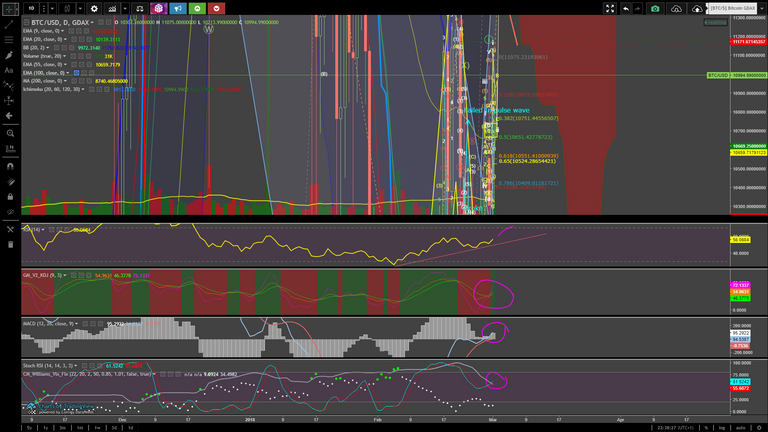

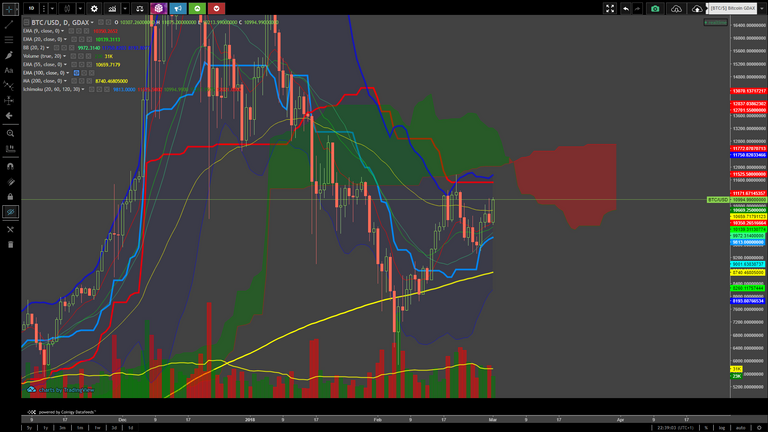

Daily; remains bullish! The goal is to break into that Kumo cloud. We have got the T(enkan) (blue line) trending upwards as well, looking for a cross with the K(ijun) in 10-12 days or so.

I will continue posting throughout the day, tomorrow. Until then... keep the bigger picture in mind!

Regards,

Arch