Over the years, Bitcoin has been frequently promoted as a "safe haven" and the narrative has only strengthened in recent weeks. Apparently, the idea will not die, despite its legendary volatility and reports of thefts and hacks from time to time. So is it a safe haven or not? CoinFalcon analyzes the facts so you can decide for yourself.

What is the Bitcoin safe haven theory?

The bitcoin safe haven narrative is a story that is almost as old as Bitcoin itself.

For those who believe that Bitcoin falls into the category of safe haven assets, it will not be a mere coincidence that its price has experienced impressive gains in all the chaos we have witnessed in recent times. We examine some of these moments of economic uncertainty and political instabilities in relation to the performance of bitcoin prices at that time.

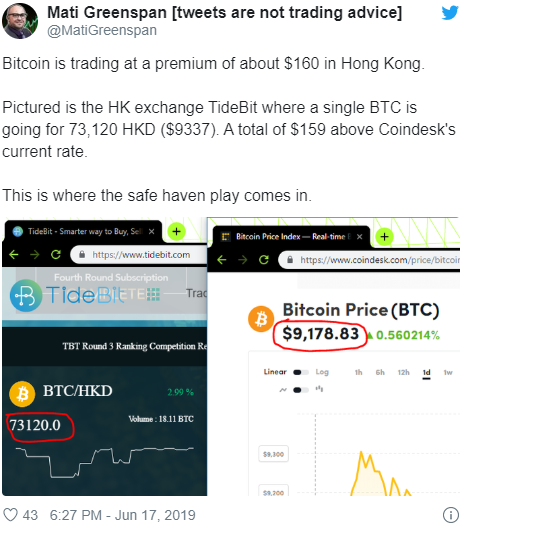

Hong Kong protests

Let's start with the Hong Kong protests that began in March 2019. Just three months later, bitcoin was trading at a premium of more than US $ 150 (HK $ 1170) in Hong Kong.

Analysts noted that this was due to the strong demand for bitcoin in the city-state after a series of violent protests over a controversial extradition bill.

Over the years, Bitcoin has been frequently promoted as a "safe haven" and the narrative has only strengthened in recent weeks. Apparently, the idea will not die, a weight of its legendary volatility and reports of robberies and hacks from time to time. So is it a safe haven or not? CoinFalcon analyzes the facts so you can decide for yourself.

What is the Bitcoin safe haven theory?

La narrativa de refugio seguro de bitcoin es una historia que es casi tan antigua como el propio Bitcoin. En términos más simples, establece que los inversores recurrirán a activos y monedas estables no soberanos para salvaguardar su riqueza en tiempos de crisis financieras mundiales y agitación geopolítica.

Para aquellos que creen que Bitcoin cae en la categoría de activos de refugio seguro, no será una mera coincidencia que su precio haya tenido experiencias impresionantes en todo el caos que hemos presenciado en los últimos tiempos. Examinamos algunos de estos momentos de incertidumbre económica e inestabilidades políticas en relación con el rendimiento de los precios de bitcoin en ese momento.

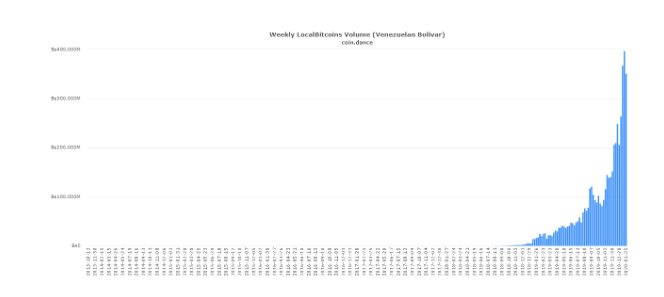

Venezuela's inflation crisis

Coincidence? What about the case of Venezuela, where its citizens turned to Bitcoin to protect themselves against the country's drowned inflation? Things got so bad that a cup of coffee went from 0.75 bolivars to 2,800 bolivars over a 12-month period, an increase of more than 370,000%. This added to the rising crime rate and the lack of affordability of needs such as toilet paper and medications. In response, Venezuelans not only used digital currency for payments and remittances, but also for donations to charities.

Needless to say, the bitcoin trade in the region skyrocketed and set new historical records as the weeks went by.

United States - Iran Fiasco

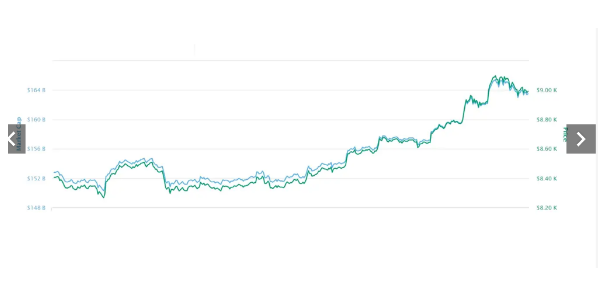

Enter 2020 and we are greeted by the news of growing tensions between the United States and Iran after the former murdered a senior Iranian military officer. Amid reports from both countries courting the war and subsequent reprisals of Iran through a missile attack on a US base, Bitcoin increased feverishly along with oil and gold.

It was no surprise that oil prices soared after news of the conflict. World oil production would definitely be affected if the situation had escalated to a large-scale war between the United States and Iran. But the interesting thing here is that Bitcoin rose along with gold, the world's leading safe haven asset. There is no direct correlation between bitcoin and gold, so its 21.7% increase in price during the period was interpreted by many as a definitive sign that bitcoin is considered a safe asset during the wave of uncertainties.

Twitter's crypto community wasted no time tracking the price of bitcoin before, during and after military tensions.

The coronavirus catastrophe in China

The deadly virus has been in trend in some media since late December, but it wasn't until Wuhan, the most populous city in central China, was quarantined on January 23 that many people began to realize the gravity of the situation Now China hosts the largest bitcoin exchange in the world (Binance), as well as the world leader in bitcoin mining, which controls more than 70% of the collective hash rate of the Bitcoin network. As such, it is safe to say that the country is an important bitcoin engine.

Let's look at the likely scenario that may have developed since the coronavirus outbreak. Many Chinese citizens would have chosen to leave the country as soon as possible, but it is never so easy to simply get up and leave. They must be able to finance their relocation and also maintain easy access to their money so they can stay abroad for as long as necessary. Unfortunately, they cannot easily fly with large bundles of cash or piles of gold bars.

So where do they turn to? Bitcoin With this digital currency, all you need to move your money and access it anywhere in the world are your crypto wallet keys. No additional luggage, no asset declarations, and certainly no long comings and goings to access your funds.

At the time of writing, bitcoin is trading at $ 9365 at CoinFalcon amid fears that the coronavirus is now spreading worldwide; This figure represents one of its highest levels in the last three months.

The detractors' argument

Despite these correlations, those who say that Bitcoin is not a safe asset have indicated that there is little research to support the theory. They argue that since Bitcoin is a non-sovereign currency and an uncorrelated asset, its market movements are impartial to geopolitical or financial turbulence events.

There are even those who believe that the bitcoin safe haven theory is simply a tool to manipulate prices at the whims of bitcoin whales.

What is your verdict?

CoinFalcon one of the easiest places to buy bitcoin, ethereum, litecoin, xrp and other cryptocurrencies. Buy cryptography with your credit card or by bank transfer and track your investments directly from the CoinFalcon application. Sign up for your free account and get the future of money in your hands today.

Source

Plagiarism is the copying & pasting of others work without giving credit to the original author or artist. Plagiarized posts are considered fraud and violate the intellectual property rights of the original creator.

Fraud is discouraged by the community and may result in the account being Blacklisted.

If you believe this comment is in error, please contact us in #disputes on Discord

Source

Plagiarism is the copying & pasting of others work without giving credit to the original author or artist. Plagiarized posts are considered fraud and violate the intellectual property rights of the original creator.

Fraud is discouraged by the community and may result in the account being Blacklisted.

If you believe this comment is in error, please contact us in #disputes on Discord

Congratulations @queromoney! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOP