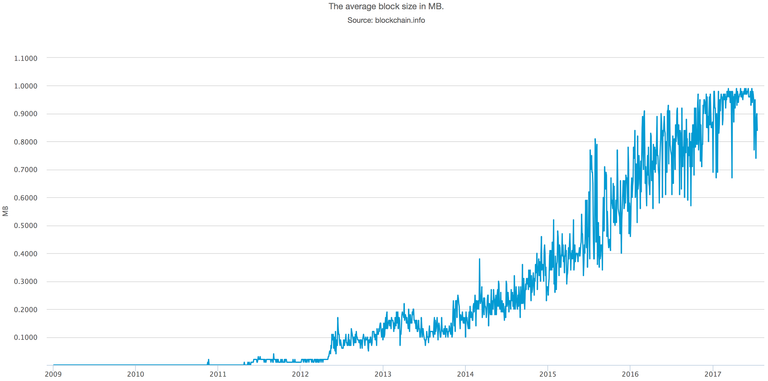

The Bitcoin blockchain is currently capable of processing 1MB of TX (transactions) every 10 minutes, or ~3 TX/s. Near the end of 2016, for the first time in the history of the Bitcoin network, full blocks were mined. This meant that in order to get accepted in the next block, people had to outbid one another in order to get their TX accepted in the next block.

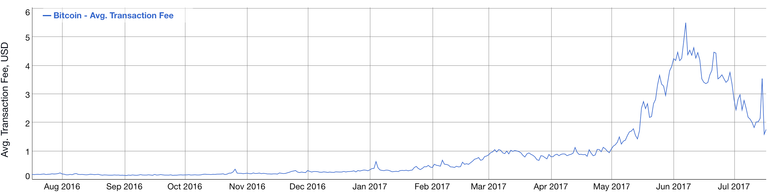

As a result of these bidding wars, the average TX fee increased rapidly, peaking at over $5 USD in June.

At the time of writing this article, the average TX fee dropped to $1.77 USD. Although this is significantly lower than $5 USD, many people have argued that it is a sign of people leaving Bitcoin for cheaper alternatives like other cryptocurrencies or fiat money.

Nevertheless, Bitcoin TX are still very expensive and Bitcoin needs to scale in order to keep up with its competitors.

Chain-split

Bitcoin is a consensus system. In order to upgrade the system flawlessly, there needs to be an overwhelming consensus throughout the entire network of nodes. If part of the network disagrees with this update there will be a split in the Bitcoin blockchain, resulting in two versions of the Bitcoin TX history.

A chain-split could be temporary but could also go on for an extended period of time. Almost everybody agrees that a long-term split would be detrimental to the short-term Bitcoin price, with a lot of people pointing out to Ethereum’s contentious and continuous hard-fork resulting in Ethereum & Ethereum Classic (although both coins are now valued at respectively 20x and 15x their price before the split).

Proposals

Different scaling proposals have been offered by different groups in the community: Bitcoin Unlimited, Segwit, UAHF, UASF, Segwit2x. All of these proposals have groups that oppose them and therefore any of them could theoretically result in a chain split.

Meet Segwit2x

After two years of toxic debate and many failed scaling attempts a group of developers has now come up with what seems like a mixture and/or compromise of many of the before mentioned scaling solutions: Segwit2x.

If everything goes according to plan, Segwit2x should activate Segwit on August 1st 2017, and 3 months later activating a hard-fork to 2MB blocks. Allegedly giving both Segwit proponents and big-block proponents what they want.

However, there are alternative outcomes depending on how much (continuous) support each of these upgrades get. For a comprehensive oversight of all the possible outcomes please take a look at this flowchart.

What should I do with my bitcoins?

First of all I would recommend you take control of your own private keys before August 1st. That means you store your bitcoins on your own devices and don’t leave them on the exchanges. This is important because in the case of a split they might follow a chain that you do not agree upon.

Secondly I suggest you do not do any trading or transacting during August 1st. After this day you should keep a close eye on the news. Once multiple sources tell you that the network has not forked and everything is working properly you can start making use of the Bitcoin network once again.

Another thing to keep in mind is that the second part of Segwit2x (the block-size increase) is not bound to happen because miners might back out of the agreement after Segwit is implemented. This could mean another risk of a chain-split 3–6 months after August 1st, so be prepared to take the same measures again around those dates.

Hopefully, when the smoke clears, we are all still transacting on one and the same Bitcoin, with enough capacity to get ready for moon.

@ravendothknow

Nice Job!

Keep the good work up!

Thanks for sharing

Congratulations @ravendothknow! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Interesting thoughts