LONDON – Cryptocurrency Bitcoin isn't actually cash in the full feeling of the word, as indicated by experts at Bernstein.

While it enables exchanges comparatively to money, Bitcoin is still only an "oversight safe resource class," out of the span of state control but to frame a piece of the arrangement of settlement and credit that characterizes cash.

"Fiat cash is as yet the last type of settlement – governments still gather assesses in fiat cash and compensations are as yet paid in fiat cash," a group of experts drove by Gautam Chhugani and Gaurav Jangale said in a note to customers on Wednesday.

"Along these lines, until further notice, Bitcoin has just risen as a 'restriction safe' resource class," Bernstein said.

The cryptographic money, which is floating around the $4,800 stamp, is more similar to an economy keep running by its clients instead of a danger to standard cash.

"Bitcoin could be viewed as virtual 'conveyor money' economy bolstered by a decentralized 'trustless' system – another crypto economy with its own particular convention or strategy," Bernstein said. "The confidence of its citizens– programming engineers, mineworkers, financial specialists, early individual and sovereign state adopters would drive the estimation of that system."

Bitcoin hit about $5,000 toward the start of September, however rapidly observed its value decrease in the midst of news of a crackdown in China and feedback from JPMorgan CEO Jamie Dimon. In the wake of bottoming out close $2,900 per coin on September 15, it has since mobilized.

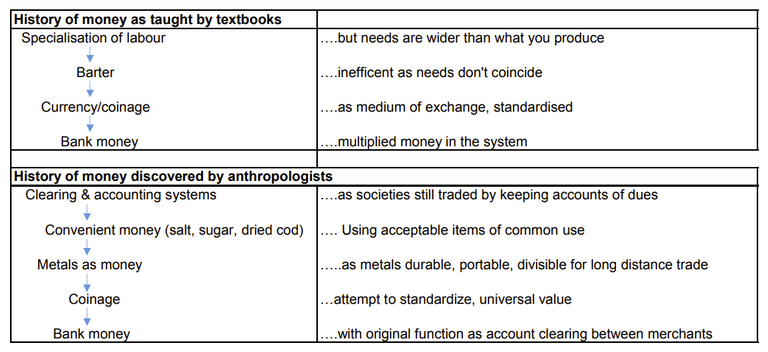

Bernstein said that cash developed as an arrangement of monitoring and clearing IOUs, as opposed to as a metal token in lieu of a bargain framework, a capacity that Bitcoin is yet to satisfy in the more extensive economy.

Here's the diagram to clarify: