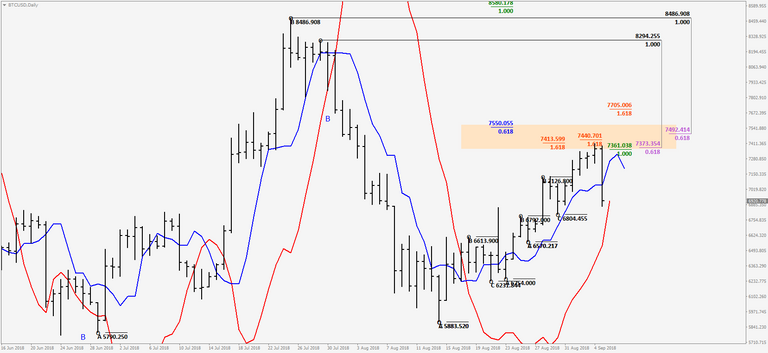

In our previous analysis, we mentioned the stop grabber buy pattern which targets the stops above 8500 and we also mentioned the gap at CME futures contract at 7365. We placed buy limit orders around 6480 and got filled. Our first target was the gap + fibonacci agreement resistance zone around 7300-7500.

So looking our weekly; our long term context is still valid and stop grabber buy is in play. We have OP fibonacci expansion resistance at 8600 just above the highs and very strong agreement (1.618 fibonacci expansion + 0.382 fibonacci retracement) resistance zone around 10200.

On the daily;

Market has showed a significant pull pack after closing the gap and touching our agreement resistance at 7400ish. as expected. Daily trend change is approaching.

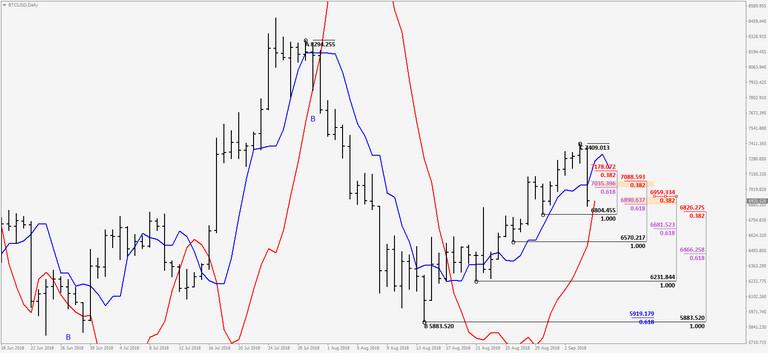

Looking at our fibonacci support levels on daily ;

We have disrespected confluence (fibonacci 0.318 + 0.618 retracement levels) support around 7035-7088 this zone might act as resistance on the pullback. Market sitting on 6900 confluence support zone recently. We do have another gap on daily at 6595. So market might try to close this gap first and then push higher.

On the long term it is still bullish we can move our stops to breakeven. I already closed half of my long position at daily agreement resistance at 7370. Take note of that failing of stop grabber on weekly will be very bearish.

Note : My analysis owes a great deal to Joe DiNapoli's methods, and uses a number of Joe's proprietary indicators. It is my own view of the market and is not endorsed by Joe DiNapoli or any related companies.