Sunday, July 29: crypto markets have seen veering patterns over a 24-hour time frame, with nine out of the ten best cryptographic forms of money by showcase top somewhat in the green, as indicated by Coinmarketcap.

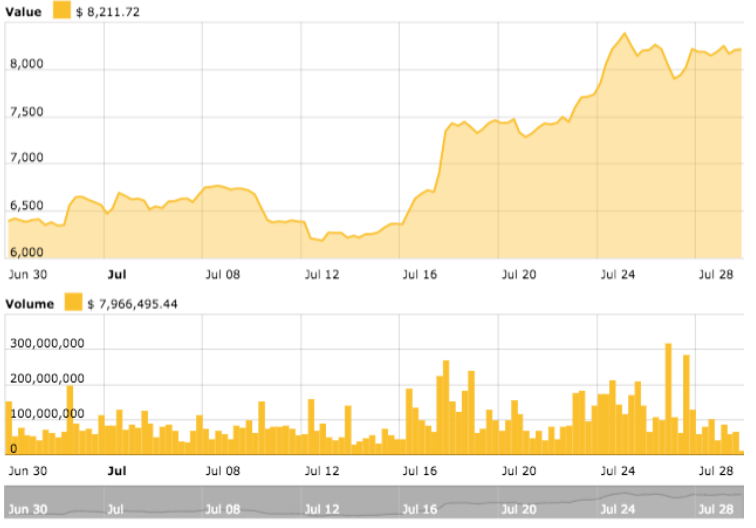

Bitcoin (BTC) is somewhat up by short of what one percent in the course of recent hours and is exchanging at around $8,206 at squeeze time, with an intraday high of $8,285. The significant digital currency came to as high as $8,431 this week, following the crypto advertise bounce back that began in mid-July. Holding a portion of the greatest increases among the best ten coins over the previous week, Bitcoin is presently up very nearly 39 percent over the previous month.

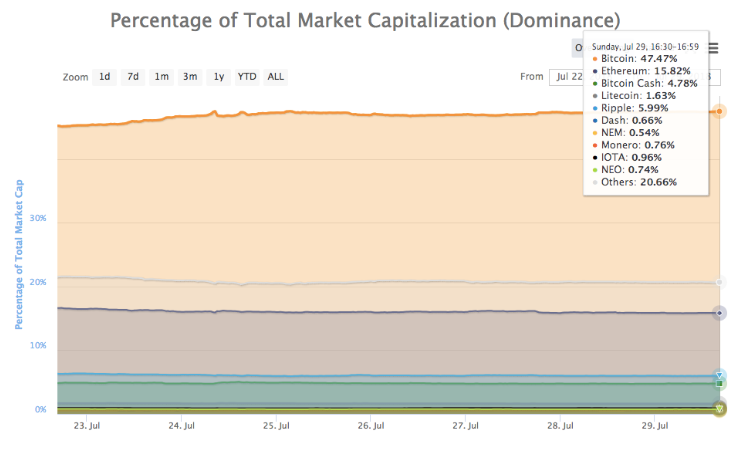

Bitcoin's market predominance over altcoins likewise continues developing, as of now adding up to just about 47.5 percent.

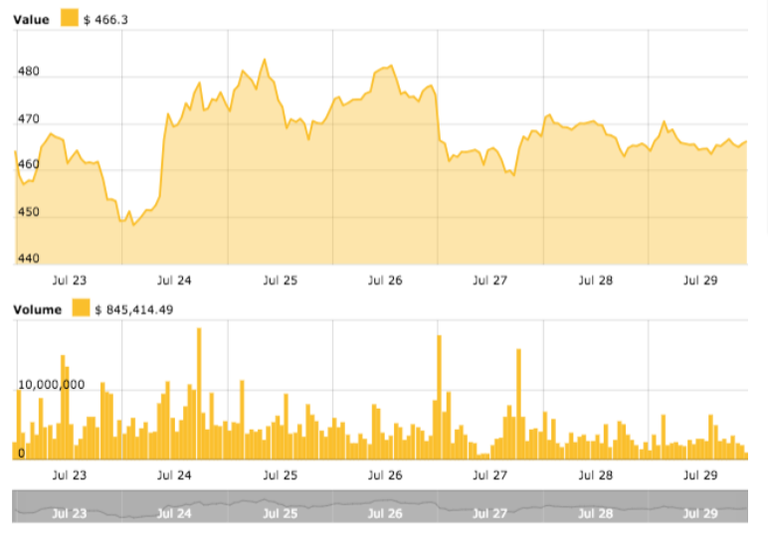

Ethereum (ETH) is down an insignificant rate over a 24 hour term, exchanging at around $466 at squeeze time. The best altcoin continues fluctuating around $460, having seen its intraday high of $470. Over the previous week, ETH achieved its pinnacle of $483 on July 25.

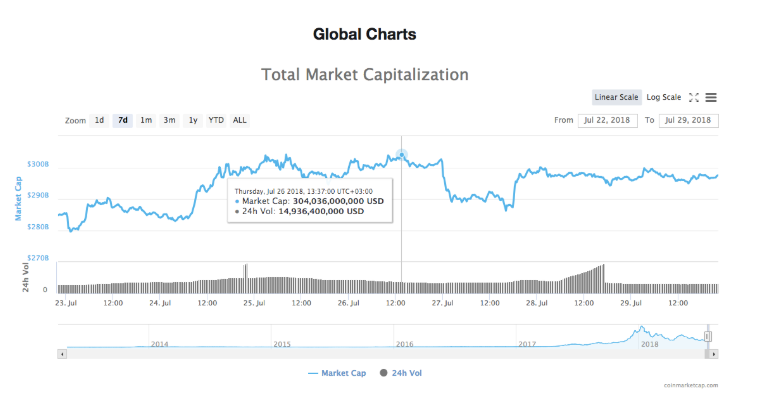

Add up to advertise top is floating around $297 billion by squeeze time, subsequent to contacting $304 billion prior this week..

TRON (TRX) has seen the greatest increases in the course of recent hours, picking up just about 8.5 percent by squeeze time. This week, the altcoin has broken into the main ten coins by advertising top, with its market top having outperformed that of Tether (USDT). At squeeze time, TRX's market top adds up to around $2.6 billion, while Tether's market top has tumbled from its intraweek high of $2.7 billion to a current $2.5 billion, as indicated by Coinmarketcap.

Prior this week, on July 26, the U.S. Securities and Exchange Commission (SEC) formally dismissed the Winklevoss twins' appeal to hoping to audit the past dismissal of their Bitcoin trade exchanged store (ETF) in March 2017.

In this manner, SEC Commissioner Hester M. Peirce distributed an official dispute of the second dismissal of the Winklevoss' application. Peirce contended that the monetary controller has violated "its restricted part" since it concentrated on the highlights of the basic BTC advertise, as opposed to the subordinates that the candidate proposed to list.

On July 27, Nasdaq held a private gathering with agents from both conventional fund and crypto industry firms to talk about an approach to "get the [crypto] business on the way to legitimacy."..

thanks for sharing. informative

Congratulations @sabafarid! You have completed the following achievement on Steemit and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!