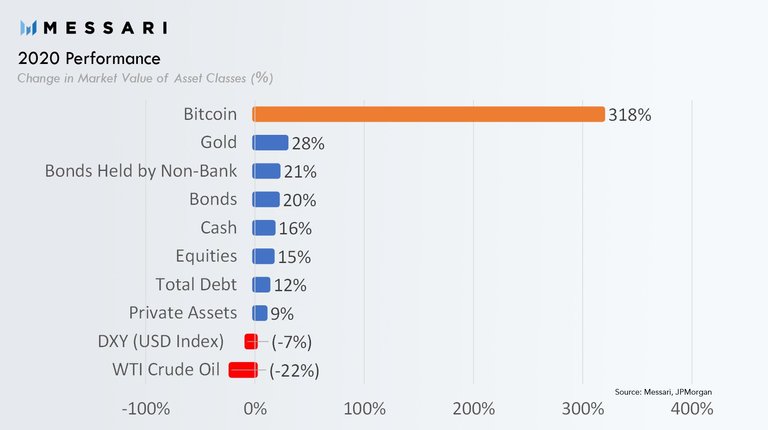

2020 ended with records. Bitcoin has become an asset class, boosted by the halving and the interest, even financial engagement, from institutional investors such as Paypal, Square and MicroStrategy.

Bitcoin, seen as a digital gold, has been also used as a hedge against inflation and competes with dollar. When DXY loses, Bitcoin gains.

2020 was the year where Bitcoin embraced all-time high and went above $30,000. Just yesterday, Bitcoin marked the $34,000 threshold. The story continues today as Bitcoin is in price discovery.

Ethereum

Ethereum is the second crypto. Ethereum is not just a crypto, it's a portal for decentralized apps such as DeFi, NFTs and social media.

Ethereum marked the $1,000 threshold last week and is boosted by its passing from Proof of Work to Proof of Stake with Eth2. Currently,there is more than 1 million Eth staked on the beacon chain. The process continues until the completion in 2022.

Ethereum has challengers such as Polkadot and Cardano.

DeFi

DeFi, a bubble like ICOs in 2017 or a serious project for blockchain ? I think DeFi just got a start as a bubble as the decentralized industry emerged last year, but remains a clear challenger of financial industry.

Today,we can have better yields with DeFi such as Compound, Maker and Aave. However, DeFi can be dangerous and risky: SushiSwap is a story that ends well, but remains an use case. The issue remains the regulation, will states let a financial world without KYC or flash loans and liquidity pools are not regulated yet?

Conclusion

2020 was the year of excess for crypto with Bitcoin and Ethereum marking all-time high and the boom of DeFi.

Happy New Year !