Hello friend today i will discuss about Weekly price of crypto Bitcoin, Ethereum, Bitcoin Cash, Ripple and many mores...

Bitcoin to be $20,000 by the end of 2018 on the theory of the cost of mining and rising difficulty over the same. On the other side, the institution critical stance on cryptocurrency.

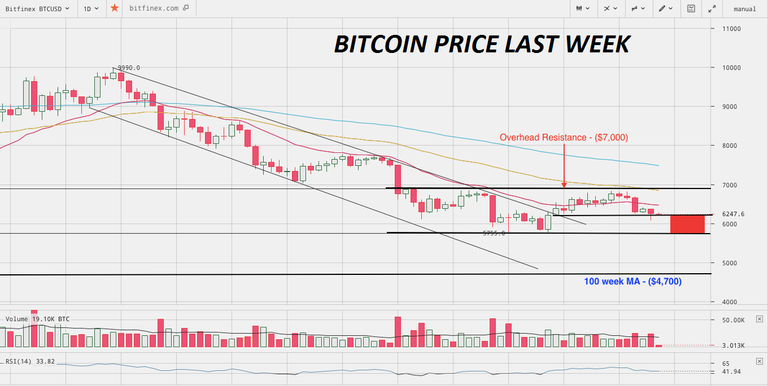

~ BITCOIN

The relative signal is bearish and Traders will have to wait for proper hints of reversal. BITCOIN has exposed itself to testing lower levels of $6,000 and if that broken, can re visit newer lows.

The strongest of support lies between $5,350 and $4,700 with the being a stronger representing the 100-week MA. BITCOIN in order to gain any mid-term bullish momentum has to crossover $7,000 resistance.

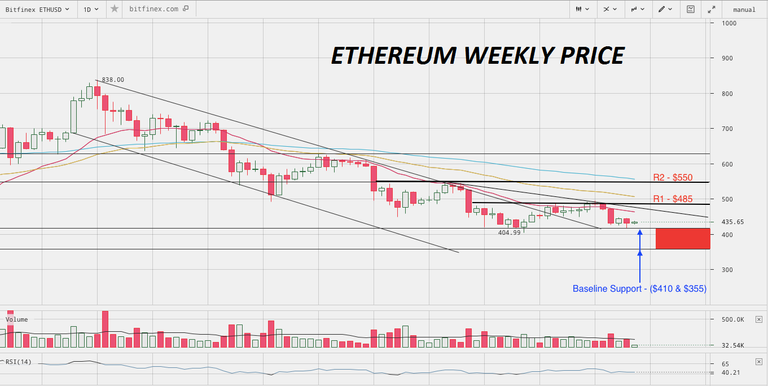

~Ethereum

Ethereum despite invalidating the pull-back efforts have managed to defend its immediate support of $410 and thus, it shows subtle strength around the level. Having said above, ETHEREUM still looks under bearish zone with the flag-bearer cryptocurrency Bitcoin holding on lower levels. But any pull-back in BITCOIN will instill more momentum in ETHEREUM .

At present, ETHEREUM will gain momentum only if the 20-day is crossed over. On upper levels, ETHEREUM finds resistance at $485, $550 and $635 whereas on bottom side, the support lies at $410 and $355.

~BITCOIN CASH

We have been mentioning in our previous analysis too that BCH has consistently shown signs of weakness with the cryptocurrency not even gaining advantage over its minor overhead resistance in short time-frames.

BITCOINCASH still continues to face pressure on every pull-back attempt and only a cross over above $880 will instill investor and trader confidence in this asset. BITCOINCASH has been known for its outrageous escalated momentum and so, a momentum above 20-day close shouldn’t be avoided as well.

On lower side, BITCOINCASH finds most important support only at $600 which if broken, will open up a fall probability of another to $500 range.

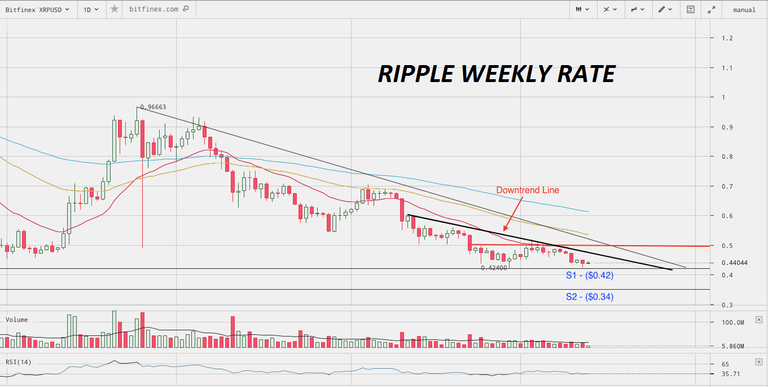

~RIPPLE

XRP among all the major cryptocurrency pull-backs has failed to receive any attraction from investors and the relative asset could not gain access above its immediate important resistance of $0.56.

At present, XRP continues to face selling pressure and the given trend will reverse only if the mentioned resistance of $0.56 is crossed and closed above the same. An resistance is formed around $0.50 which collides both with the downtrend line and 20-day . On lower side the recent of $0.42 acts as supports which if broken, will expose XRP to test $0.34.

~CONCLUSION

Bitcoin is slow rising in market dominance with present dominance around 43% of the overall cryptocurrency market. Given the high rate of correlation between Bitcoin and Altcoin prices, Bitcoin would be the trend-setter in market. Bitcoin currently is under bearish zone with respective supports being broken. A subtle support around $6,000 can be looked out for but if broken, will expose the respective asset down to $5,400 & $5,000. Short-term bias would go positive only if Bitcoin crosses $6,450 for a momentum rally up to $7,000

Coins mentioned in post: