Bitcoin has built significant momentum over the past 24 hours, surpassing the $11,000 mark. The majority of alternative cryptocurrencies in the market have performed poorly against bitcoin, as the most dominant cryptocurrency in the market continued to lead a strong rally.

Against the U.S.A. greenback, bitcoin has multiplied by nearly eight % since Gregorian calendar month seventeen, achieving $11,200. aside from some tiny cryptocurrencies appreciate Aion, bitcoin has been the simplest playing major cryptocurrency within the market.

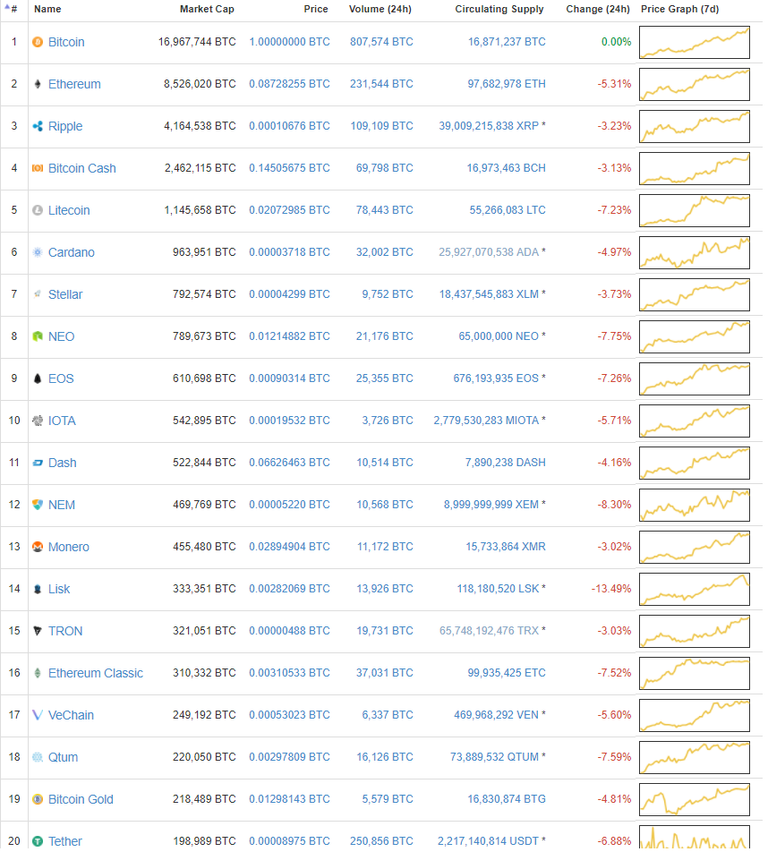

Every prime twenty cryptocurrency within the international market has recorded a loss against bitcoin within the past twenty four hours, with Ethereum’s native cryptocurrency Ether demonstrating a five % loss, Litecoin recording a seven % loss, associated modern recording nearly an eight % loss against bitcoin.

During a recovery amount, whereby new investors and traders enter the area because the market begins to visualize gains, cryptocurrencies with robust network result admire bitcoin includes a robust advantage over alternative different cryptocurrencies. Most investors United Nations agency exited the market because the value of cryptocurrencies fell did it out of panic and concern.

Most investors that ar getting into the area currently ar experiencing FOMO, or concern of missing out. Hence, if FOMO is driving new investors into the scene, particularly status and large-scale institutional investors, the go-to investment is bitcoin.

As investment adviser Ross Gerber same, the demand for bitcoin from Wall Street and massive patrons has been increasing over the past week.

“Bitcoin $11,000. Had an interview with a large investment management firm the opposite day. It didn’t take long until they started asking Pine Tree State crypto queries. Started taking notes. What do the coins do. however will it work. Trust Pine Tree State the massive players ar looking at,” same Ross.

South Korea

The demand for bitcoin and alternative cryptocurrencies has been on the increase within the South Korean cryptocurrency market, because the “Kimchi Premium” reappeared on major cryptocurrency exchanges as well as Bithumb and Korbit. though the premium is just concerning two to three p.c, that is considerably smaller than its rates in December, at one purpose in February, premium rates disappeared in Asian nation because of a scarcity of demand.

South Korea is a very important marketplace for different cryptocurrencies like Greek deity, Qtum, Cardano, Ethereum, and Ripple. South Korea’s cryptocurrency exchange market solely accounts for around half dozen p.c of worldwide bitcoin trades except for altcoins, the country remains united of the biggest markets.

UpBit, the sole cryptocurrency exchange within the country that supports over 100 cryptocurrencies, has systematically been the second largest cryptocurrency exchange within the international market, behind Binance.

Since the cryptocurrency market knowledgeable a significant correction in January, most analysts within the South Korean market didn't expect the market to start its recovery amount in February. But, demand is already growing within the native market and analysts expect it to be mirrored upon the world market within the next few weeks.